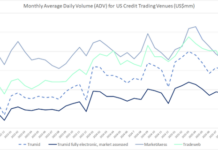

Electronic trading is certainly on a growth spurt – Coalition Greenwich reports e-trading was 46% volume across all assets in 2021 – but this is often confined to smaller trading sizes.

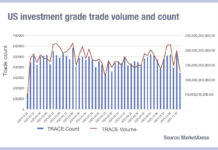

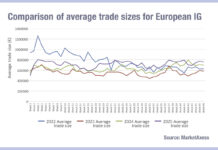

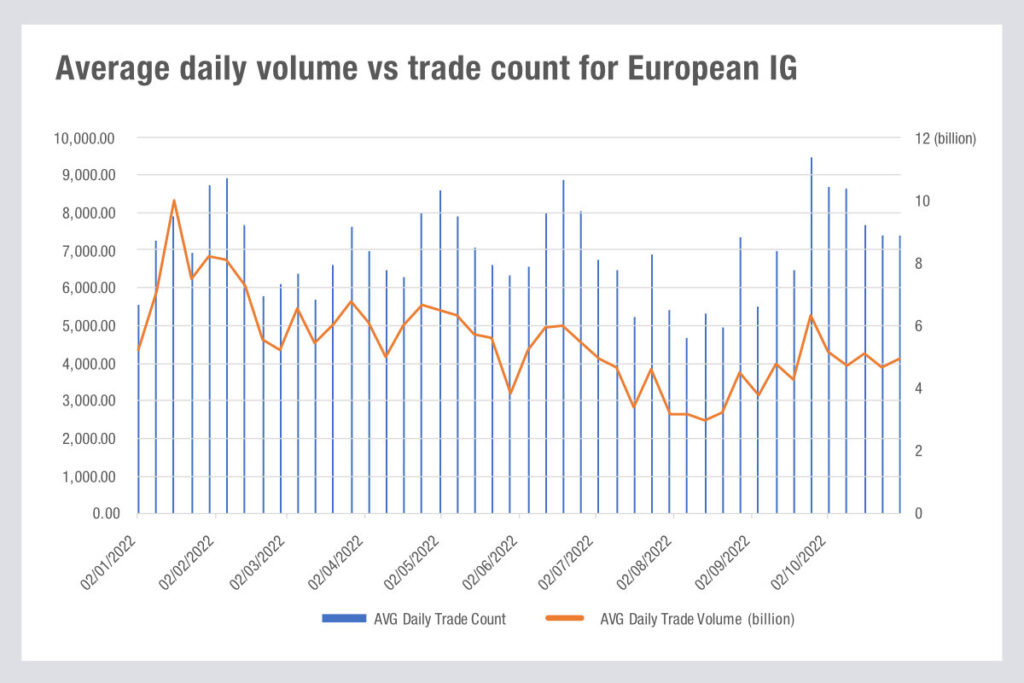

According to the latest data from MarketAxess TraX, which tracks trading across multiple markets and counterparties, the number of trades in European investment grade is still growing relative to trading volume by notional traded.

This suggests that electronic trading is providing a greater level of liquidity support than other trading – including block trades supported by bank balance sheet – and voice trading.

It also potentially means that liquidity is harder to find as the flow of trades is more fragmented between different counterparties.

The parlous state of bond trading has been highlighted in 2008 with many traders observing the current model simply does not work. In the UK Gilt market and US Treasury market problems with bank withdrawal has received more response from authorities than the corporate bond markets.

Yet as rates rise and borrowing is strained, the risk of a credit event increases, making the risk for investors in corporate bond markets potentially greater. Many non-traditional liquidity providers are engaging as price makers through all-to-all trading.

Examining data carefully to find how trading is taking place, building a picture of activity, is crucial in the current environment.

©Markets Media Europe 2025