Primary markets: Give me some credit: Outlook for bond issuance in 2023

New issues provide liquidity and price points for bond traders; we assess the prospects for the year ahead.

As the cost of borrowing continues to...

Market structure: Is e-trading plateauing?

The overall pace of bond market electronification is slowing, but trading evolution is not linear.

Electronic trading has grown as a proportion of total trading,...

Trading Intentions 2023 Profile: Neptune

Neptune proves the standalone choice

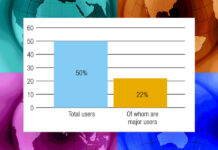

Neptune is the most used standalone pre-trade data source in credit markets, with half of desks employing its streaming axe...

Research: Trading Intentions Survey 2023

Major platforms show stable leadership in corporate bond trading

Some notable changes in results this year also reflect a change in demographics from respondents. This...

The Agency Broker Hub: The challenge of retail-size electronic fixed income trading

By Lisa Tellia, E-Commerce Distribution – Market Hub, Global Markets Sales & Platforms at Intesa Sanpaolo

Fixed Income execution has traditionally been very complex and...

Industry viewpoint: New strategies for corporate bond index futures in 2023

David Litchfield, director for derivatives sales at Cboe Global Markets, explains how Cboe corporate bond index futures are supporting traders in a highly changeable environment.

The...

On The DESK: Putting trading at the head of the table

Frans de Wit’s elevated role as head of trading at PGGM Investment Management will help improve execution quality and trading efficiency for end investors.

What has...

Viewpoint: Knowing the boundaries

Interview with Tim Whipman, head of business development at TransFICC

In February this year ESMA published its Opinion on the Trading Venue Perimeter, which provides...

Viewpoint: MarketAxess to increase automation with Adaptive Auto-X

MarketAxess is aiming to initially launch Adaptive Auto-X in the first half of this year to provide clients with algorithmic workflows and allow them...