Interdealer broker BGC has confirmed its May 2018 acquisition of emerging markets bond trading platform embonds, while several sources close to the firm have reported a round of redundancies in its emerging markets trading team.

BGC has been building a strategy across the interdealer and dealer-to-client space in fixed income markets this year. It announced its return to the US Treasuries market in June with the launch of FENICS USTreasuries, a platform that offers interdealer trading alongside intermediated buy-side access to interdealer market rates.

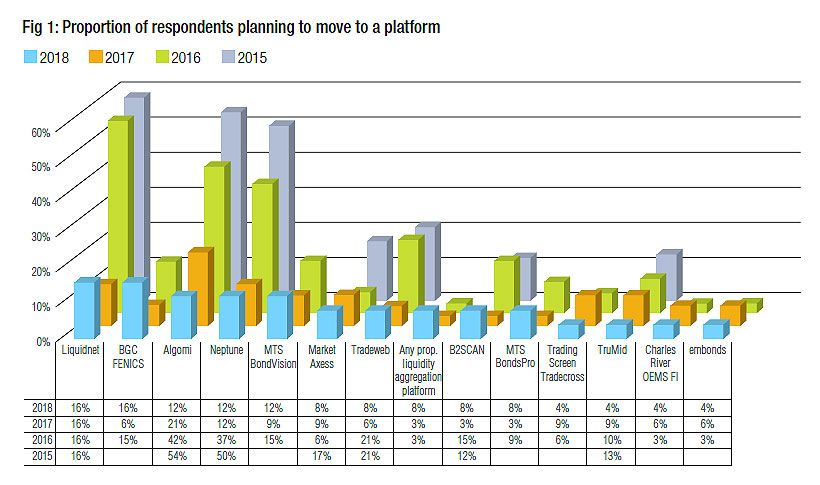

The acquisition of embonds, a European multilateral trading facility (MTF), expands its capacity to support buy-side trading in emerging markets bonds. Embonds had proven popular with asset managers, exhibiting a healthy pipeline of expected engagement from buy-side desks in the annual ‘Trading Intentions Survey’ run by The DESK (See Fig 1). It uses a combination of central limit order book, request for quote and auction model to effect execution.

One source said it was early days for its strategy to emerge, but “clearly the company wants to upgrade on employees given the backdrop of the marketplace.”

©Markets Media Europe 2025