As new platforms promise to increase efficiency in bond issuance, buy-side firms are looking for leverage to drive change, and not only through technology.

As new platforms promise to increase efficiency in bond issuance, buy-side firms are looking for leverage to drive change, and not only through technology.

The US debt markets had issued US$1.92 trillion of bonds by September 2020, with US$1.4 trillion raised in the first half alone, according to Refinitiv data. That peaked the total issuance for 2017, a record year.

“[That] six months underscore how much more active the primary markets have become; a record US$1.4 trillion dollars raised in that time,” says Keenan Choy, managing director for Fixed Income Syndicate & Capital Markets at Wellington Management. “Yet with that increase the process itself really hasn’t changed much over the years; over my career really. It’s still very analogue.”

Tapping into the primary markets is currently one of the best sources of liquidity that asset managers can access, but transactions are amongst the least efficient, leading buy-side trading desks into a heavy workload.

“We are very large users of primary market liquidity for fixed income,” says Ed Wicks, head of trading at Legal and General Investment Management. “On any given day it’s absolutely normal for us to be participating in multiple deals across issuers and tranches so I have a keen interest in trying to help and ameliorate this process in fixed income.”

The challenge stems from the interaction with syndicate banks who are responsible for getting the best price for newly issued bonds on behalf of the companies issuing the debt. Communication is conducted manually by email and messenger, with cutting and pasting of messages. Information is often missing due to the lack of a common format.

As the costs of trading on the sell-side are effectively paid by the issuers, who have no visibility over the process, issuers have little leverage to demand more effective trading which would lower the banks’ costs and therefore the fees charged for issuance. On the other hand, buy-side firms see the inefficiency, but have far less leverage.

Banks’ interactions with investment managers are bilateral, and have no standard way of being managed.

Banks have no commercial incentive to offer information consistently in the deals they engage in, or between firms.

There have been efforts to standardise the process. In August, the Credit Roundtable, a buy-side body established to support investors in the corporate bond markets, issued guidance in the form of ‘Investment Grade Primary Best Practices Framework’.

These included such basic information as ‘Actual maturity date of bond; actual ‘Cusip’ code for bonds; expected ratings or actual ratings as provided by agencies within 15 minutes of deal announcement’.

Missing information requires front office staff on the buy- and sell-side on six-figure salaries to be chasing around for the data which could have been initially input into a system and sent to investors with no need for manual intervention.

“I would characterise today’s model as very manual and it’s questionable as to what value those traders are adding by having to delve into such a manual process,” notes Wicks. “We could automate a lot of this process and add value straightway in terms of freeing up time.”

Although issuers eat the costs of the sell-side activity their level of awareness and concern about those costs can be limited.

“For many corporate treasurers there is a level of opacity around the underlying fees that they pay,” says Naresh Aggarwal, associate director for Policy & Technical at the Association of Corporate Treasurers (ACT). “Whatever efficiencies advisors build, will not necessarily be reflected in the fees they charged to issuers. Also for some pricing is only one component of the relationship. Treasurers I have spoken to who have been active in the debt markets over the last 12 months, their concern is not 10 basis points here or there on fees, it is whether they are getting a good rate on their five-year bond.”

One corporate treasurer contacted for this article said, “I am not sure what inefficiencies you are referring to. Documents and presentations typically go out via email or get uploaded on a tool such as Finsight for minimal cost. I don’t know what communication would be manual.”

The impetus to change

Without the fee-payers pushing the banks to change how they work, where does the impetus come from? The obvious answer is cost pressure.

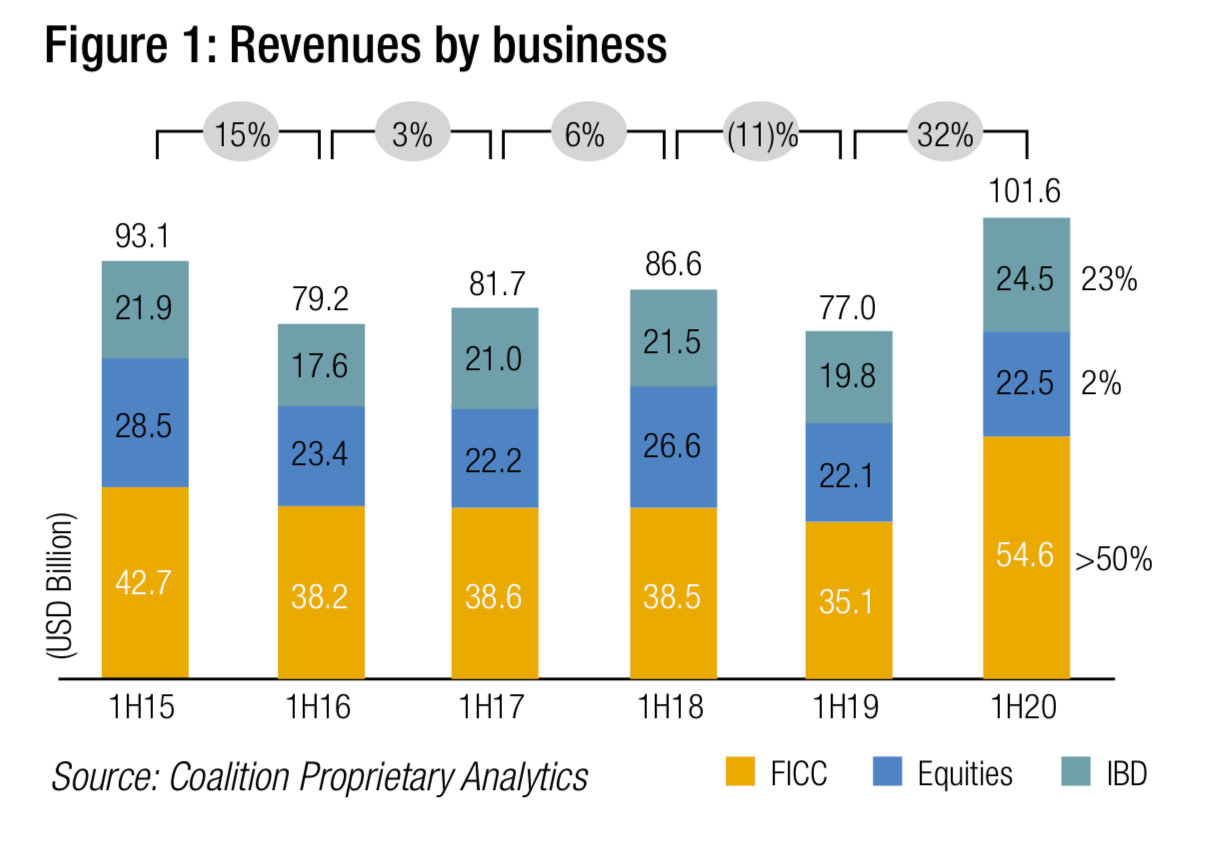

Although the syndicate desks of banks have been more successful in revenue generation than secondary market desks (See Fig 1), banks are under considerable pressure to increase their return on equity. As volume of issuance increases it is not scalable for banks to throw more people at their primary markets business. Automation is the preferred option for any business to expand, and it would suit investors.

“I see a lot of scope for improvement through digitising this process, in terms of the efficiency and the consistency of that information being relayed to us,” says Choy. “I think that would cut down a lot of the time it takes to get this information together and run it through our internal systems, since we run a lot of compliance checks on the deals before we can evaluate them and see if they meet the needs of our investors and from there proceed with putting orders together.”

Tools already exist such as IHS Markit’s Investor Access, which has had notable success in Europe, and smaller firms like fintech firm Origin Markets which has stepped into the private debt placement areas. More are launching later this year, with DirectBooks – formerly Project Mars – which is a US bank-led project and block trading specialist Liquidnet’s planned offering.

Although DirectBooks is keeping its cards close to its chest, Liquidnet has revealed it will help by applying natural language processing (NLP) to communications between buy and sell-side firms through the application of machine learning tools, thereby taking the unstructured data and making it structured.

“Will we get to the point where every single data field that clients want will be available upon a new issue announcement? Probably not in the near term,” says Constantinos Antoniades, head of fixed income at Liquidnet. “However, there are many steps that can be taken to increase the speed and amount of information to asset managers. Greater standardisation, adoption of an electronic workflows, order management system (OMS) connectivity, and use of natural language processing (NLP) technology can help bridge the gap.”

Nick Hall, managing director and head of fixed income at IHS Markit notes that collaboration between providers will be key if investors are not to be inconvenienced.

“What concerns users is fragmentation,” he says. “As you have more players in the market there are naturally concerns that will fragment activity. We’re very focused on keeping our network connectivity in place so that if there are other market participants out there who are emerging our strategy is collaboration and integration. It really makes no sense for buy- or sell-side firms to switch systems to work on different deals.”

Reducing that fragmentation into a single point of access would create a significant advantage, concurs Choy, through the reduction of duplication not only of structures but of messaging.

“Centralising the information so that on one deal we have consistent streams of information from the multiple book runners managing the trade would bring efficiency,” he says. “Potentially down the road, also communicating orders only once but disseminated to the multiple book runners, rather than communicating the same information multiple times would also enhance efficiency.”

Potential and limits

Buy-side firms can exert leverage on banks to optimise this process, if they are in a strong position to engage with their dealers. LGIM has a trading research team within the global trading group which is responsible for aggregating and integrating its data, to support more intelligent trading decisions.

“We can leverage that team to help us when it comes to holding counterparties to account with regard to allocation data that we store, and we have stored for years,” says Wicks. “So we are able to offset that manual time-consuming process, because we have a scaleable electronic trading model, and access to our own trading research team.”

Lisa Mahon Lynch, managing director, Global Trading at Wellington Management notes that the firm has built its infrastructure to support integration with primary market solutions.

“We have developed proprietary order management systems (OMS) across our desks, with an architecture that allows for integration with third party platforms and applications,” she says. “In that light, we welcome and support the innovation underfoot in this space, and look forward to engaging further as the platforms go live.”

Yet Choy also warns that technology alone will not provide the solution if behaviour during the issuance process is not effectively managed.

“What technology cannot really solve is greater transparency of the deal; for instance: being alerted to non-standard terms and what has changed from the last deal to this deal, communicating upfront the size goals of the deal, and better understanding of how demand responds to changes to the terms of the deal,” he says. “These are important to making proper investment decisions.”

Wicks notes that the buy-side needs to apply pressure where it can to drive reform, and with a consistent voice.

“I would incorporate [performance data] into counterparty review discussions, leverage the relationships that you have with your existing counterparties to make sure that your voice is being heard,” he says. “And crucially make sure that everyone in your firm is on the same page, and that you are speaking with one voice. If your firm is speaking with one voice, then the industry is speaking with one voice and the chances of success are higher.”

©The DESK 2020

©Markets Media Europe 2025