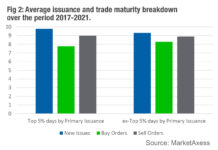

New issuance drives up secondary selling

News that high yield (HY) issuance has fallen in Europe may be of little consolation to investment grade investors, as new data from MarketAxess...

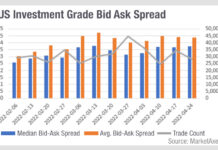

Is US investment grade market-making starting to fray?

In US credit, mean bid/ask spreads are skewing upwards from the median, indicating that a greater proportion of larger spreads are in some cases...

European trading strained in high yield

Comparing European high yield (HY) and investment grade (IG) corporate bond data from MarketAxess, the pressure for traders and investors in high yield markets...

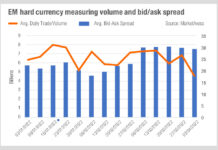

The cost of liquidity in EM today

A very graphic representation of the cost of liquidity can be seen in the latest data from MarketAxess. It shows that average daily volume...

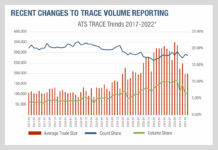

What FINRA’s trade reporting changes tell us about consolidated tapes

Understanding the difference between commercial and public data offerings is crucial for data users. A good example of this difference can be found with...

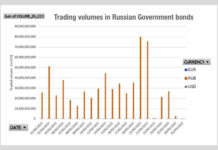

A very clear contrast in trading volumes as sanctions bite

The second chart this week shows trading in Russian government bonds which fell off a cliff at the start of March, triggered by an...

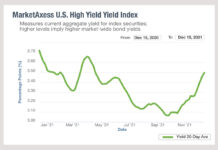

Analysis of US yields in 2021 and anticipation for next year

Yields for US high yield bonds have turned a corner, according to MarketAxess data, following a drop from 3.65% in April down to 3.065%...

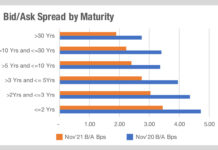

The impact of trading long-dated bonds

Faced with the prospect of climbing rates, some investors will be looking to switch out of lower coupon bonds to capture higher returns. However,...

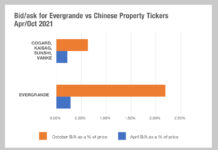

China Focus: The secondary effect of defaults

The bid-ask spread for bonds in China’ property market has expanded by 300% this year, although even more so for Evergrande which increased by...

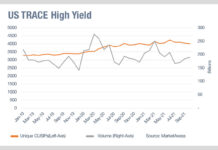

Prioritising investment on the high yield trading desk

When we look at the priorities of trading desks in developing more automated tools, we can consider the longer term market trends as a...