Strong bond issuance in the first quarter (Q1) is galvanising performance of debt capital market teams at investment banks, in turn creating optimism amongst analysts. They report they are now looking for positive guidance on equity capital markets (ECM) and merger and acquisition (M&A) activity.

“In the last two quarters, investors have been searching for greenshoots in banking activity, and now we have confirmation of positive trends crystallising,” write Morgan Stanley equity analysts Betsy Graseck, Giulia Aurora Miotto and team. “DCM is [the] leading strength in investment banking (IBD) activity, up 24% year-on-year (YoY)) and 89% quarter-on-quarter (QoQ), with notable strength in HY / Leveraged Loans and Europe.”

The team also said, “In equity capital markets (ECM), deal volumes are up 12% YoY, up for the second quarter in a row, suggesting a sustained pick-up, with the US leading the way, followed by Europe, whereas Asia is still lagging. In M&A, most global IB managements have highlighted a strong mandate pipeline buildup – announced M&A volumes are up 29% YoY, indicating a strong revenue pickup in 2H24, while completed deals are down 28% YoY.”

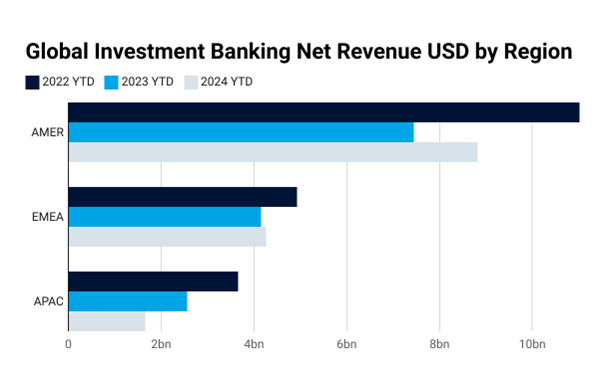

In Dealogic’s preliminary ranking for IB revenues in Q1, it found that net IB revenues in Europe and the US are up against 2023 YoY but down on 2022. APAC has seen declining revenues over the previous two years.

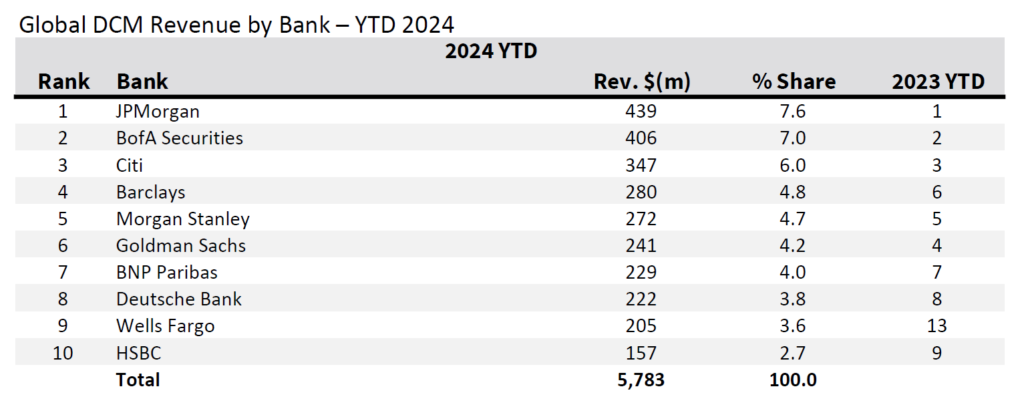

Globally, JP Morgan, Bank of America Securities and Citi are in first, second and third place for DCM revenues, and they are also hold those ranks in the US, while Citi takes global first place as bookrunner by volume issued. In the EMEA region, BNP Paribas, JP Morgan and Citi are the first, second and third largest DCM banks by revenue. In APAC, the leaders are ANZ, Westpac and then Citi by revenue.

According to the MS analysts, other peer-group analysts are giving guidance in investment bank revenues of growth between 10-20% YoY and QoQ, while markets revenues – for secondary trading – are expected to be down mid-to-high single digits in Q1 2024.

©Markets Media Europe 2024

©Markets Media Europe 2025