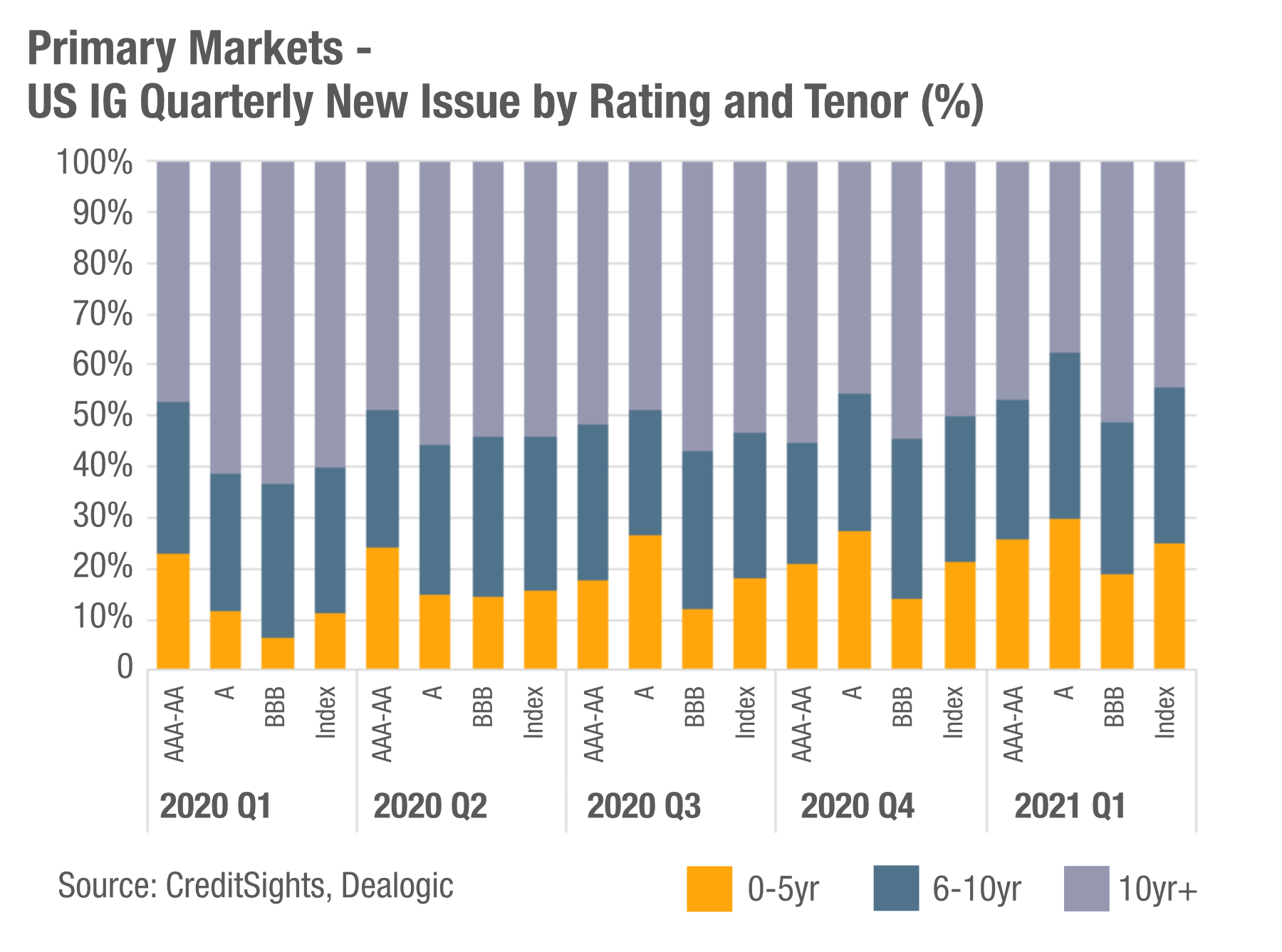

The analyst team at CreditSights has spotted that the tenor of investment grade bonds being issued in the US primary market Q1 2021 has declined against the levels seen in Q1 2020, with many more issued in the 0-5 year range than in the 10 year plus range.

The analyst team at CreditSights has spotted that the tenor of investment grade bonds being issued in the US primary market Q1 2021 has declined against the levels seen in Q1 2020, with many more issued in the 0-5 year range than in the 10 year plus range.

A change in the tenors being issued could reflect the lower confidence in long term rates to remain stable, however if rates were to rise that would increase borrowing costs when these bonds are rolled over in the longer term.

As Jack Fischer, analyst at Refinitiv Lipper recently observed, “When interest rates rise, bond prices fall. As new bonds get issued at higher yields, previously issued bonds lose their appeal. In reflationary periods, purchasing securities with higher yields, shorter durations, or adjustable rates are all central strategies to limit interest rate risk.”

The implications for investors and buy-side traders looking at the investment grade market stem are a key issue. How much this issuance reflects investor demand and how much it reflects issuer interests is central to this issue.

Analysts report seeing the long end of the curve outperform as investors have looked to add longer dated bonds to capture the 3-4% yields available in the 30-year in IG.

If 30-year investment grade bonds are pricing at attractive levels to the issuer, that might suggest it is investor demand that has driven the shift towards fewer long-dated IG debt being issued. That may mean a more competitive trading environment for shorter-dated bonds, depending upon the mandates that investment traders are working on.

The speed of any change in rates will affect volatility levels. The investor response to changing rates will drive large-scale directional change as was seen in the 2013 taper tantrum, when the market responded to the mention of a change in quantitative easing as if it were a full-on stop and reacted strongly.

The consensus is that the Fed will telegraph virtually every thought it has about tapering to the market, so that investment banks and investment managers have less fear of a sudden movement – and can respond in a more measured way.

Analysts at Morgan Stanley recently warned that uncertainty around the trajectory of rates “and the total return damage to portfolios has now reached a point that could test IG credit in the near term.”

That may see secondary market activity increase if investors pull money out of credit funds, adding to directional market activity.

©Markets Media Europe 2025