Trading in AT1 bonds spiked on Monday 20th March as a result of the Credit Suisse rescue at the weekend, with one platform trader observing that Monday’s market activity consisted of “Trading and matching AT1s all day.”

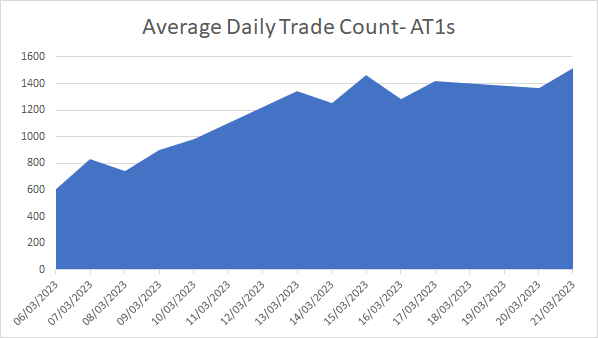

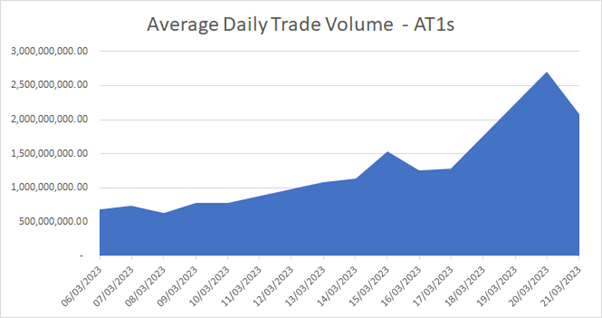

Yet trading was also elevated in the week before the Credit Suisse collapse according to data from MarketAxess Trax, which tracks trading across multiple markets and counterparties. On Monday 13 March, AT1 trade count had already risen by 37% (Fig 1) against the previous Friday, while trade volume (Fig 2) rose by 39%.

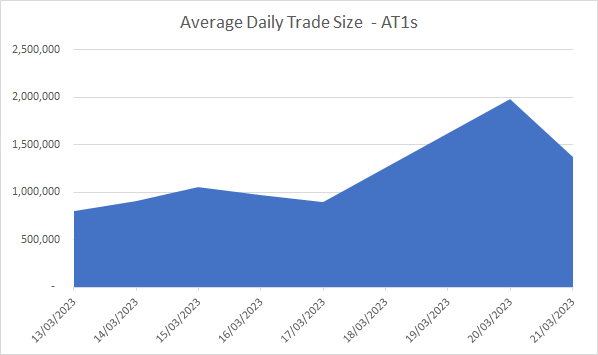

However, average trade size (Fig 3) did not increase in that period, and only began to grow on 17 March, the Friday after Credit Suisse’s lifeline from the Swiss National Bank was publicly declared – and behind the scenes, as revealed by the FT, the UBS deal was set up by regulators.

The Swiss regulators’ subsequent decision on Sunday 19 to make good equity investors while wiping out AT1 securities holders, during the Credit Suisse “emergency rescue” as Colm Kelleher, CEO at UBS described it, led investors to question whether the US$260 billion AT1 market needed repricing.

A joint statement issued by Europe’s Single Resolution Board, the European Banking Authority and ECB Banking Supervision said, “Common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier 1 be required to be written down. This approach has been consistently applied in past cases and will continue to guide the actions of the SRB and ECB banking supervision in crisis interventions. Additional Tier 1 is and will remain an important component of the capital structure of European banks.”

TraX data shows that the average daily trade size more than doubled on 20 March against the previous Monday, to US$20 million, while the trading volume also doubled over the same period to reach US$2.7 billion. Paul Summer, head of structured notes and financials trading at KNG Securities, a fixed-income focused investment bank, says,

“After an initial selloff, the AT1 bond market has recovered somewhat from the shock of the Credit Suisse writedown. The affected Credit Suisse AT1 bonds are now trading at around 5% of notional value, as some investors see hope of a legal challenge.”

“The Credit Suisse Tier 2 bond 6.5% 08/08/23, which was not written down even though it included bail-in language, dropped to 60% but is now trading above 90%. Investors in other AT1 bonds were comforted by comments from the EU and UK authorities that they would expect common equity instruments to absorb losses before AT1 is written down. However, in our view, this will permanently affect the AT1 market, with investors having to pay much more attention to the terms and conditions of future new issues, and consequently demanding a higher interest premium.”

©Markets Media Europe 2023

©Markets Media Europe 2025