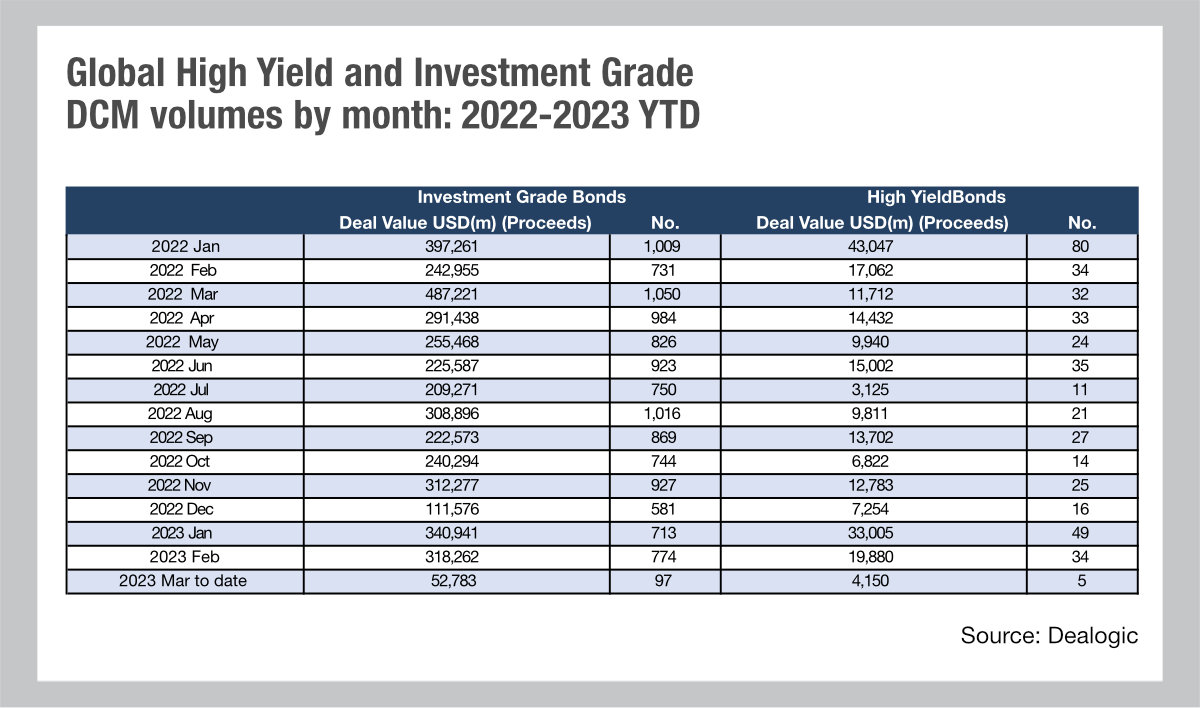

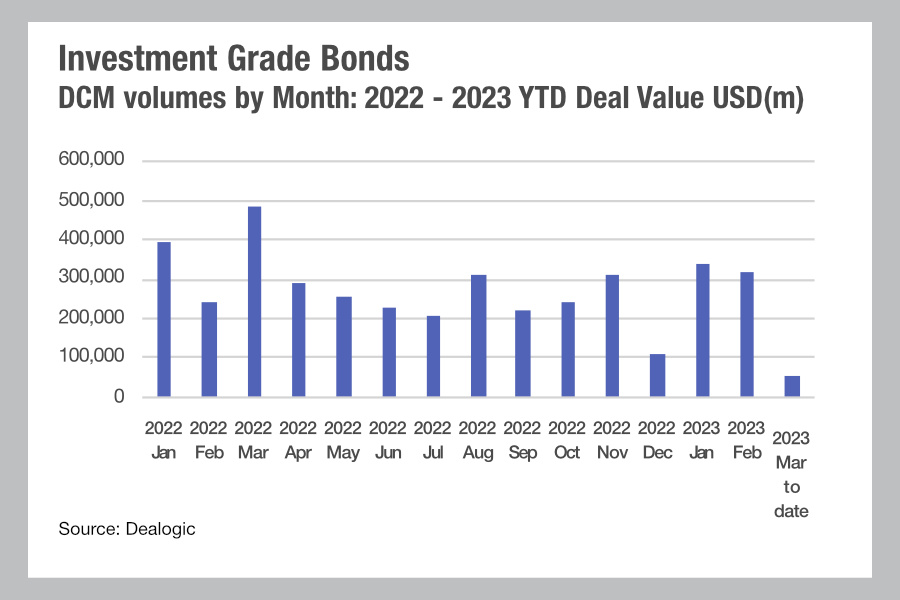

Bond issuance has continued to beat expectations in February 2023. Last month saw 774 investment grade bonds issued globally, for a notional value of US$318 billion in proceeds according to Dealogic data.

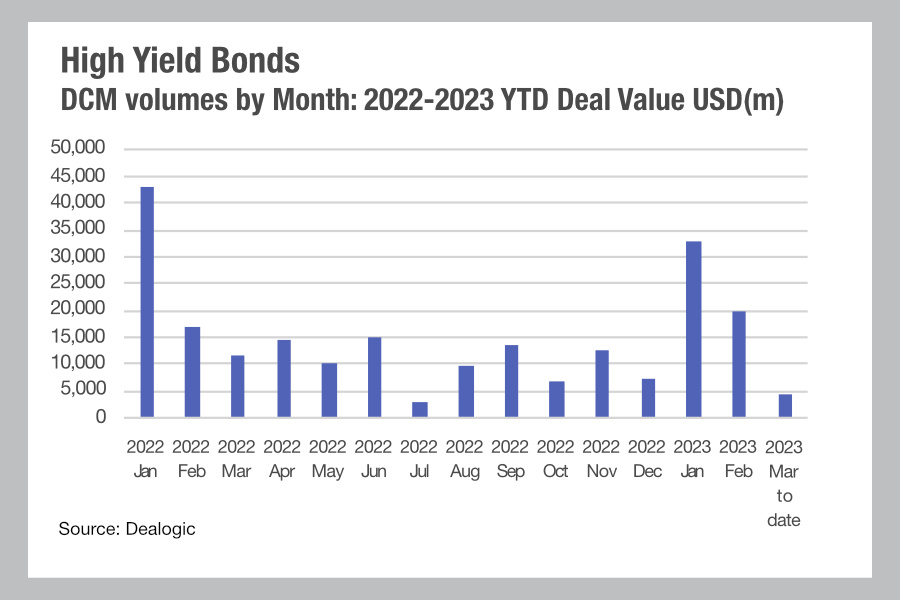

High yield markets saw 34 deals – the same number as in February 2022 – but with US$19.9 billion raised which is 16.5% higher than the same period in the previous year. Investment grade deals represent a 6% increase with a growth of 31% against February 2022.

Talk on the street is that a lot of new issues were being held back at the end on 2022 as inflation expectation were being set, but this new front-weighted loading of new issues carries further implications.

The first is that issuers may be concerned the Federal Reserve will push up rates to 6% this year, making it cheaper to issue bonds at the start of the year than later on. As every major economy fights inflation, other central bank rates will follow the Fed affecting global issue of corporate bonds and govies.

The second is that issuance may face a dramatic slowdown at a point in the year as financing demands are met earlier in the year.

If that were to take place, buy-side traders would face a reduced workload and be able to refocus on the secondary markets where they add more value. However, primary markets are also a useful source of pricing data and liquidity for bond investors. A severe change in primary market activity could create more pressure for firms trying to access both liquidity and pricing data.

A final point is this; if rates go up, equities go down and investor money may well flow into fixed income funds which could – if under operational pressure – make buy-side traders’ lives more difficult. The average difference between inflows and trading desk resourcing is around 18-24 months so desks will need to plan ahead to cope with the impending strain, using more efficient ways of trading and better pre-trade analytics.

©Markets Media Europe 2023

©Markets Media Europe 2025