Is European credit electronification bouncing back?

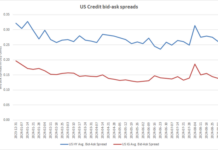

There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found...

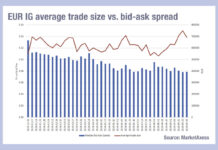

Who can make money, market making Euro credit?

Looking at the average bid-ask spreads of European credit trades, and correlating them with the average trade sizes for the year to date based...

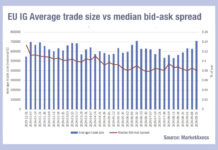

Falling costs of liquidity not halted by summer vol

The bid-ask spread for corporate bond markets has continued on a downward trajectory in September, after a bump in August, according to data from...

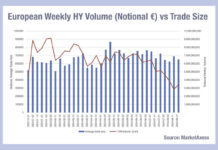

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...

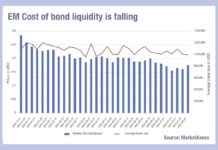

Falling emerging market liquidity costs reversed with Fed concerns

Traders in hard currency fixed income emerging markets have seen a decline in the costs of liquidity this year, according to data from MarketAxess’s...

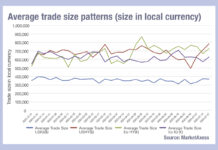

Not average: Trade sizes in 2024

Looking at the average trade sizes for high yield and investment grade bonds, across Europe and the US in 2024, we can see considerable...

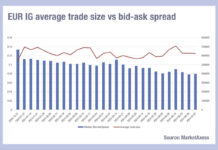

Europe’s incongruous drop in IG bid-ask spreads

European investment grade (IG) credit traders will have seen average bid-ask spreads declining since April, with the median average (typically about €0.03 cents lower...

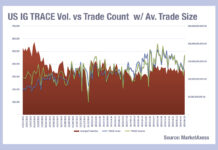

Upping strike rate and strength in US IG

We often hear ‘nothing really changes’ in relation to capital markets so it is good to have an insight into real progress, courtesy of...

The good news on high yield trading

Two weeks ago we noted that high yield markets have seen trade sizes increase since the start of the year, running counter to the...

High Yield did not get the ‘trade size’ memo

High yield trade sizes are continuing to rise in 2024, and its bonds continue to show signs of increasingly manual trading. As bond markets...