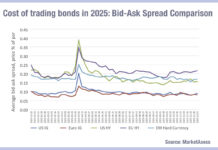

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction in the bid-ask spreads in European credit, year to date, based on MarketAxess’s CP+ price data.

Looking across emerging markets (EM), US and European markets, the smallest reduction in bid-ask spreads this year has been in US high yield. Over the past week these were 96% the size of bid-ask spreads at the start of the year, hitting 0.26 basis points (bps) median and 0.32 bps mean average.

EM bid-ask spreads were 67% the size of bid-ask spreads at the start of 2023, at 0.24 bps median and bps 0.29 average.

As noted last week, US Investment grade is now just 65% of where it was at the start of the year, a massive reduction relative to HY in the US market, at 0.12 bps median and 0.15 bps average.

That is a tighter spread than in European high yield, however the latter has a bid-ask spread now only 0.25 bps, or 53% of where the median bid ask spread was at the start of the year and 0.29 bps or 55% of the average bid ask spread for the same time.

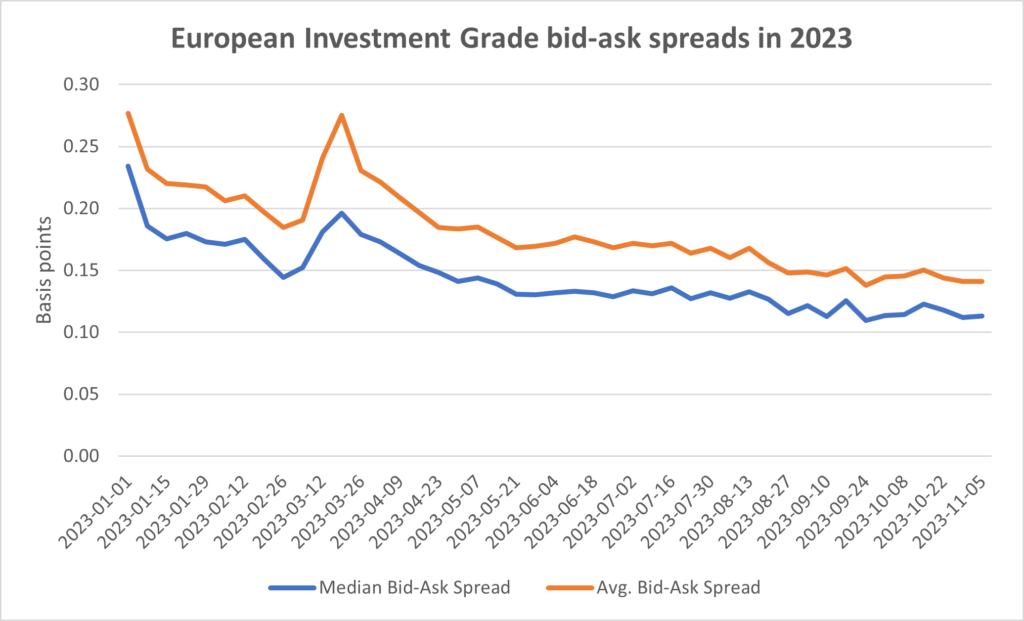

Yet the prize for greatest bid-ask spread reduction in 2023 – year-to-date – goes to European investment grade. Measured by median, its bid ask spread of the previous week were just 0.11 bps, making them just 48% of their level at the start of the year, and tighter than spreads in the US IG market.

Looking at their average they were 0.14 bps, also coming below the US IG market and 51% of their size at the start of the year.

The reason for this is likely to be the improving liquidity picture as macros data is providing well balanced motivation for both buying and selling activity, with relative value trades proving attractive, and uncertainty around the point at which ‘peak yield’ has been reached.

©Markets Media Europe 2023

©Markets Media Europe 2025