The recovery from last year’s market sell-off and the ongoing Covid-19 pandemic appears to have been marked in many regions, with volumes for both buying and selling activity remaining largely high and bid-offer spreads receding back towards pre-pandemic levels.

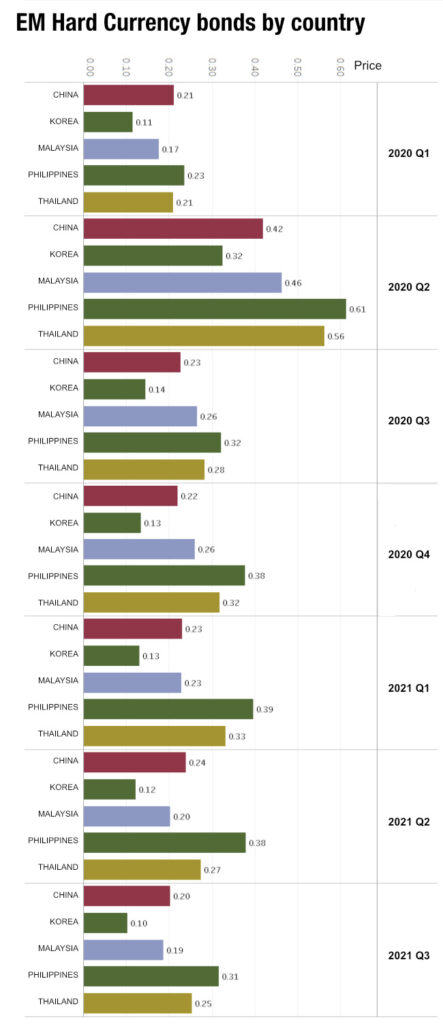

However, there are anomalies. In Asia Pacific using MarketAxess data, we can see that these spreads for Chinese and Korean hard currency bonds have returned to pre-March 2020 levels, but for several other Asian markets they have remained elevated.

Overall, while bid/offer spreads ballooned in the sell-off with most more than doubling, leading to an elevated level in Q3 /4 2020, they then followed a pattern of decline. As such execution costs for buy-side traders were returning to normal. That has a material impact on the cost of large scale investment decisions, and ultimately the end investor.

Understanding why spreads have failed to recover in the Philippines and Thailand to the same extent as China and Korea is likely to be based on two key things. Firstly, a market structural answer. Both China and Korea have well developed capital market structures that allow investors form overseas to supplement local liquidity and thereby drive down volumes. That is less true for the Philippines and Thailand.

Secondly, there could be an ongoing pandemic issue, with some local investors noting that both are “suffering materially” with their Covid strategies at present, leading to more risk aversion from regional and global banks in making markets for local bonds.

Finally, there is a likely economic issue found in the 0.5% interest rate that both countries have as their base rate, compared with China’s 3.85% and Korea’s 0.75%, although the latter rose to that level only in Q3 2021.

©Markets Media Europe 2025