FlexTrade Systems, the execution and order management system (EOMS) provider has facilitated a direct electronic execution between UBS Asset Management and JP Morgan in the European Union on FlexTrade’s fixed income EMS solution, FlexTRADER FI (FlexFI).

The bilateral electronic trade between UBS Asset Management and JP Morgan was made possible by direct connectivity between JP Morgan electronic liquidity and UBS Asset Management’s instance of FlexTrade’s FlexFI system.

This type of integration enables UBS Asset Management to interact and source liquidity directly from its liquidity providers to its trading desk electronically, allowing a more systematic approach to bilateral trading, over a manual phone or messaging based interaction.

Lynn Challenger, global head of trading and order generation at UBS Asset Management, said, “Our bilateral connectivity to JP Morgan, using FlexTrade’s fixed-income EMS, FlexFI, is the next big step in the electronification of our bond and credit trading activities. Working on this initiative with FlexTrade and JP Morgan, we have produced a highly sophisticated, transparent way of simplifying and streamlining our workflows and interacting with the sell side.”

Eddie Wen, global head of digital markets at JP Morgan, said, “Over the past few years, JP Morgan has made significant strides in expanding the digital distribution of our liquidity to clients. JP Morgan’s ability to connect its liquidity directly into client workflows through EMS solutions like FlexTrade, delivers significant efficiency gains and cost savings to our clients. Further, this solution provides clients with greater choice in the ways they can execute with JP Morgan.“

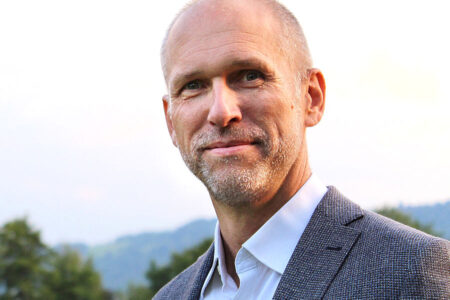

Andy Mahoney, managing director, EMEA at FlexTrade, noted, “Working with UBS Asset Management and JP Morgan on this new initiative and the outcomes it can create illustrates how revolutionary an EMS can be for fixed income trading. Incorporating actionable sources of liquidity into the trading workflow seamlessly gives clients a unique view of the market. In addition, bringing manual, opaque processes into a machine-readable format offers a first step toward improving transparency and efficiency with technology. As a result of industry collaboration, this innovation delivers true innovation – at speed – in the fixed-income EMS space. This will be crucial to driving efficiency, ultimately benefiting the end investor.”

Providing direct connectivity between buy-side and sell side firms via an EMS has proven controversial, as regulators have sought to establish whether the model should be incorporated into trading venue regulation.

In Europe the ‘trading venue perimeter’ consultation was launched in April 2022 by the European Securities and Markets Authority (ESMA), with trading venues keen to ensure even regulation is applied to potential rivals, while EMS/OME providers argue against their categorisation as multilateral trading facilities based on their function for the counterparty that employs them, not both sides of a trade.

In the US, Bloomberg has warned the Securities and Exchange Commission about the impact of blurring the lines between venues and other electronic tools.

©Markets Media Europe 2022

©Markets Media Europe 2025