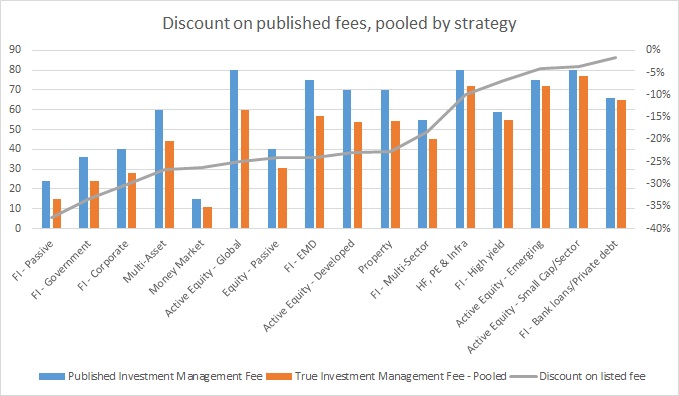

Bond funds are dropping their investment management fees by up to 37% – in the case of passive funds – from those of the published prices, in order to win business from institutional investors, according to research by industry data provider, Broadridge.

Analysis from its Global Market Intelligence platform, which tracks US$25 trillion in assets under management (AUM) along with fees, and Lipper Fund Research, part of Refinitiv, has shown that fixed income portfolios are particularly vulnerable to fee pressure from end investors seeking when negotiating a mandate (Fig 1.)

Fig 1

In a presentation, Nigel Birch, senior director at Broadridge, said that five factors were impacting fees overall: structural client change; absolute performance with an expectation of muted performance over the next ten years; relative performance of active funds vs passive funds; regulation increasing fee transparency; and product innovation including no-fee funds.

The low yield environment was harming fixed income funds particularly, he argued. The proportion of revenue share from fundamental active fixed income is likely to fall from around 25% in 2018 to below 20% by 2028.

This competitive pressure is likely to drive demand for greater efficiency on buy-side bond trading desks, says Matthew Hodgson, CEO of analytics firm Mosaic Smart Data.

“The pressure for them to acquire new technology will be correlated with asset management firms’ ability to acquire clients, and seeing the success from firms that are applying those data technologies and techniques, automation and analytics, to drive performance.”

The drive towards passive management, which suggests investors have falling confidence in the alpha that a portfolio manager can generate, and care more about matching the index at the lowest possible cost will create a specific set of operational needs he says.

“That is not just about data, but about having infrastructure to connect to all liquidity providers and then using rules based logic to distribute orders in order to get the best outcome,” he observes. “The trading value is to measure the difference between the index performance and slippage, and that ultimately gives you execution costs. Driving that to zero is what people are looking for.”

For active funds looking at execution analytics, they are more likely to focus on assessing how order flow to dealers supports access to liquidity and subsequently market impact.

“Ultimately it will become about transaction quality analysis, being able to understand execution quality and determining where to trade based on that,” says Hodgson.

©Markets Media Europe 2025