JP Morgan leads DCM amidst primary markets retreat in Q1 2025

In the first quarter of 2025, global debt capital markets (DCM) activity retreated while JP Morgan maintained its position at the top of the...

Debt deals decline

Debt markets have seen a year-on-year (YoY) decline in deal activity in 2025, according to data from Dealogic, reflecting the pensive mood amongst corporations...

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

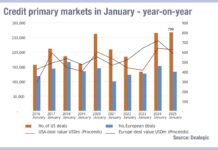

Retreat in credit market primary activity in January 2025, Munis a bright spot

In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis)...

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

Refinancing debt: New bonds, old problem

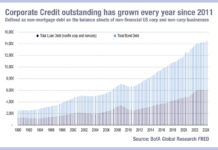

A new paper from Bank of America’s credit strategist Neha Khoda and Adam Vogel has found that bond issuers are facing a significant increase in costs...

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

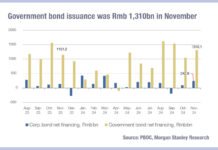

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

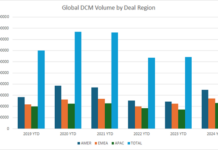

DCM deals substantially up year-on-year

Total deal size volume for debt capital markets, year-to-date is up 32% on 2023, according to data from Dealogic.

The trend in regional deals has...

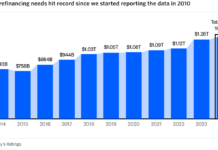

Moody’s: Short-term refinancing to grow in 2025

A report from rating agency Moody’s, has found that the proportion of US non-financial investment-grade corporate bonds needing refinancing within five years has grown...