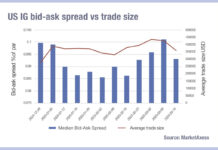

Traders would do well to run close analysis over their European trading activity this month, as data from MarketAxess Trax, which tracks trading across multiple markets and counterparties, shows that bid-ask spreads are staying wide – and will possibly broaden at year end – while trade count continues to outpace trading volumes. This tells us that larger sizes are harder to trade and costs are staying up.

The potential differentiator in fighting these liquidity and pricing challenges could well be better pre-trade and post-analytics. Buy-side firms that are able to evidence the coverage that their market makers provide can use that leverage to improve the amount of balance sheet they see.

At year end, with sell-side dealers typically taking risk off their books in order to cement any returns and optimise their profile in regulatory assessments, it can be much harder to get trades done.

That does not reflect buy-side activity however, as passive funds have to rebalance regardless and active portfolios – although typically re-engaging in the new year rather than end of year – have to consider capturing the crop of higher yielding bonds that are buying bonds being issued in 2022. Issuance is falling and access is highly competitive.

Trading analytics are not a quantitative determinant of best execution – it is a process not a number – but they have been effectively employed by more advanced firms to drive up better execution at year end via the broker review process.

So if you are an asset manager and looking for a gift to put on the list this year, consider getting your trading desk better analytics.

©Markets Media Europe 2022

©Markets Media Europe 2025