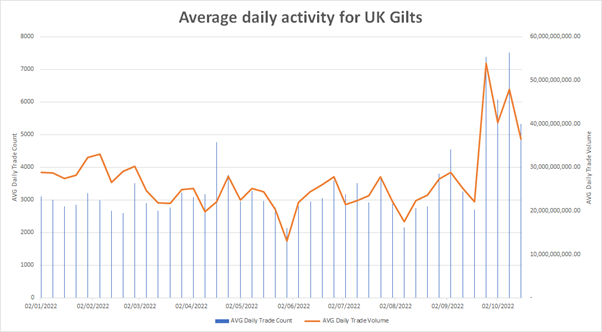

To look at the whipsaw effect of the UK’s 23 September mini-budget on secondary UK bond trading, we have taken data from MarketAxess TraX, which tracks trading across multiple markets and counterparties. Firstly, looking at volumes, we can see the huge jump in activity at the end of September.

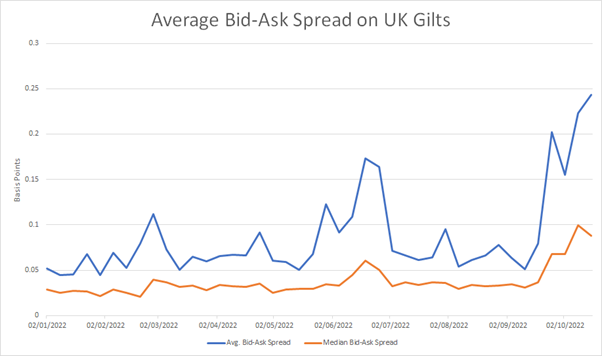

Mirroring that was the volume of trading in UK corporate bonds, which are benchmarked against gilts, also spiked. Moreover, we saw the bid-ask spread for gilts more than double, reflecting the very directional nature of liquidity provision.

Although the Bank of England announced it would be buying Gilts from 28 September it created a limited window of support, until 14 October. Volumes did drop off somewhat as the window closed however, average bid-ask spreads – which had risen by approximately 150% – were still high. The median bid-ask spread fell at this point, suggesting that there were parts of the market in which bid-ask spread was higher for certain bonds than for others.

There was a similar but more limited increase in bid-ask spreads for IG credit, increasing by approximately 10% which was far lower than for rates.

The outcome for traders, with higher bid-ask spreads and higher – but very directional – volumes show precisely why fund managers needed support from the BoE in order to trade gilts.

©Markets Media Europe 2022

©Markets Media Europe 2025