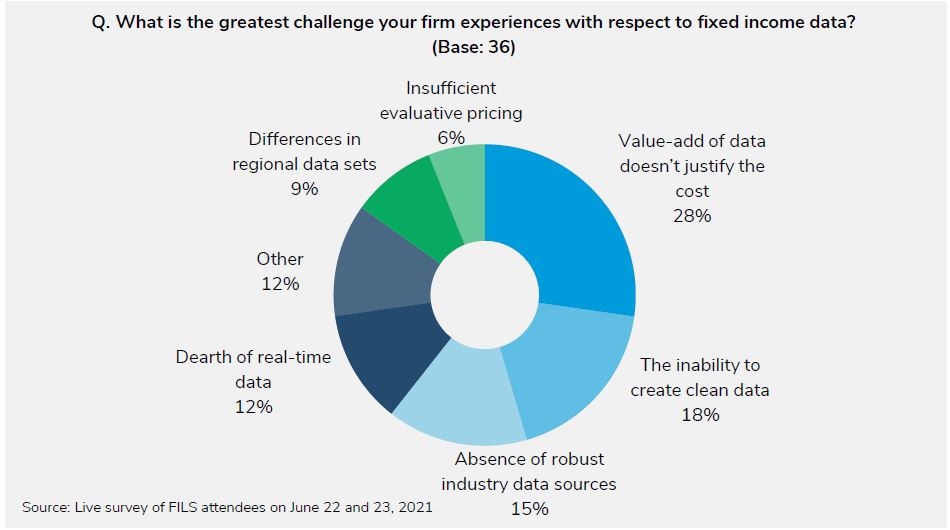

A new report from analyst firm Aite-Novartica has found nearly a third of bond market participants and traders believe it is hard to justify the cost of data, given the additional value it provides.

“In many cases, the inability to create clean data was to blame – a phenomenon that lives on both sides of the market,” noted the author, Aité Novarica’s Audrey Blater.

The research, entitled ‘Connecting the Disconnect’, found that “The proliferation of data is coming from more non-traditional forces, such as the post-trade and even the settlement layer, and there’s a virtuous cycle at work in which data is aggregated and creates a framework for more data. Taken together, market participants believe fixed income data has encouraged more trading, has allowed buy-side firms to better define relationships using pre- and post-trade analytics, and has enabled more automation of low-value trades.”

“Credit evolves along a lengthy time frame, and the market is likely in the middle stages of this process. However, during the early months of the pandemic, this evolution broke down,” says Aite-Novarica group practice lead, Audrey Blater. “Trades that were low-touch became high-touch in a matter of hours as liquidity drained from the markets. Over the past 18 months, a broader range of tools and technology are necessary to navigate the fixed income markets.”

Understandably, given the importance of data from multiple sources, improved aggregation of data was seen to be a highly desirable solution as a supporting element of data sourcing within the next 12 – 18 months.

The report also found that technology advances were proving to be the greatest challenge for traders to keep up with 50% of respondents citing it as their greatest difficulty.

Recent discussions between The DESK and buy-side traders have highlighted the challenge posed to traders in keeping abreast of quant and technology skills in addition to their day jobs, which the development of a separate quant team can alleviate.

Aite-Novarica Group collected data from polls held during the recent Fixed Income Leaders Summit (FILS), hosted by Worldwide Business Research (WBR), to gauge market sentiment across a number of subjects. These questions, combined with ongoing industry research of fixed income and data topics, form the basis of its report. A total of 580 attendees virtually attended FILS from 22 June to 23 June 2021, and had the opportunity to respond to live polling questions. Of that total figure, 332 were from the buy-side, 148 hailed from sell-side firms, and the remaining 100 attendees were other market participants from associations, the vendor community, media outlets, research firms, and regulatory bodies.

©Markets Media Europe 2025