Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages across credit markets for US, Europe and in emerging markets.

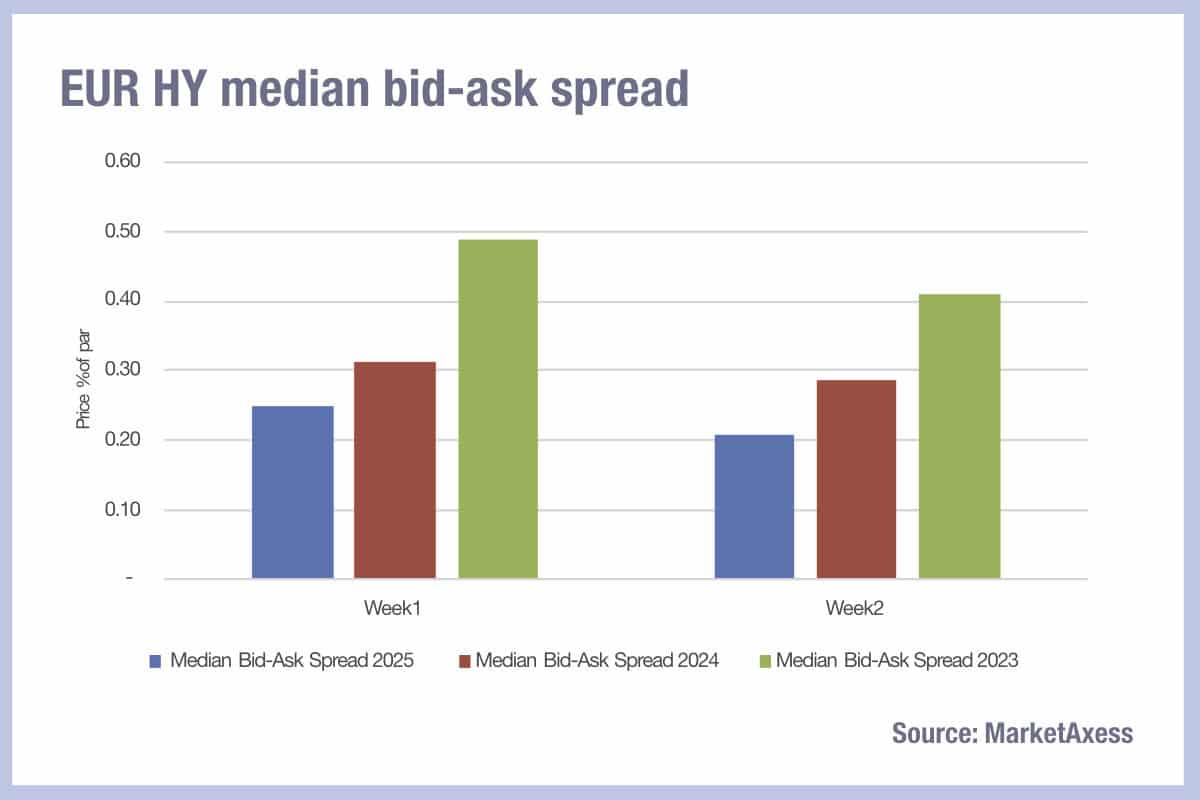

European corporate bond trading saw median bid-ask spreads for high yield trading reduce by 21% in the first week of the year and 27% in the second week of the year relative to the same period in 2024, following drops of over 30% in each of those weeks in 2023. Over two years, bid-ask spreads have reduced by 49% in the first two weeks of the year.

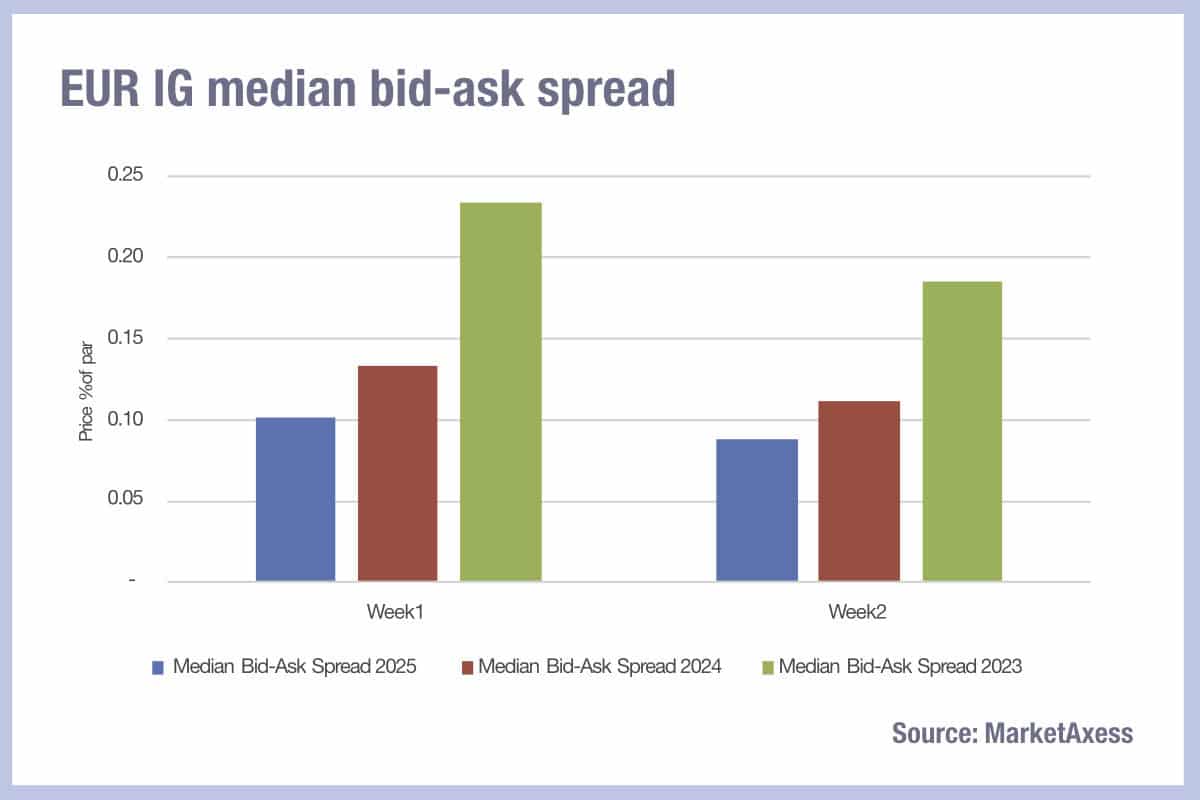

Investment grade European credit fell by 21% and then 24% in 2025 relative to the first two weeks of 2024, the latter hitting a median bid-ask spread of €0.09 cents. Across two years that represents a reduction of 56% and 52% for the first two weeks of the year.

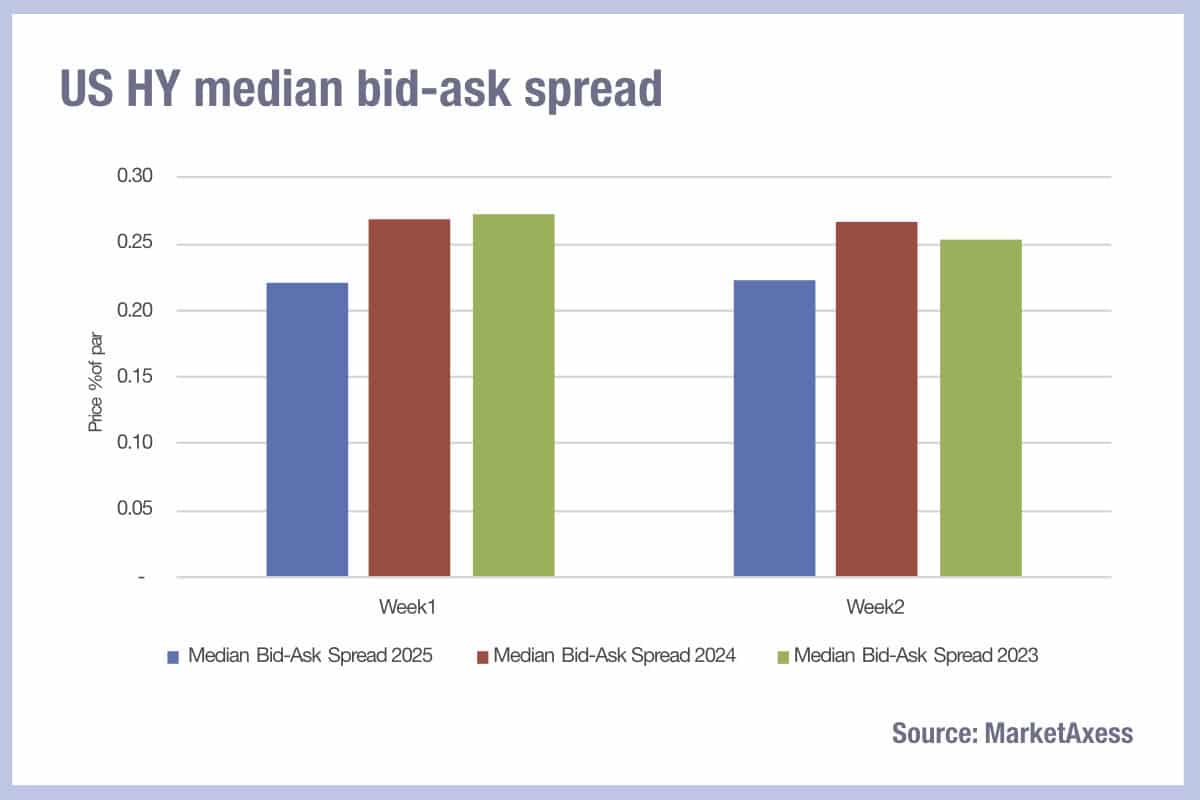

In US markets the same trend was apparent, with traders finding liquidity considerably cheaper in 2025 compared with the previous year. Bid ask spreads in high yield reduced by an average of 17% in the first two weeks of the year, however HY US trader had seen little to no decline between 2023 and 2024.

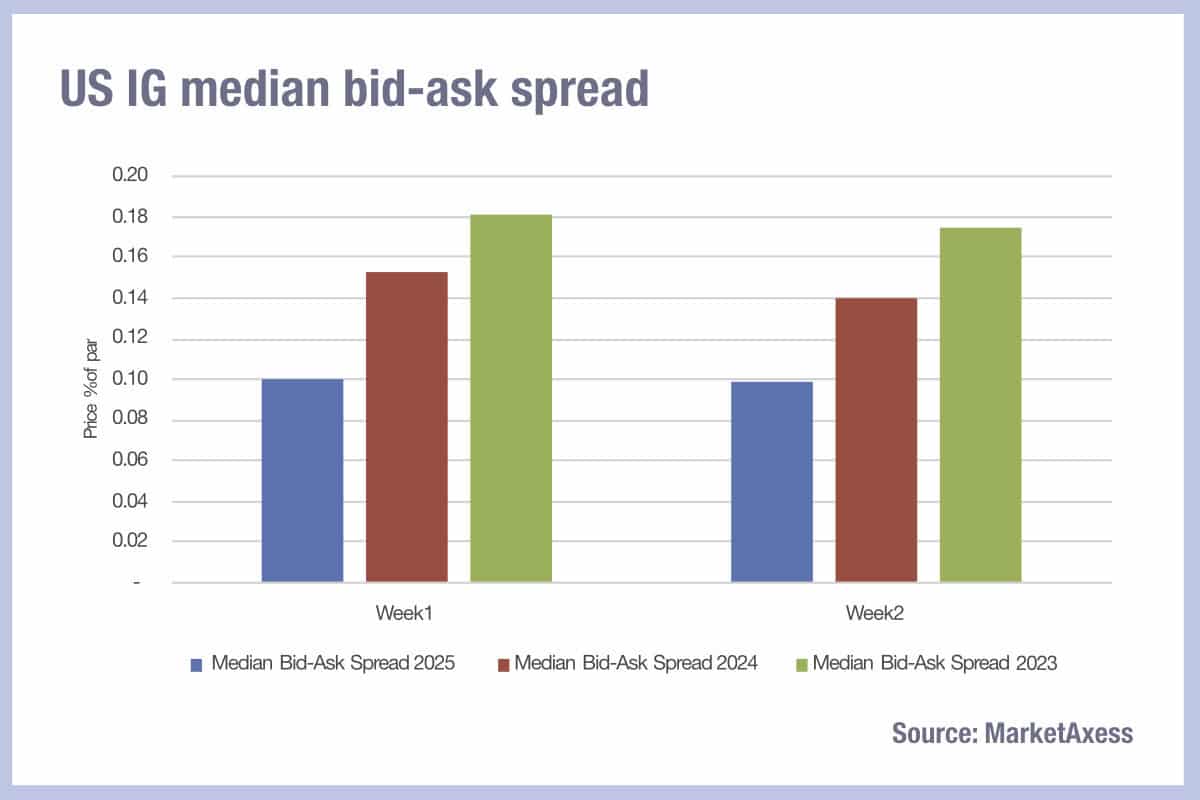

US IG traders saw liquidity costs fall for the second year in a row in the first two weeks of the year, down 35% / 30% in weeks 1 and 2, with a 45% / 43% drop-off over two years.

This suggests that all is well with the world for buy-side traders, who will be trading at a lower cost than ever before and feeling that their dealers are delivering top-notch market making.

Whether dealers will be of the same opinion is less clear – tighter bid-ask spreads are indicative of tighter margins on the dealer side and that suggests competition is fierce.

It is highly probable that increased electronification of markets is a major vector for reduced costs, however there are very different model for trading as seen between Europe and the US.

The increased pace of change in Europe vs US markets may be indicative of accelerated change in the former, as Europe’s markets roll out the electronic models of trading initially launched in North America.

©Markets Media Europe 2024

©Markets Media Europe 2025