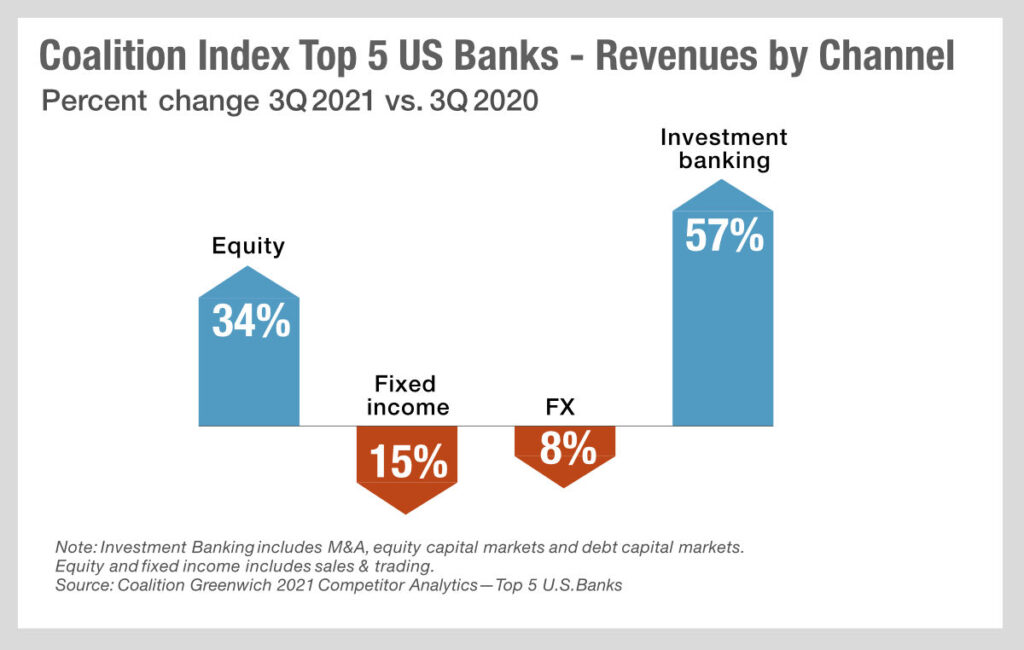

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed income is still far behind the advisory side of the business in supporting issuance and M&A.

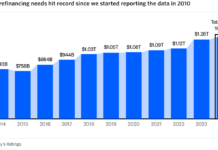

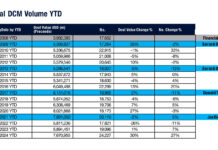

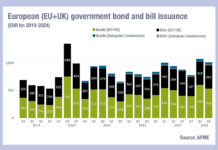

Despite having an outstanding quarter in the 2020 sell-off, the continued higher levels of volatility and even volumes at the start of 2021 have not been able to support banks’ fixed income market making businesses. Next year is expected to see issuance decline slightly this is still from a record high set last year, with which 2021 was on a par.

While investment banks had a great Q3 overall, it was not the bond trading desks finest hour.

Collectively this tells us that the banks need to either improve or pull back from fixed income market making. They are loudly complaining about the fees from trading on platforms, they have been pushing for direct streaming of bond prices to clients and they have been vocal supported of portfolio trading in many cases.

Historically, several large banks have stepped back from trading fixed income when the going got tough, and with even the biggest banks taking hits in bond market revenues it is hard to see how smaller firms can survive.

Innovation is one way forward – and price streaming would fall into that category. A potential barrier is the European Securities and Markets Authority’s opinion on trading venues vs trading tools due out next year. If it determines that executing a streamed bilateral price on a desk that has multilateral connections is a ‘trading venue’ that may impede innovation.

Lower platform trading costs is another way forward, however these costs only constitute part of the pressure on banks to make money in secondary markets. Electronic liquidity providers are a greater issue, as they are proving highly effective competitors.

In a game of ‘last bank standing’ it is possible that many of the tier 2 and 3 banks will stick to primary markets in future, with fewer offering risk trading – or matched principal trading – to clients.

©Markets Media Europe, 2021

TOP OF PAGE