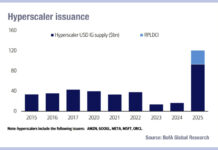

BofA: deluge of hyperscaler issuance steady at US$100bn in 2026

According to Yuri Seliger and Sohyun Marie Lee, credit strategists at Bank of America, in a note published on 17 November, the total of...

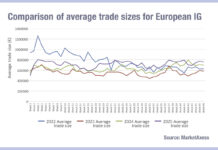

Credit trades’ double-figure yearly growth proves liquidity dividend

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...

MarketAxess: CP+™ for ETFs: Improving ETF portfolio management with predictive pricing

In a recent conversation, Kat Sweeney (Global Head of ETFs and Data Solutions at MarketAxess) and Jeff Lenamon (Head of Portfolio Construction & Senior...

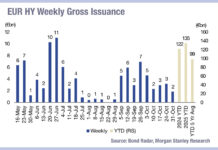

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

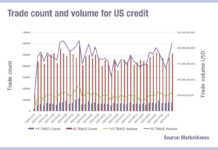

Trade size disparity in US credit speaks volumes about balance sheet

Analysis of trading activity in the US corporate bond market shows that investment grade (IG) bonds are seeing greater moves towards larger order sizes...

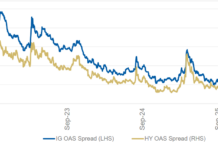

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

Analysing concern around Japan’s government bond issuance and interdealer inefficiency

The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the...

September takes the biscuit in new issues

September did not disappoint in its delivery of high issuance in the US for corporate bonds across both investment grade and high yield. Monthly...

What’s up EM?

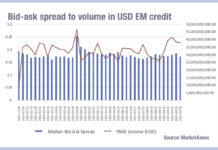

Emerging market volumes have jumped in September, hitting levels not seen since April 2025, when the US trade taxes on imported goods from every...

Issuance up in lower rated debt

Analysis by Morgan Stanley’s team has found that, despite the slowing down of bond issuance globally in August, the higher levels of activity in...