Bond markets could potentially use tokenization to improve efficiency, liquidity and transparency according to the Hong Kong Monetary Authority (HKMA) as consultancy McKinsey said tokenization may have reached an inflection point for certain use cases and asset classes.

Tokenization refers to the process of issuing a digital representation of a traditional asset on a blockchain or distributed ledger. Tokens can represent tangible assets such as real estate, financial securities or non-tangible assets such as digital art and other intellectual property.

HKMA began investigating tokenization in 2021 in collaboration with the Bank for International Settlements Innovation Hub Hong Kong Centre to test the concept of tokenized green bonds. In February this year Hong Kong completed an HK$800m ($101m) offering, Project Evergreen, which it said was the first tokenized green bond issued by a government globally. The clearing and settlement system for the bond was the HKMA’s Central Moneymarkets Unit, using GS DAP, Goldman Sachs’ tokenization platform.

Bond Tokenisation in Hong Kong, HKMA’s report, summarized the project across technology and platform design, deal structuring, legal and regulatory considerations and outlined possible next steps to promote the wider use of distributed ledger technology in the local bond market.

“The issuance demonstrated the possibility of deploying distributed ledger technology to a real capital markets transaction under the existing Hong Kong legal framework,” added HKMA. “It also showed the potential in DLT to enhance efficiency, liquidity and transparency in bond markets.”

Project Evergreen launched in 2022 and used DLT to settle securities tokens, representing beneficial interests in the green bond, on a delivery-versus-payment basis. Cash tokens represented a claim for fiat Hong Kong dollars against the HKMA on a T+1 basis across a private blockchain network. Processes of the bond lifecycle, including coupon payment, settlement of secondary trading and maturity redemption, were also digitized and performed on the private blockchain network.

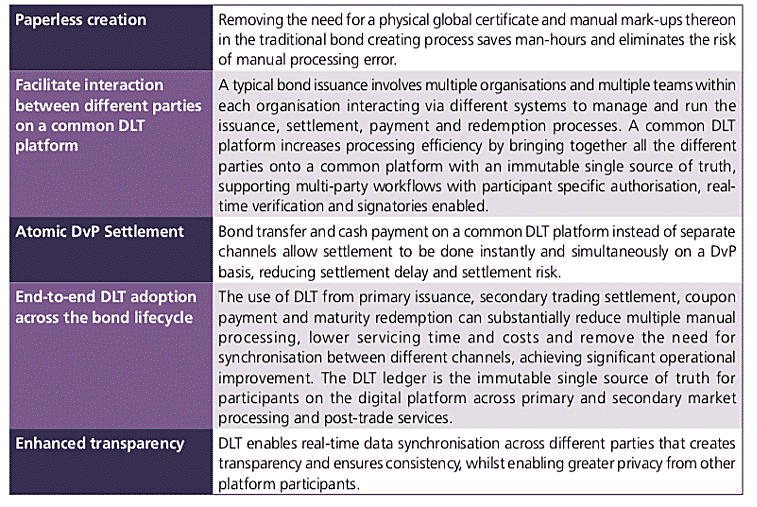

The report highlighted the potential of DLT to increase efficiency for institutional bond issuance:

HKMA continued that to fully unlock the potential of tokenization, more could be done to explore further use cases, address issues of fragmentation and enhance the legal and regulatory framework.

Building on Project Evergreen, HKMA said it will work with the government and the industry to conduct further tokenized issuances.

Eddie Yue, chief executive of HKMA, said in a statement: “DLT holds promise for revolutionizing the operation of the financial markets. Building on the experience from this issuance, the HKMA and the Government will work with other stakeholders to conduct further tokenized issuances to push the boundary and encourage usage.”

Inflection point

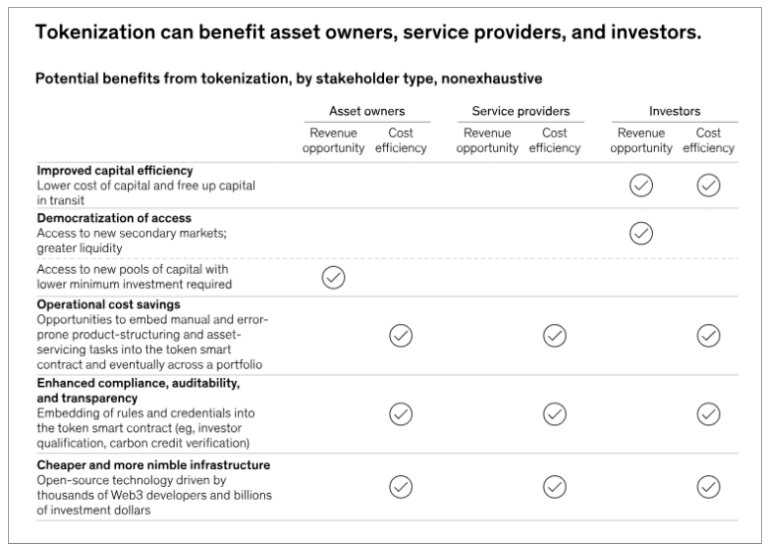

Tokenization may have reached an inflection point for certain use cases and asset classes as trends over recent months show a possible acceleration of adoption according to McKinsey. The consultancy said in a report that approximately $120bn of tokenized cash is now in circulation in the form of fully reserved stablecoins, and on-chain volumes for stablecoins have routinely been more than $500bn per month.

In addition, rising rates have made tokenization use cases more attractive through delivering capital efficiency. For example, there is a cost difference between a $100m notional one-hour repo facility versus the standard 24-hour facility when rates have risen from 0 to 5%.

“Short-term liquidity transactions such as tokenized repos and securities lending are more attractive with higher rates, as are tokenized money market funds for fluid collateral management,” said McKinsey.

McKinsey highlighted that over the past five years banks, asset managers, and capital market infrastructure companies have built digital asset teams of 50 or more and their understanding of the technology and its promise has increased.

Although McKinsey said the specific time frame for the ultimate adoption of tokenization is unknown, it expects early institutional experimentation across certain asset classes and use cases to have the potential to scale in two to five years.

The consultancy gave the example of Broadridge, the fintech infrastructure company, already facilitating more than $1 trillion worth of tokenized repos every month on its Distributed Ledger Repo platform. HKMA said the total global issuance of tokenized bonds had reached $3.9bn as at the end of March 2023.

“We are currently seeing greater experimentation and planned expansion of capabilities (often through partnerships) among these capital market incumbents, with some working on integrating or rolling up necessary capabilities to become a one-stop shop for asset tokenization and distribution,” added McKinsey.

U.S. Treasury Token

An example of a tokenization use case is DigiFT, a decentralized exchange (DEX) for digital assets, announcing the launch of the DigiFT U.S. Treasury Token, DUST, on 10 August 2023.

DigiFT said it is the first and only DEX enrolled in the Monetary Authority of Singapore’s FinTech Regulatory Sandbox.

Henry Zhang, chief executive of DigiFT, said in a statement: “As the first fully regulatory-compliant U.S. Treasury Token offered on a DEX, DUST will enable us to broaden pathways for investors to explore tokenized real-world assets on-chain with full transparency, backed by institutional grade risk management mechanisms.”

This article was first published in Markets Media

©Markets Media Europe 2025