This page is dedicated to research articles with secondary market data provided by MarketAxess. For further information please contact Dan Barnes.

Home ‘BoB’ – Barnes on Bonds

‘BoB’ – Barnes on Bonds

SECONDARY MARKETS

Excited or scared? The liquidity rollercoaster

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the US on 2 April.

In US investment grade (IG), data from...

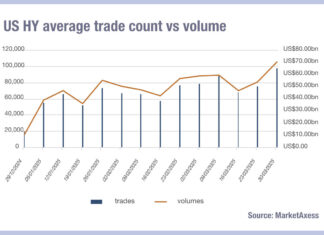

US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’ tariffs.

Activity trended up drastically in mid March, MarketAxess data shows,...

PRIMARY MARKETS

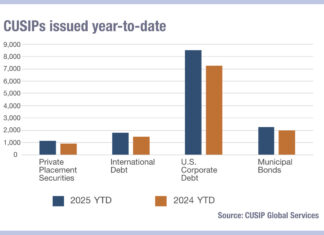

CUSIP issuance up YoY, but March decline signals concern

Year-to-date CUSIP issuance, which is indicative of new debt securities being issued, has increased year-to-date against 2024 figures, according to CUSIP Global Services (CGS).

Its latest CUSIP Issuance Trends Report for March 2025, which tracks the...

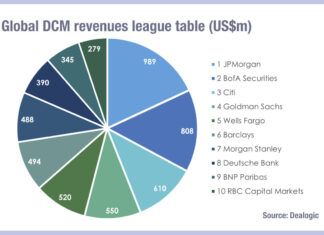

JP Morgan leads DCM amidst primary markets retreat in Q1 2025

In the first quarter of 2025, global debt capital markets (DCM) activity retreated while JP Morgan maintained its position at the top of the league tables.

Primary markets activity varied significantly by region but was...