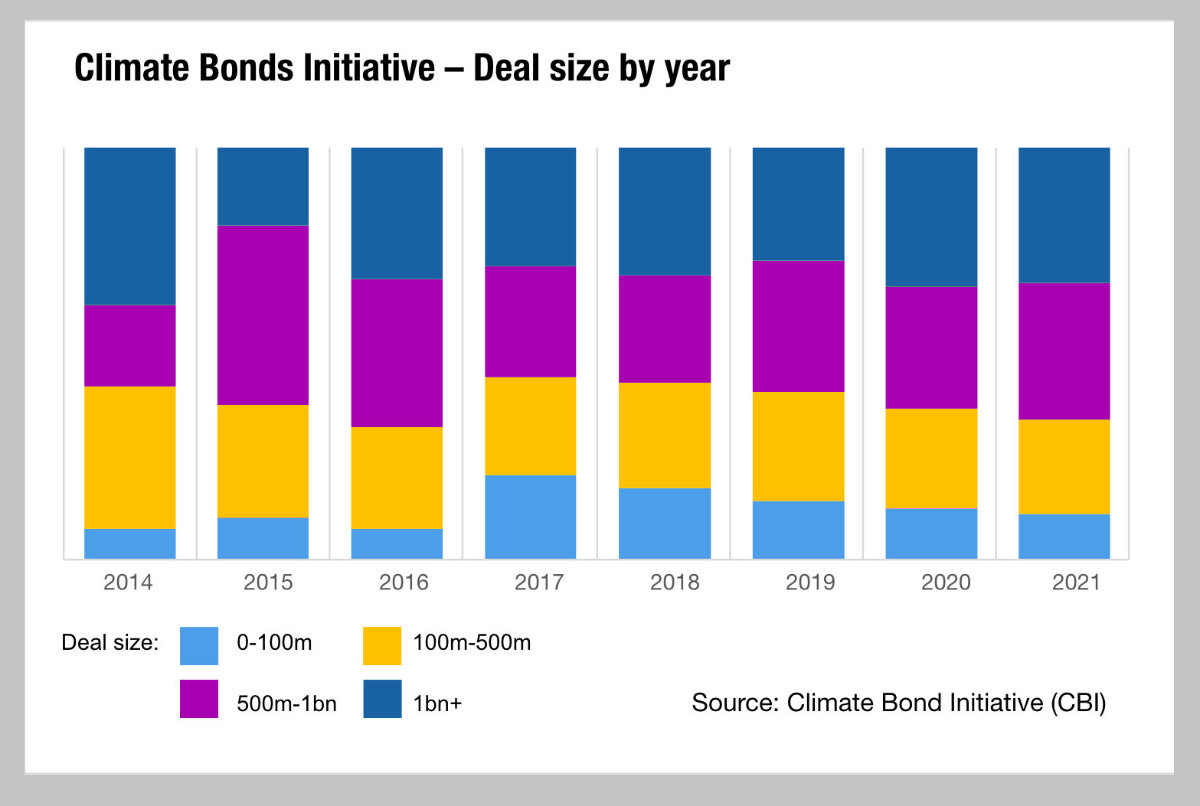

Bond issuance sizes in the ESG space are growing, and the average size of the deals are growing too. The proportion of benchmark-sized deals – measured by the Climate Bond Initiative (CBI) as over US$500 million – globally in the past year increased to 64% of the total, up from 56% in 2017, while the total volume of issuance has nearly doubled in that period from US$156.9 billion to US$290.1 billion.

That puts the deals at benchmark size up from US$87.9 billion in 2017 to US$185.6 billion in 2020, which in one sense is good news. As deals become concentrated the frequency with which buy-side traders repeat the processes involved in getting allocations reduces.

Primary markets are a key source of fixed income assets with many buy-and-hold funds in the green space hoovering up new issues as soon as they come to market. The composition of issuers is changing significantly year-on-year, with volume of bonds issued by non-financial corporates doubling between 2018 and 2019, then government-backed green bond issuance doubling between 2019 and 2020.

In 2021 the level of issuance has already reached US$230 billion by 23rd July, according to CBI data and although investment manager NNIP has predicted this year would see new issues of US$300 billion, it seems clear that level could be surpassed. Fund managers are also seeing continued appetite amongst investors, creating a tension between available supply and demand. In secondary markets voluems have also grown, with MarketAxess reporting US$13 billion worth of green bonds traded in Q2 2021, up from US$6 billion in Q2 2020.

The one market in which issuance will be more of a concern is the US, which has an outsized number of bond issues to the value being raised. If primary markets platforms prove a success this year in the North American market that may ease some of the pressure on buy-side desks.

©Markets Media Europe 2025