By Julien Alexandre, 12 October 2022

Corporate Bond Market Distress Index

The NY Fed recently launched the Corporate Bond Market Distress Index and backfilled it all the way to 2005. Their goal is very clear: determine whether the market is in distress or not and compare current market conditions to two well-known times of market distress: the Global Financial Crisis and the Covid crisis. With this index, the NY Fed tackled the challenge of measuring how well markets are functioning by consolidating liquidity and stress metrics from both the primary and secondary markets into one number. Indeed, measuring liquidity or lack thereof in Fixed Income markets remains a challenge. Traditional measures of liquidity like bid-ask spreads or volumes are helpful but imperfect, so this new index is a welcome addition.

Return of volatility and liquidity

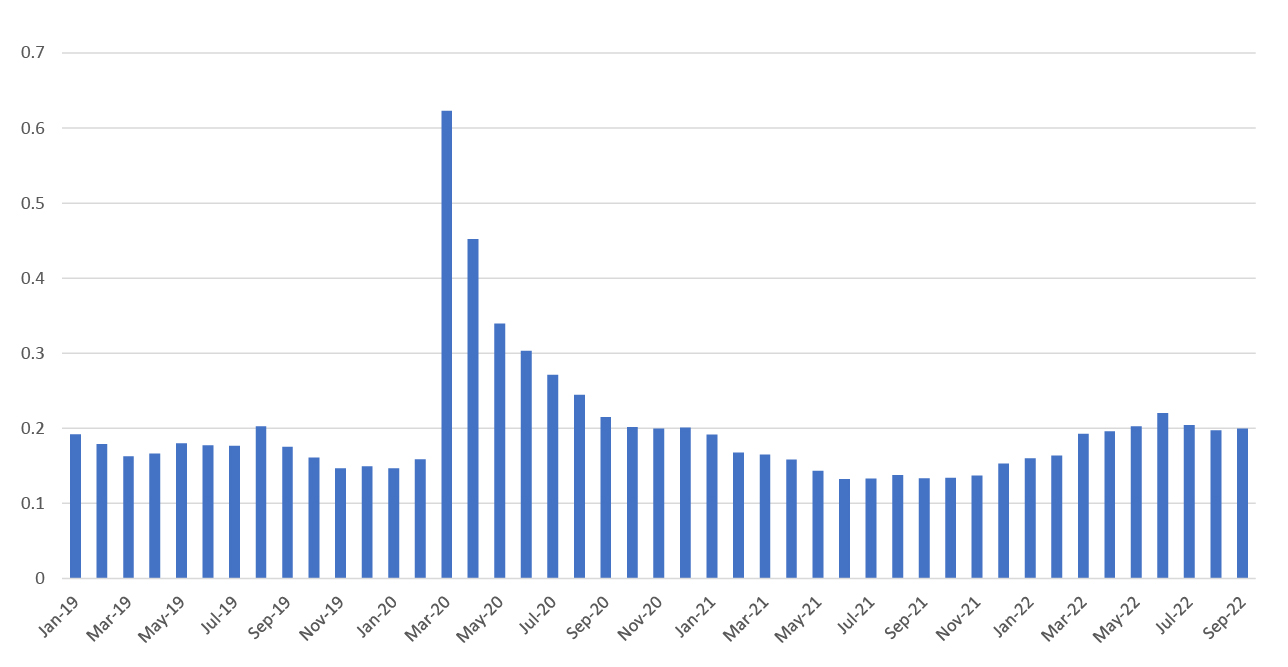

With this year’s return of volatility, is the market currently in distress? The NY Fed’s index indicates that June 2022 was the most distressed month for US IG Corporates since the Index debut in 2005, with September 2022 right behind at the exception of the Global Financial Crisis of 2008-2009, Q1 2016 and the Covid-driven Crisis of Q1-Q2 2020. While it is true that with Composite+ bid-ask spreads are 66% higher in June 2022 vs June 2021, the market has seen better; the situation is not as gloomy as one would think. First, June 2021 was an all-time low in terms of median bid-ask spreads and when we compare June 2022 to June 2019, the increase in round trip trading costs is limited to 24%.

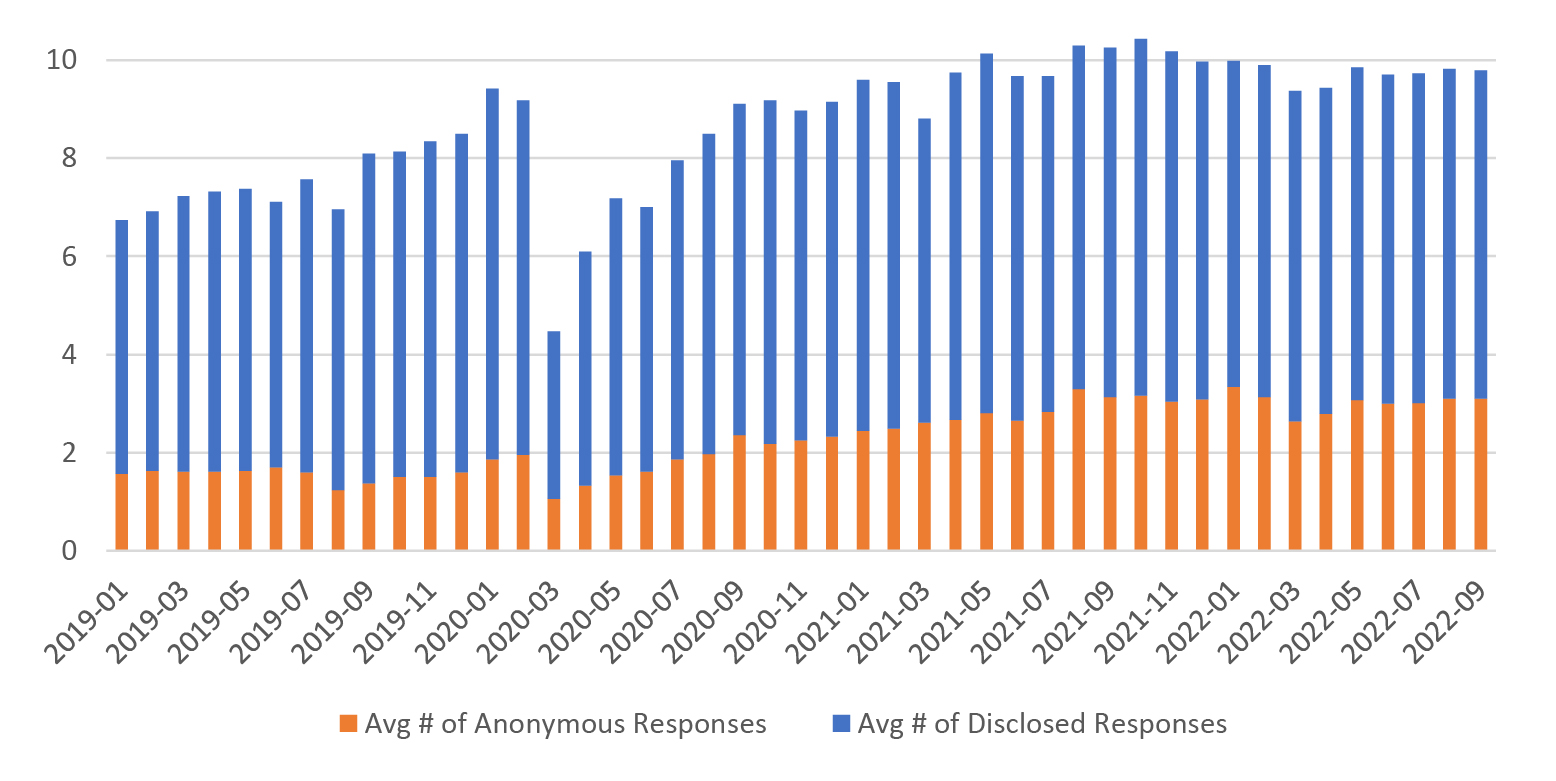

Second in 2022, the number of firm prices sent back to client RFQs on MarketAxess, a good proxy for market depth, remained constant. This liquidity metric is powerful because it shows that 2022 is in stark contrast with the Covid-driven crisis when liquidity dried up substantially. Another important fact that we see in Figure 2 is the increasing number of Firm Anonymous Responses. All-to-all trading and the diversity of market participants that it brings help make the market more robust, including in times of volatility.

Median Composite+ bid/ask spread for US IG corporates ($)

Avg # of firm prices back per client inquiry

Takeaway

On the one hand, this year’s return of volatility led to a 30% increase in bid/ask spreads compared to 2021.

On the other hand, market depth, as expressed by the number of firm prices back, that takers have received on MarketAxess, remains at the same elevated levels as last year.

For questions or follow-up, email our data scientists at research@marketaxess.com.

©Markets Media Europe 2025