To see political risk writ large in financial markets, look no further than the UK. While Rishi Sunak has won the race to be the new Prime Minister on Diwali – an auspicious start for Britain’s first Hindu PM – the previous administration will be remembered for a far worse start.

In today’s Barnes on Bonds we will be examining what that looked like from the trading desk. On 23 September 2022, the then Chancellor of the Exchequer issued a ‘mini-budget’ which saw tax cuts and increases in borrowing.

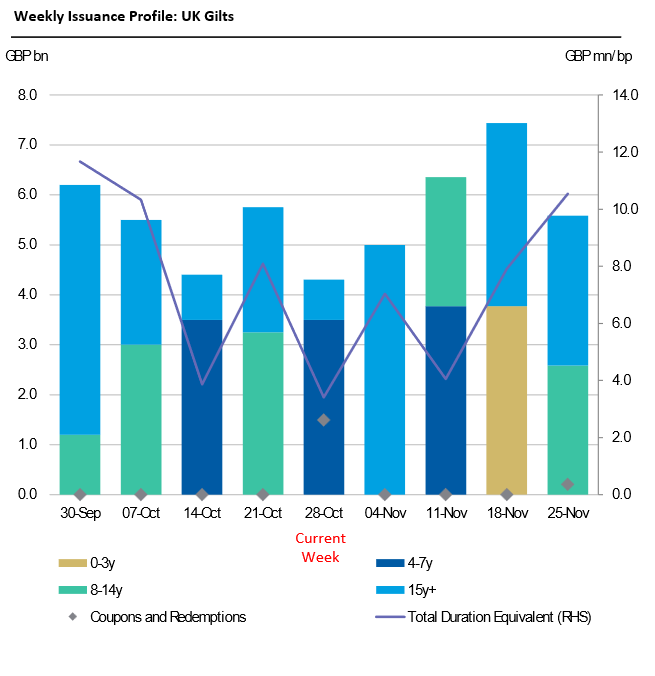

With an announcement of the mini-budget, the UK’s Debt Management Office (DMO) increased its 2022/23 financing target by £72 billion pounds after Kwarteng’s mini-budget, with £62 billion pounds of funding through UK government bond (gilt) sales.

Gilts sales continued but the Bank of England’s plan to sell bonds it had been holding as part of the quantitative easing programme – which saw it build a portfolio of close to £850 billion of government bonds – were delayed, as the price of gilts fell and yields rose.

Even worse, it had to step in as a buyer-of-last-resort as of 28 September, so that sellers, particularly UK pension funds, could trade out of bond inventory to raise cash to be posted as collateral, needed to help manage leveraged liability driven investment strategies.

In a statement it said the purchases would be carried out on whatever scale was “necessary” to effect the outcome of market stability in an operation fully indemnified by HM Treasury.

On 17 October, a new chancellor of the Exchequer, Jeremy Hunt, reversed the budget and introduced a more austere plan. By 19 October, this had had enough of a positive effect on gilts to lead the BoE back to selling bonds in the following month.

©Markets Media Europe 2022

©Markets Media Europe 2025