The DESK’s Trading Intentions Survey 2020 : Streamed dealer prices

STREAMED DEALER PRICES.

Streaming prices from dealers provide a key perspective on the market, but unless they are executable they have limited value for trading....

Subscriber

The DESK’s Trading Intentions Survey 2020 : Tradeweb

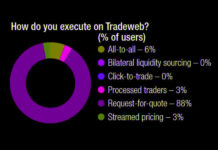

TRADEWEB.

A real innovator in the trading protocol space, Tradeweb is constantly vying for the top spot with Bloomberg and MarketAxess.

Its pioneering of portfolio trading...

Subscriber

Pre-trade data: The next generation

The first generation of pre-trade analytics are consolidating; the second generation of price and liquidity providers such as Bondcliq and Katana will need to...

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...

Tackling the cost challenge in fixed income trading

In today’s highly competitive and cost-conscious fixed income market, small and medium sized institutions can struggle without the efficiencies of scale which large institutions...

Europe’s liquidity rules are holding up… for now

New guidance on fund liquidity has followed redemption concerns in European equity and bond funds, writes Lynn Strongin-Dodds.

The risk that funds are unable to...

Repo market stress prompts calls for central bank support

Could central bank intervention bypass sell-side intermediaries, if they only act as agents not risk takers? David Wigan reports.

The stresses in the US repo...

Power to the people

New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was...

CSDR mandatory buy-in delay welcomed

Umberto Menconi, head of Digital Markets Structures, Market Hub, Banca IMI, Intesa Sanpaolo Group

Since the financial crisis waves of new regulation and the need...