Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity support.

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity support.

Buy-side traders see that sell-side fixed income dealing desks who both make money for their banks and happily provide liquidity, often have three elements in common; they have balance sheet, they have volatility appetite when looking at their P&L, and they are often broad sales desks, who can cover a range of clients.

Yet banks are under considerable pressure on multiple fronts, which makes these characteristics increasingly scarce. Firstly, competition in the bond markets from non-bank liquidity providers is delivering very tight bid-ask spreads in parts of the market, notably indexed bonds. Secondly, capital rules are reducing the capacity of banks to provide balance sheet, as holding riskier assets such as corporate bonds requires greater capital to be held as a risk buffer, which cannot then be used elsewhere. Thirdly, cost pressures are driving dealers to automate processes wherever possible, and that has reduced the budget for long-serving high-touch traders.

“On the sell side, spreads are compressing so firms are finding it hard to make money from flow business, across asset classes, and at the same time, prudential rules are impacting risk taking, so it’s a very difficult environment at present,” observes Ed Wicks, global head of trading at LGIM.

All of this creates challenges for buy-side firms. A sell-side desk with discretion over P&L can occasionally take a hit to support liquidity flow in volatile markets, because over the longer term the desk will make back money. If those desks reduce it can be harder for buy-side traders to find the other side of the trade in fast markets.

“Comfort around moving the size of risk can often be sell-side trader dependent,” notes one buy-side trader. “If you’ve got big sizes, it’s often a specific trader who you reach out to, regardless of the bank, because they’re comfortable with risk.”

The electronification of markets and weakening of relationships can gradually unwind the motivation of banks to deliver liquidity, especially if trading is entirely commoditised.

“As request for quote (RFQ) has expanded from going to two or three dealers, now it can be six plus,” says Audrey Blater, senior analyst in the Market Structure and Technology team at Coalition Greenwich. “That buy-side desk may not care who executes it, because everybody’s going to give them a price. This comprises margins.”

In parts of fixed income that are only partially electronic – and that includes the global corporate bond market – many buy-side desks would like to see an optimal mix of sustainable trading and efficient pricing.

“Traditional over the counter (OTC) trading has historically been done by dealers distributing market data over email,” says Jason Quinn, chief product officer of Trumid. “That inquiry tends to come in non-comp. This way of trading is important from a high touch perspective, because it tends to be higher quality. There is a desire from both sides not to have the market gravitate towards 100% competition at all times.”

The evolution of the dealer

The response from sell-side firms has been to build out their low-touch offerings alongside their high touch trading desks.

Alexis Besse, head of International fixed income quantitative strategies at Jefferies, says, “There is a traditional fixed income business that is centred around content, block trading and moving risk efficiently supported by sales and credit analysts. There’s also the low touch business working hand-in-hand with the ETF offering and market making on ETFs which is the other ecosystem. They overlap when it comes to bond trading, because some smaller ticket, higher velocity trading is helpful for both traditional fixed income, voice business, as well as our systematic trading.”

“Low and high touch complement each other,” says Melvyn Merran, managing director for fixed income quantitative trading at investment bank Jefferies. “On the one hand, low touch offers very high turn-over to move and settle odd-lots efficiently, permitting you to do more with less balance sheet. The ETF’s create-redeem process is core to that ecosystem. On the other hand, high touch is essential to trade larger blocks, gather market colour and alert on special credit situations.”

Of course, this evolution has not been smooth. Bringing the low touch model from other asset classes does not work as most of fixed income does not have disclosed two-way pricing to support pre-trade price formation. Having developed single dealer platforms in the 2010-13, they moved more into platform-based trading, before building pricing algorithms to stream prices onto platforms, and then in some cases supplying direct price feeds to clients.

Besse notes, “The sell-side has struggled to strike the right balance with low touch credit trading. However, Jefferies has been building this business with Fixed Income ETFs, Credit Algorithmic and Portfolio Trading under one desk, fully integrated within our fixed income infrastructure, a model we think is best suited to service our clients efficiently over time.”

Equally, the highly automated liquidity providers who are moving into the credit space are not able to provide full coverage without supporting low touch trading, characterised by the hiring of sell-side credit sale traders as new entrant Citadel Securities began doing towards the end of 2023.

Best practice

There are best practices that every market participant can engage in, to better support both low- and high-touch trading.

For buy-side traders, supporting their high touch counterparts without compromising best execution obligations is entirely possible. Firstly, when asking for prices in competition (in-comp), they can include those dealers who offer a strong relationship over the longer term that they see the flow.

Banks also need to be aware that the staff on their desks has a material effect on the flows they get shown.

“You can see a difference between a sales-led broker model or a trader-led broker model,” notes one buy-side trader. “You get a higher turnover of traders where there’s been a sales-driven manager, and on the flip side, longer term traders stick around if it’s a trader in charge. That is driven by the manager knowing full well that there are days you win and days you lose, but if you’ve got the right methodology, the desk will come good.”

They also need to build out high and low touch services with a single eye, despite their different models, in order to deliver an effective holistic solution for clients.

“We keep looking for the best models to interact and to work together, especially on overlapping business,” says Besse. “We have fully dedicated trading books for the low touch business and for the voice desk. Risk is obviously managed separately because we have different utility functions. It is both a competitive model, but also a collaborative one, with each business solving for a slightly different thing.”

Equally, trading platforms need to support both high and low touch trading to bring the two sides of the street together.

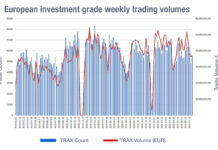

“As we considered delivering an ecosystem of workflows on our platform, an important protocol was disclosed non-comp trading, which relies on distribution of market data, and bilateral negotiation that is attributed trading,” says Quinn. “That’s what we deployed in 2019 and have been operating on Trumid for the last five years. In February, Trumid Attributed Trading in saw activity up around 60% year-over-year and the number of users transacting daily in the protocol, up around 30%. Algos are an important and growing component of that.”

©Markets Media Europe 2023

©Markets Media Europe 2025