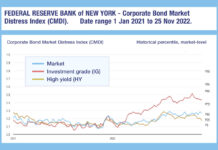

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

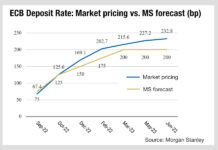

Chart of the week: ECB rates rise expectations

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which...

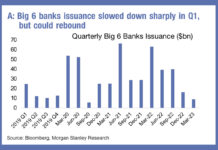

Keep an eye on bank issuance

Bank bond issuance is expected to pick up this year according to research by Morgan Stanley analysts. With deposits proving less attractive as a...

Absorbing Gilt

The year after next, the UK is set to issue £305 billion gilts to support the government’s spending programme. The high level of issuance...

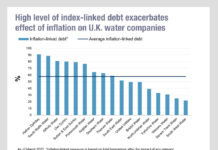

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

If you go down to the woods today…

The bond market is bearish at a historical level according to analysis by BofA Securities, with high yield down -16.7%, investment grade down -19.3%,...

Primary markets start 2023 with top ten hit

Bond issuance for US investment grade on 3 January 2023 was the tenth largest day on record, according to data from Dealogic.

While January is...

Can primary markets deflate?

Inflation levels could have a direct impact on volume of work – and therefore operational pressure – on buy-side trading desks.

Managing the process of...

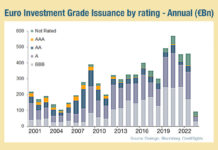

Europe’s record IG credit issuance could boost electronic trading

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity...

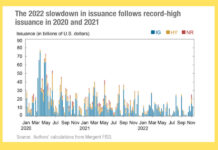

Liberty Street Economics asks: How Is the corporate bond market functioning as rates rise?

The Federal Reserve Bank of New York’s market structure and macro analysts, Liberty Street economics, has examined how corporate bond market functioning has withstood...