Innovation through electronic trading

Dan Philip, Institutional Sales & Trading at Jane Street speaks to The DESK.

How has the bond market changed this past year, in the aftermath...

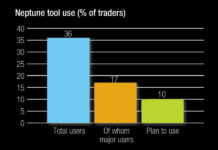

The DESK’s Trading Intentions Survey 2021 : Neptune

Neptune has expanded its user base to 36% of buy-side traders in 2021 up from 29% in 2020, a considerable increase and one that...

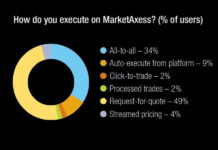

The DESK’s Trading Intentions Survey 2021 : MarketAxess

Consistently rated as the most effective platform for finding liquidity in the corporate bond market, MarketAxess has frequently been ahead of the market in...

The DESK’s Trading Intentions Survey 2021 : Profiles

Bloomberg

Bloomberg has the highest penetration of any provider into the buy-side fixed income trading desk. This year has seen it significantly revise charges to...

Primary markets : Discretion is the better part of bond issuance

The US regulator has raised questions over bank control of new issuance automation – the question is whether banks behave with valour.

A recent report...

Does trading performance need to be quantified to justify outsourcing?

An asset manager may need to assess the value that an outsourced trading provider offers using a range of measures in fixed income markets.

Fixed...

Trading : Intertwining electronic trading of credit and rates

Electronic market operators are bringing together credit and rates trading platforms in an effort to deliver more efficient execution for traders.

The interplay between the...

The DESK’s Trading Intentions Survey 2021

This year sees tighter pipelines for new business and a wider array of trading protocols.

Executive summary

One year on from the sell-off in Q1 2020,...

On The DESK : Alex Brause : The central bank’s buy-side trader

Balancing leadership and discipline with greater autonomy in trading. Alexander Brause speaks to The DESK and explains his role as head of fixed income...

Industry viewpoint : MTS : David Parker

Revolution over evolution: The corporate bonds landscape

David Parker, Head of MTS Markets International

Over the last two years, electronic trading of corporate bonds has rapidly...