Do Europe’s credit trading costs invert the pattern for US debt trades?

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

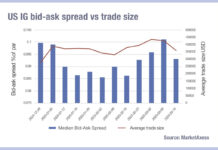

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

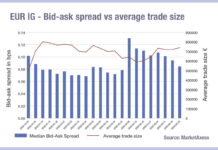

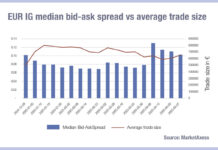

Liquidity recovery continues in European investment grade

The careful return to pre-trade-war bid-ask spread levels continues in European credit markets, according to data from MarketAxess TraX, which assesses trading across multiple...

European liquidity costs remain high after April shock

Bond markets are beginning to settle on both sides of the Atlantic after the shock of Liberation Day and various amendments to tariff policies...

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...

Excited or scared? The liquidity rollercoaster

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the...

US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’...

Is rising credit risk displaying in bid-ask spreads?

US credit markets are seeing a divergence in bid-ask spreads and trade sizes between high yield and investment grade bonds, according to data from...

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...