Bloomberg is radically changing its charging model for fixed income trading. It is to apply fees for fixed income trading across its venues in Europe, the US and Asia Pacific (APAC) as it moves all trading onto regulated entities. In Europe this includes new subscription charges to allow firms to obtain discounts on trading across its multilateral trading facilities (MTFs). However, subscription fees will also be charged at between US$250 to US$3,500 even where no discount is given.

Nicholas Bean, global head of electronic trading at Bloomberg, said, “Where they are not already offered through regulated entities, execution and trade negotiation services for bonds, fixed income derivatives and exchange traded funds (ETFs) in the US and Asia will be moved into regulated entities in 2021. In tandem with this, we will introduce sell-side transaction fees.”

On Friday the firm confirmed it would not be charging buy-side firms fees for fixed income trading (see: Bloomberg: No charge for buy-side fixed income trading). Subscription fees will be charged only to sell-side firms, meaning buy side firms will not be required to pay for fixed income trading.

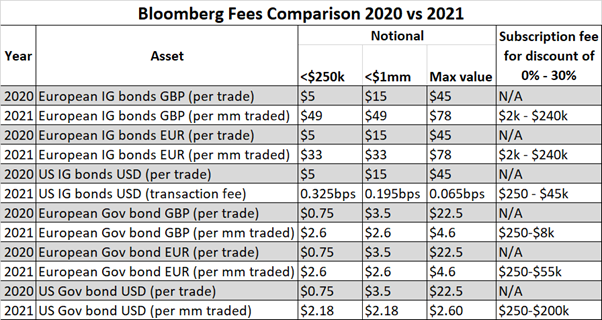

Bloomberg’s trading fees are also changing, moving in many cases from what was largely a per-trade fee to a charge based on volume or notional traded. The subscription costs to obtain discounts reflect the relative costs to trade an instrument, so to get a 30% discount on transaction fees for trading European investment grade and high yield bonds costs US$240,000, while getting a 30% discount to trade European government bonds costs US$55,000 per year. A source close to Bloomberg noted this was similar to a prepayment plan for volume.

Transaction fees are only charged to firms that respond to requests for quotes (RFQs) and orders. That is typically sell-side dealers, although investment managers can take the other side of a trade to seize an opportunity.

Source: Bloomberg, The DESK

Although some firms are still absorbing the information regarding the change in cost, several dealers spoken to expected the difference in costs to be anywhere between five to ten times their current charges. The annual connectivity fee of US$18,000 will stand.

“It’s fair to say our decision was not a surprise to our clients, in part because of the global trend in regulation,” said Bean. “Overall, our discussions with clients have validated our thinking that our approach strikes the right balance between investing in our platform and providing a competitively priced offering.”

“[This model]would bring them in line with other platforms,” noted one head of trading. “[And it] may accelerate direct trading as now the sell-side are getting squeezed from all angles.”

Adrian Biesty, head of trading at Lombard Odier, responding to The DESK’s coverage on Friday, wrote on Linkedin, “They should have thought about this aspect of their business model years ago! The gap between them and other vendors is telling, and always slow to innovate in the fixed income, currency and commodity (FICC) trading space because they couldn’t fund development.”

Bean said, “The electronic trading space is increasingly competitive and the new fee structure will enable us to accelerate developments that address fast-moving changes in electronic fixed income and derivatives trading. At the same time, global regulators continue to support a more robust regulatory framework for electronic trading and related services. In addition to enhancing our existing products, we will accelerate developments in portfolio trading, automation, repos, interest rates, mortgages, and other areas of priority interest to our clients.”

©Markets Media Europe 2025