A report by the Association of Financial Markets in Europe, and investment data management provider, Finbourne, has found enhanced transparency could potentially boost liquidity if carefully applied.

The report is intended to identify where more trading activity/liquidity exists in various issue size and trade size categories, so deferrals can be properly calibrated for either more transparency or highly targeted deferral periods.

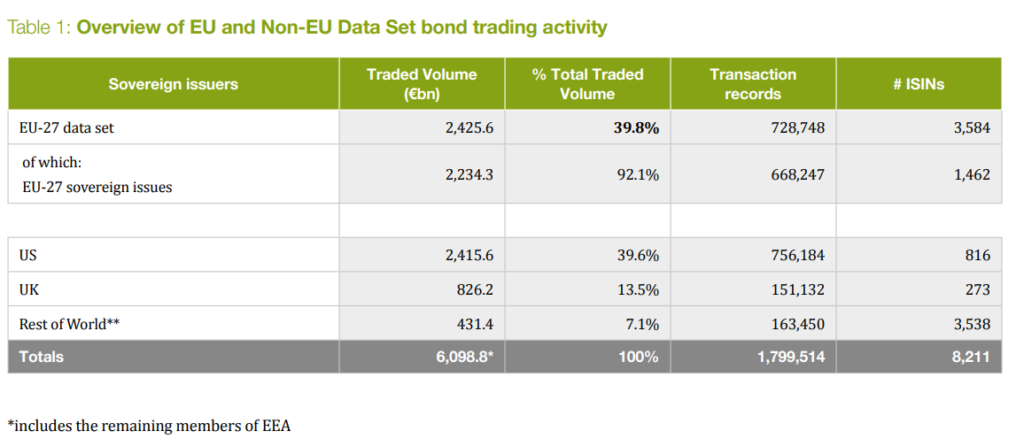

The analysis examined post-trade data from major approved publication arrangements (APAs), multilateral trading facilities (MTFs) and organised trading facilities (OTFs) from 1 March 2021 to 31 December 2021, regarding sovereign and public bonds traded on European Union (EU) platforms per the Market in Financial Instruments Regulation (MiFIR reporting requirements). This represents over €8.4tn of (gross) volume, almost 1.8m transaction records and over 8,200 distinct bonds/ISINs. Notably, the vast majority of trades (92%) in the combined sovereign/public bond category relate to direct sovereign issuance from debt management offices DMOs rather than non-sovereign public entities.

The analysis, focusing on actual Average Daily Volume (“ADV”) data as a proxy for market liquidity, examined how the transparency regime for EU-issued sovereign and public bonds can meet the needs of all market participants, with the key drivers being increased transparency in liquid EU-issued sovereign bonds, with appropriate and well calibrated deferrals continued protection of risk-taking liquidity providers in illiquid EU-issued sovereign bonds

Only 40% of the traded volume on EU venues relates to EU sovereign and public bonds; the remainder are non-EU bonds from the US, UK and many other countries.

The report found that currently ‘real time’ reporting on EU sovereigns/public bonds is higher than that for corporates – respectively 76% versus 8% by number of trades, and 36% vs 16% by volume.

In breaking down trading activity for combined sovereign/public bonds by trade size, from the current Size Specific to the Instrument (SSTI) threshold of €6.5 million to over €1 billion, and by issue size (those under €5 billion to those over €15 billion), the study found 50% of volume occurs in issue sizes more than €15 billion. A significant proportion of volume is trading in very large (or even “super large” trade sizes of over €100 million).

Approximately 64% of the overall 3,580 EU ISINs takes place in the small trade/small issue size category, whereas a relatively small number of ISINs are involved with the largest trading volume.

Detailed trade out times also provide a proxy measure of how long it might take liquidity providers to trade out of their risk positions. As was the case in the corporate bond study, this report confirms that

Trade out times for sovereigns/public bonds are significantly longer for small issuance sizes and larger trade sizes. Trade out times vary significantly for various issue and trade size categories, ranging from a few minutes to well over a year depending on the issue and trade size category. As a result, the data clearly supports real-time and EOD reporting for several categories of trades, but also that certain deferrals should be significantly longer than four weeks. This data supports AFME’s consistent position that deferral times should be calibrated by ESMA, only after analysis of actual trade data collected from the fixed income consolidated tape.

AFME trader members anecdotally highlight that in addition to this quantitative analysis there are numerous other factors which impact liquidity. These include the size of the amount outstanding. there is generally more liquidity in a very large issuance size of c €10billion (sometimes referred to as “benchmark” bonds although each sovereign may have a different definition of benchmark) than in a €1 billion issue. Liquidity is also usually better in the months immediately following issuance, the more that a bond ages, the less liquid it will become.

Likewise, a new ten-year bond will probably be more liquid than a 20 year bond with ten years remaining to maturity. Duration (change in price for a given change in yield will vary depending on the maturity of a bond, with long duration bonds changing much more in price for a 1 basis point change in yield than a short maturity bond) will impact liquidity, with long duration bonds generally less liquid. Lastly “nominal” bonds, which are generally fixed rate with bullet maturities, are more liquid than non-nominal bonds such as floating rate and index-linked bonds.

AFME and Finbourne concluded that data from this analysis could provide support for revising the calibration of the deferral regime for EU sovereign bonds. Repeated exercises of this nature could help grow the EU fixed income market if near real time public dissemination for a significant number of trades is introduced progressively and carefully together with measuring the impact on market liquidity, and calibrating deferrals carefully for all sizes of transactions.

©Markets Media Europe 2022

©Markets Media Europe 2025