A new trend or only a one-off? Gherardo Lenti Capoduri, head of Market Hub & Umberto Menconi, head of Digital Markets Structures, Market Hub, talk to Dan Barnes

Is equity retail order flow growth a new trend or only a one-off?

The weight of retail investors’ order flows has rapidly increased in recent months and today it is no longer possible to ignore this trend and its potential impact on equity markets, as shown by patterns in equity trading volumes and unusual levels of stock price volatility.

In 2020 and 2021 retail brokerage platforms registered a rapid growth of client base particularly in the US, and retail investors’ participation in US equity order flows increased to nearly 20% in 2020 from 15% in 2019.

There are also clear signs that retail players are moving to trade more sophisticated financial instruments, with the volume of options traded for example, jumping in 2020 compared to 2019. In the same period, there was also a proliferation in the number and types of products available to the retail investor.

What are the main features of retail order flow growth?

The main features which have led to the reshaping of equity markets are:

- Technological innovation and new trading solutions have made it easy to access the global stock markets, in a sort of democratisation of equity trading; anyone may access directly a wide range of investment opportunities and may trade directly through a personal device (laptop or mobile phone). At the same time, markets have increased the supply of retail financial products.

- The pandemic:

- lockdown has boosted saving rates;

- policy stimulus has put money into people’s pockets;

- lack of sporting events has reduced the time to bet;

- zero return on cash savings and the prospect of double-digit returns in equities.

- Zero cost-fee model: Retail platforms brokers are changing the fee model with dedicated offers for retail orders stimulating retail investors’ attention

- The role of “Millennials”: It is likely that the exponential growth of the retail investment market can be attributed to Millennials who are increasingly interested in financial investments. Analysis reveals that “almost half of US retail investors were completely new to the market in 2020, they are young, mostly under 34 and they are willing to borrow to fund their bets, to make heavy use of options and to use social media as a research tool to generate trading ideas.”

- Social Networks: In January 2021, institutional investors learned to their cost not to ignore the social media networks. They had adopted short selling strategies against GameStop stock, whereas retail investors decided collectively to buy GameStop shares in a massive action that was sparked by social networks and saw a surge in the price.

- Short term investment in small-cap single stocks: While retail investors traditionally were focused on large-cap names (with a buy-and-hold strategy), now social media and intraday trading strategies on TOL or retail brokerage platforms are drawing their attention to small-cap single stocks, with lower prices and higher volatility and little or no research coverage, rather than by the diversification benefits of indices.

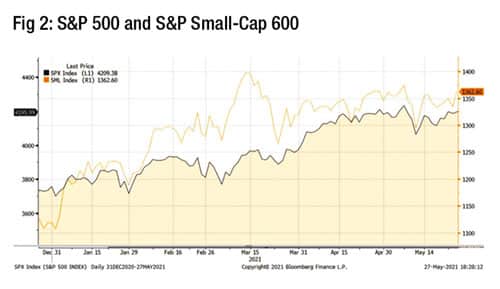

As shown in Figure 2, which compares S&P 500 and S&P Small-Cap 600, small cap stocks have a greater market volatility.

As shown in Figure 2, which compares S&P 500 and S&P Small-Cap 600, small cap stocks have a greater market volatility.

How do retail traders impact directionality of trading?

Retail traders are traditionally “momentum players”; in that they do not represent a “smart flow”, but tend to follow the “trend” and, as a consequence, to emphasise both downward and upward movements, increasing market volatility.

They usually trade on market fundamental valuations and so they tend to amplify the distance with respect to the fair value. Finally, as they follow blogs and social media forums which may focus on only a few stocks, they tend to amplify their market movements.

Does the channelling of retail flow via electronic market makers create challenges in access to liquidity?

As the weight of retail order flow is rapidly increasing, brokers should provide more efficient trading models to execute these orders which may represent a relevant pool of liquidity; one of the most common ways adopted in the USA is to channel the retail flow via electronic market makers. This operative model may impact liquidity on the exchanges and increase market fragmentation.

Can institutional investors get access to more natural liquidity through retail order flow?

The increase in the order flow from retail investors and the development of platforms dedicated to them could benefit institutional investors. Banks, brokers, market operators and online platforms may execute their equity retail order flow on systematic internalisers (SIs) and dark pools, if compliant with best execution parameters. In this way the retail order flow may increase the natural liquidity pool available to institutional investors.

What can brokers do to maximise the positive and minimise the negative impact of retail trading activity?

In order to maximise the positive impacts and minimise the negative ones of retail trading activity, some brokerage platforms that previously provided their financial services only to the institutional sector have already set up a retail investors area, making them more aware of their investment strategies, through enhanced financial education and customised services.

What lessons can investment firms and their brokers learn from recent retail investor activity?

The events that took place involving stocks such as GameStop and AMC Entertainment have led to concern that institutional investors must now adapt their risk models, TCA and investment decision processes to mitigate the possibility of this happening again.

In this sense, institutional traders will have to pay greater attention to information posted on social media platforms such as Reddit and Twitter in order to stay ahead of the curve and to anticipate the drivers of any trend and the multiplier effect on volatility. As retail order flows are now large enough to count, institutional investors have been told that “rather than criticising retail investors and their behavioural patterns, it is better to slot them into the money equation”.

What’s next in Europe?

Financial regulators now face a conundrum on how to regulate this mass of individual social media accounts and how to determine what constitutes market manipulation. Zero-commission trading models are coming under increased scrutiny in the European Union as regulators suspect their business model might run counter to the bloc’s market regulations. In Europe this trend is smaller than in the USA, but regulators warn they could grow rapidly and are used mostly by investors under the age of 30 on smartphones. For this reason, they are investigating whether the current rules are sufficient to avoid possible conflicts of interest or shortfalls in terms of retail clients obtaining best execution for their share trades and whether this trend, often referred to as the ‘gamification’ of retail investing, is in line with MiFID II and in particular whether “Payment for order flow-arrangements” are at odds with some of the basic principles of EU financial market regulation.

In September 2020, the European Commission new capital markets union (CMU) action plan announced its intention to publish a strategy for retail investments in Europe in the first half of 2022. Its aim will be to seek to ensure that retail investors can take full advantage of capital markets and that rules are coherent across legal instruments. On 11th of May, the European Commission published a new consultation, the “Retail Investment Strategy for Europe” that should be adopted in the first half of 2022.

©BestExecution 2021

[divider_to_top]

©Markets Media Europe 2025