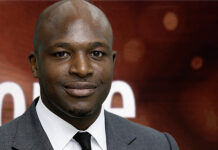

Larry Fink, chairman and CEO of investment giant BlackRock, has advocated the use of blended active and passive portfolios to optimise fixed income investments.

In his annual letter to clients, he said, “It’s not going to be just about index, where we manage nearly US$1.7 trillion. Or just about active where we manage over US$1 trillion. Some of the most interesting portfolio conversations are with allocators who are blending ETFs with active or using innovations like our active ETFs for professionally managed income solutions.”

He noted that active asset allocation, security selection and risk management had consistently been key elements in delivering long-term returns to clients.

“Our active teams across multi-asset, fixed income and equities are well-positioned to seize on broad opportunities arising out of this new interest rate and potentially more volatile regime,” he said. “We are particularly excited about the opportunity in fixed income and how artificial intelligence is propelling performance in our systematic investing businesses. Fixed income is going to be increasingly relevant in the construction of whole portfolios with higher yields and better return potential compared to the low-rate environment of the last 15 years. Now that the rate on 10-year U.S. Treasuries is near long-term averages, clients are reconsidering bond allocations.”

©Markets Media Europe 2024

©Markets Media Europe 2025