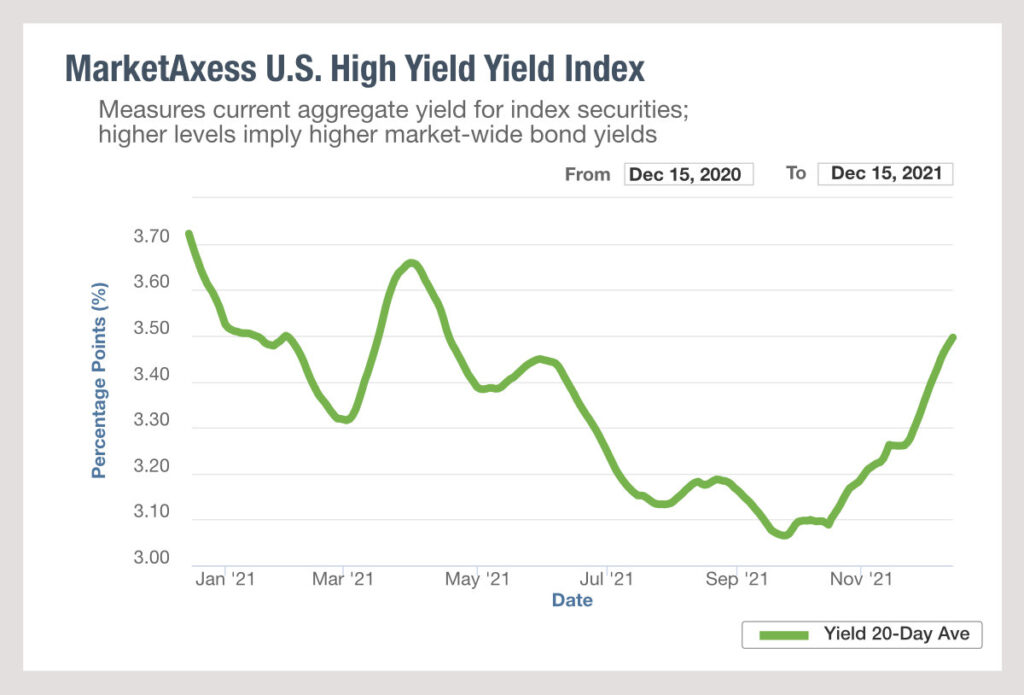

Yields for US high yield bonds have turned a corner, according to MarketAxess data, following a drop from 3.65% in April down to 3.065% in October. Currently sitting around 3.5%, they are roughly at the same level as the start of the year in January.

That is still far off the pre-Covid levels at the start of 2020, leaving a lot of recovery to bounceback. As investors positions for higher inflation, and the response of the Federal Reserve (and other central banks around the world) there is greater uncertainty in the markets.

Having not seen an inflationary environment for some period of time, investment managers are thinking about how to positions themselves.

In the investment grade (IG) market, yield started at 1.60% but is now around 2.15% which is far closer to pre-Covid levels than seen in HY.

There has been no corresponding volume shift over the year based on TRACE data, which suggests that there has been no major repositioning by investors in order to reflect these changes. That also suggests that if inflation risk continues or even accelerates, or other risks are introduced, volumes could increase massively – as has been seen in 2020.

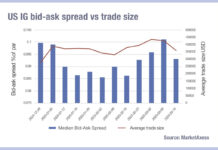

Liquidity conditions in the US have largely been positive, despite no increase in volume, which may be the result of increased trading efficiency, or possibly the lower variability between assets in a single asset class, as a result of the Federal backstop to liquidity. That may have reduced the opportunity to add alpha in portfolios and therefore dampened trading volume.

©Markets Media Europe 2025