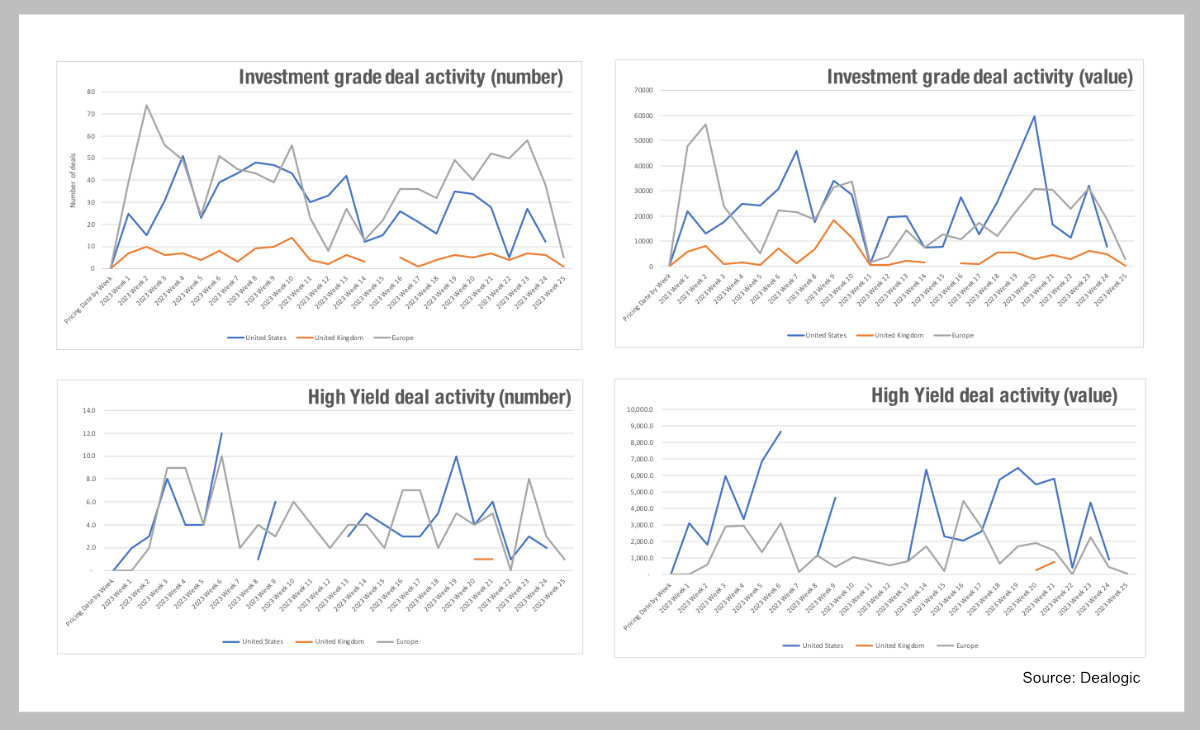

Data from Dealogic is indicating highly variable bond issuance patterns in the US, European Union and UK markets, year-to-date.

This is understandable given the rapidly rising picture for rates and uncertainty over the effectiveness of the battel against inflation. In the investment grade space, looking at number of deals and net value, the US and Europe had a spike at the beginning of the year, as the fear of even higher rates later in the year led to those deals that had been held back from 2022 being rolled over in order to avoid additional costs for issuers. Overall, the US has seen typically higher value issued while higher numbers of deals have been struck in Europe. In high yield markets issuance has been more sporadic.

The US has seen several weeks without any bonds coming to market, the UK has seen only six weeks in which bonds were issued, totalling seven deals. Europe has seen roughly half the amount of money raised than the US. With credit quality and resilience under severe pressure as rates rise, the appetite for HY bonds could fall, and the costs for issuance could move beyond the economically viable level. The recent pause in rate rises by the Fed may carry a clue as to future issuance levels. If central banks in the US and EU are expecting inflation to start falling, there is more motivation for firms to hold off issuing bonds until rates come down.

If the pause is merely a break and not the beginning of the end for rising interest rates, this could be an opportunity for issuers to push debt out to the market, before higher rates kick in. Based on the falling numbers – and value – of deals in recent weeks it seems that most firms have either already issued the bonds they need to cover debt requirements or expect the trajectory to continue upwards later in the year. That would also track with the recent – albeit small – new issues in UK HY.

Inflation is not seen to have been as responsive in the UK as in the US and Europe, and rates are widely expected to continue rising. This implies that credit conditions may get even tougher as the country faces a higher risk of recession, but also that low issuance may create a greater strain on the UK’s secondary markets due to the lack of provision from primary, exacerbating liquidity concerns for investment managers. The DESK

©Markets Media Europe 2023

©Markets Media Europe 2025