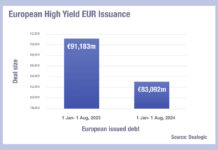

The Atlantic divide over high yield – is private credit biting?

Issuance of USD versus Euro high yield debt shows a significant split, based on Dealogic data, with US markets in 2024 issuing more than...

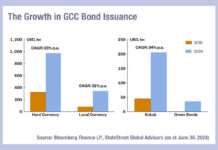

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

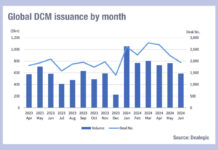

US credit issuance tailing off over summer?

June 2024 has seen US corporate bond issuance levels only slightly higher than those seen in June 2023, after record levels at the start...

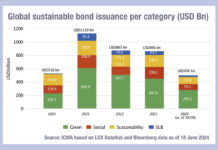

Sustainable bond issuance now 12% of total market

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found...

Issuance in double figure growth everywhere (ex-Japan!)

The debt markets have been booming globally in the first half of 2024, according to Dealogic data, with Middle East and Africa seeing issuance...

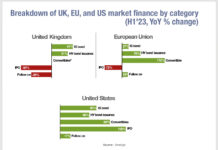

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

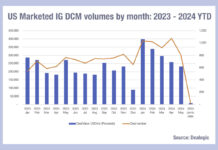

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

Emerging market bonds issuance and returns grow

This week we examine the very directional movements of emerging markets (EM) assets under management (AUM), due to investment flows and growing issuance. With...

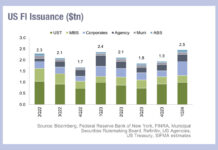

Shielding from exploding issuance

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

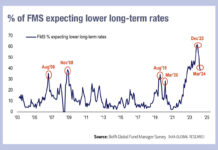

Great Expectations (on rate cuts)

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who...