On 30 November 2020, S&P Global and IHS Markit announced that they have entered into a definitive merger agreement to combine in an all-stock transaction which values IHS Markit at an enterprise value of US$44 billion, including US$4.8 billion of net debt, according to analyst firm Burton-Taylor International Consulting.

The deal would certainly spark changes in the competitive dynamics of the global market data, analytics and index provider spaces.

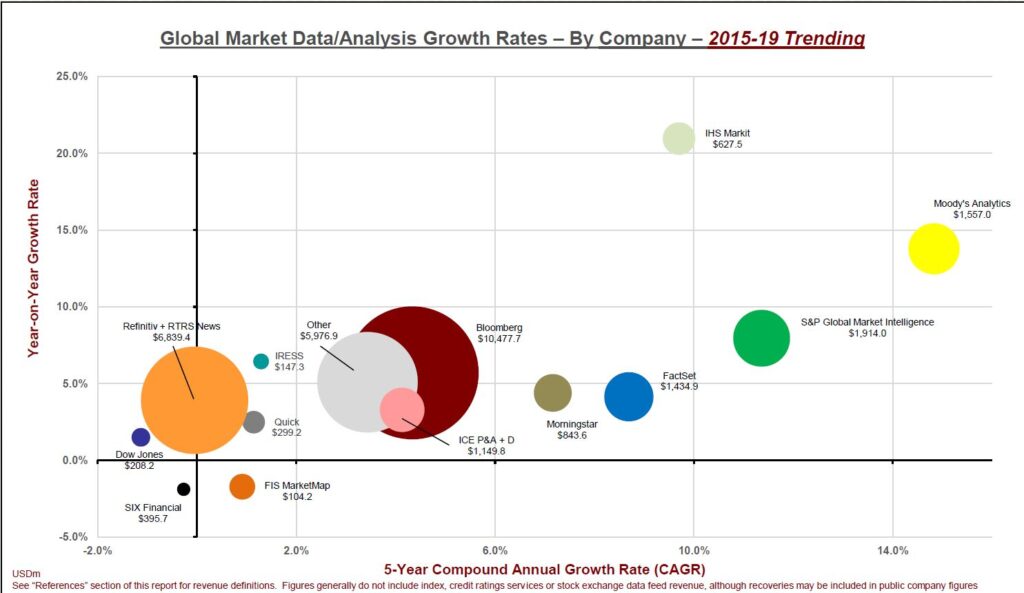

Between 2015 and 2019 IHS Markit, Moody’s Analytics and S&P GMI showed the strongest combination of year-on-year (YoY) growth and five-year compound annual growth rate (CAGR), illustrating a trend of IHS Markit, Moody’s Analytics and S&P GMI showed the strongest combination of year-on-year (YoY) Growth and 5-year compound annual growth rate (CAGR), illustrating a trend challenging the ‘big two’ data providers, Bloomberg and Refinitiv.

In 2019, Refinitiv revenue was US$6.8 billion, up 3.9% with relatively flat overall growth. For Refinitiv, real-time and trading data comprised 62.5% of the firm’s 2019 revenue, which Burton-Taylor noted was a higher percentage of revenue than any of its key competitors. While Refinitiv’s data feed business grew only slightly (1%) in 2019, but its 5-yr CAGR of 9% provides consistently strong revenue.

By comparison, Bloomberg’s overall financial market revenue grew 5.7% to US$10.5 billion for the first time in 2019, continuing its leadership among providers of market data. Bloomberg terminal revenue as a percentage of Bloomberg financial services revenue has dropped from 85.2% to 75%, and terminal revenue as a percentage of total company revenue from 85.2% to 72.4% since 2010.

Next year will likely see the completed acquisition of Refinitiv by the London Stock Exchange Group (LSEG) and certainly the effect of a new fee schedule from Bloomberg for its fixed income trading business.

Both will potentially see significant changes to their client relationships as a result.

S&P Global saw total revenue increase 8% in 2019, primarily driven by growth in annualised contract values in the market data intelligence products. Its five-year CAGR of 11.4% makes S&P one of the fastest growing companies in market data according to Burton-Taylor.

IHS Markit’s 2019 revenue was US$627.5 million, an increase of 21% on 2018 and with a five-year CAGR of 9.7%. As it is primarily serving the investment management community its pricing, reference and valuation data feeds were up 25.1% in 2019 and accounted for roughly US$546 million in IHS Markit revenue.

The proposed acquisition of IHS Markit by S&P Global, which also owns sell-side front office analysis firms Coalition and Greenwich Associates potentially creates a single entity in the financial data space, with some of the highest growth rates in the market across a five-year and year-on-year basis.

©Markets Media Europe 2025