US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

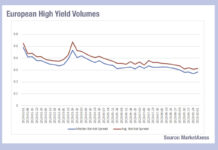

European trading strained in high yield

Comparing European high yield (HY) and investment grade (IG) corporate bond data from MarketAxess, the pressure for traders and investors in high yield markets...

What EM trade sizes tell us about market evolution

While issuance of emerging markets bonds beat the same period in 2023 by a third, secondary trading is far more choppy, with a stepped...

Europe sees big drops in implied liquidity costs

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment...

Case Study – BlueCove’s expansive view of fixed income markets

BlueCove’s expansive view of fixed income markets.

Recognising the need for smarter ways to assess market dynamics and connect with pools of liquidity, BlueCove has been...

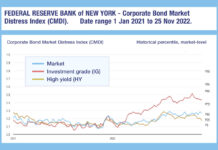

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

Tangible returns from bond trade automation

Adoption of automated trading continues apace across several bond markets and within different grades of instrument. Gareth Coltman, global head of automation at MarketAxess,...

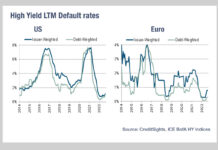

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

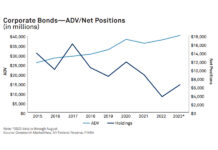

Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...

Is rising credit risk displaying in bid-ask spreads?

US credit markets are seeing a divergence in bid-ask spreads and trade sizes between high yield and investment grade bonds, according to data from...