Barclays’ Market Structure team has released its third annual survey of bond market electronic trading for buy-side clients.

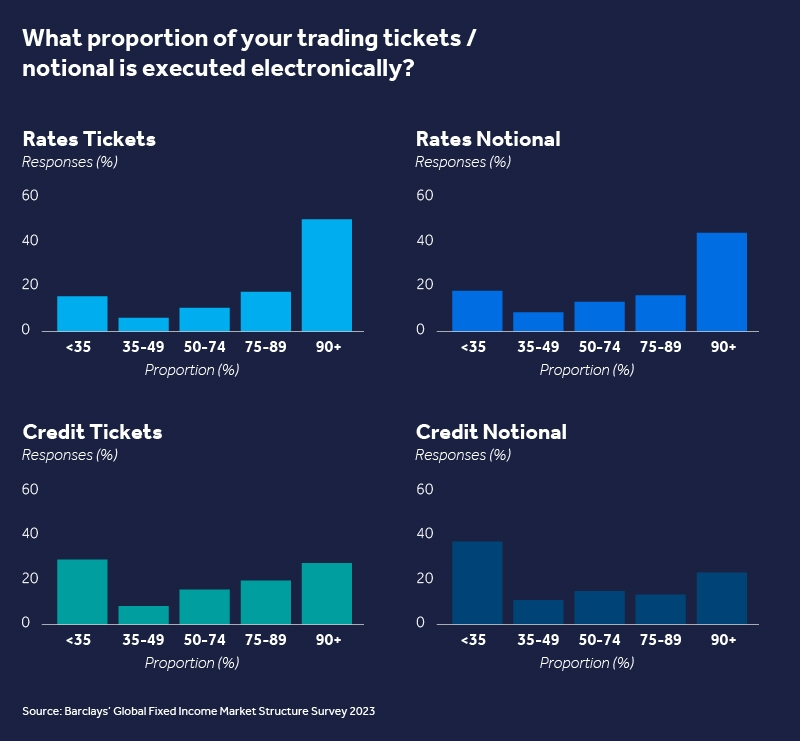

In rates markets, when asked what proportion of their trades are executed on an electronic trading venue, 50% of respondents said they use electronic trading venues for at least 90% of tickets, and 44% said they use electronic trading venues 90% of the time for notional value traded. In credit tickets, 27% use e-trading 90% of the time and by number of tickets and 23% trade 90% of notional, electronically.

Some respondents indicated they execute more than 10% of their tickets using alternative protocols such as request for market (RFM), click-to-trade, fully firm, portfolio trading and direct connectivity across rates and credit. Standard request for quote (RFQ) is the prevalent execution method across rates and credit, and more than 40% of respondents were not using alternative protocols. Adoption of automated execution is growing year on year in the rates market where there was a significant increase in the percentage of clients who put more than 50% of their flow through automated rules engines such as Tradeweb’s AiEX, Bloomberg’s Rule Builder, and Bondvision’s MTS Auto Execution, according to the research. The bank saw a 10% increase in the number of rates clients using these tools year on year, enabling two key outcomes for clients: firstly, reducing the amount time traders are spending on small size trades, where they can add little value in the execution. Secondly, with this additional time, traders can spend more time on the difficult trades where they can add significant benefit. Of those clients who do use automated execution settings, about 30% review their settings quarterly, while about 18% said they have not changed these setting since they went live. Some 36% of the bank’s clients reflect that they are facing material challenges, integrating data into their systems at the level desired. Systematic ingestion of axes and runs is the most popular take on integrated data with more than 24% of clients consuming it in an automated or semi-automated manner. However, in comparison to last year, respondents are increasing the use of other data types. This would include evaluated pricing, measures of market depth and dealer data products. The main use case for integrated data is dealer selection, with about 20% of respondents reporting this use case for both credit and rates products. Clients are also leveraging data across the investment lifecycle to help inform their investment decision making. Though it is now materially important to have systematic data integrated into trading systems, the task is often easier said than done. Of those surveyed, 36% reported an inability to integrate data into their systems at the level desired. They also reported other hurdles, including cost increases and inconsistent business data standards. With such a sizeable portion of respondents highlighting issues, the bank noted that a divide may open up between those who have made the leap and those who lag behind. Portfolio trading in credit was found to be growing, because those who do use it are deploying it in a higher percentage of their overall trading. In 2023, nearly 12% of clients were trading 25% or more of their flow through portfolio trading, up 8%, from 2022, with 4% of clients trading more than 25% in 2022. Additionally, traders are becoming more sophisticated in the ways they create and select counterparties by using pre-trade tools provided by dealers and platforms. These tools aid traders with portfolio formation for trading, dealer selection and execution cost estimates. Report author, Matt Coupe, wrote, “Electronic trading is maturing in fixed income markets and the technology is ever changing. Barclays’ Market Structure team surveyed a diverse set of buy-side clients about trading venues, data integration, rules engines and more. The responses show strong engagement and an awareness from investors to the challenges ahead for keeping pace as digitization evolves further.” Now in its third year, the global survey received 480 responses from clients representing asset managers, hedge funds and bank treasuries amongst others, and with AUM varying from multi-billion dollars to over US$1 trillion. The DESK

©Markets Media Europe 2023

©Markets Media Europe 2025