The Bank of America Global Fund Manager Survey (FMS) conducted Nov 1st-7th; post-US election, found that respondents have higher global and US growth expectations, higher inflation expectations, lower probability of a “soft landing,” lower cash levels, higher allocations to US and Japanese equities, higher tech weighting, and big expectation for small caps and high yield bonds to outperform.

After the election global growth expectations leapt from -10% in October to 23%, the highest since July 2021 and US growth expectations jumped from -22% to 28%.

Global inflation expectations flipped from -44% in October to 10%, the first time since August 2021 investors forecast higher inflation in next 12 months.

The probability of a ‘soft landing’ dropped from 76% to 55%, with ‘no landing’ estimate jumping from 14% to 33%, and ‘hard landing’ expectations unchanged at 8%.

Investor cash levels, one proxy for concern over volatility, rose from 3.9% to 4.3% for full month of November as clients raised cash pre-election, but post-election respondents reported 4% cash levels

There was also a surge in investors overweight US stocks, from 10% to 29%, the highest since August 2013, and small vs large (6% to 35%), and HY bonds vs investment grade (IG) which moved from -3% to 41%, a three-year high.

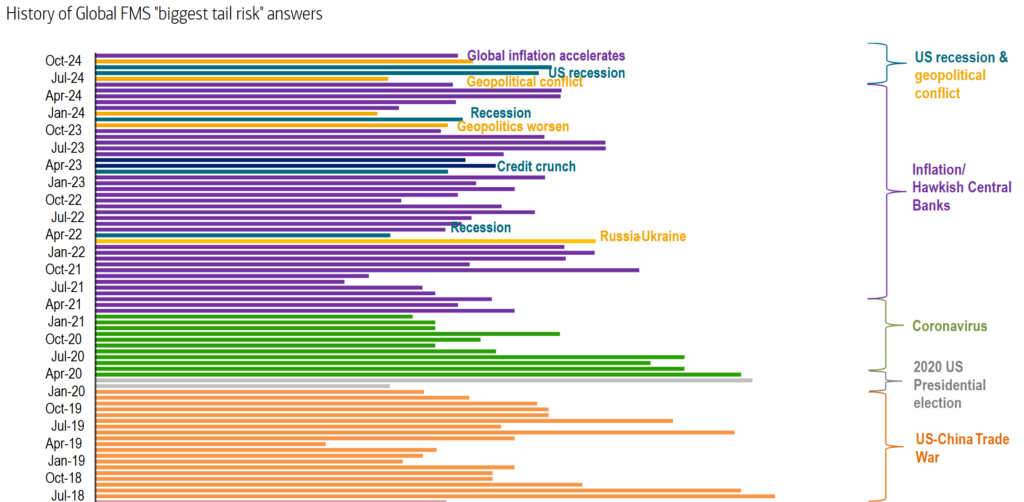

One notable item is that the longest uninterrupted “biggest tail risk” factor since 2011 has been the US-China trade war which ranked top between July 2018 and January 2020, only interrupted after 18 months by the 2020 US election, which was itself superseded by Covid.

The return of this prospect from January 2025 clearly sets up an interesting scenario for investors once – and if – the policy returns.

©Markets Media Europe 2025