If the population of a country increased by 50% since 2014, you would think a housing crisis was likely.

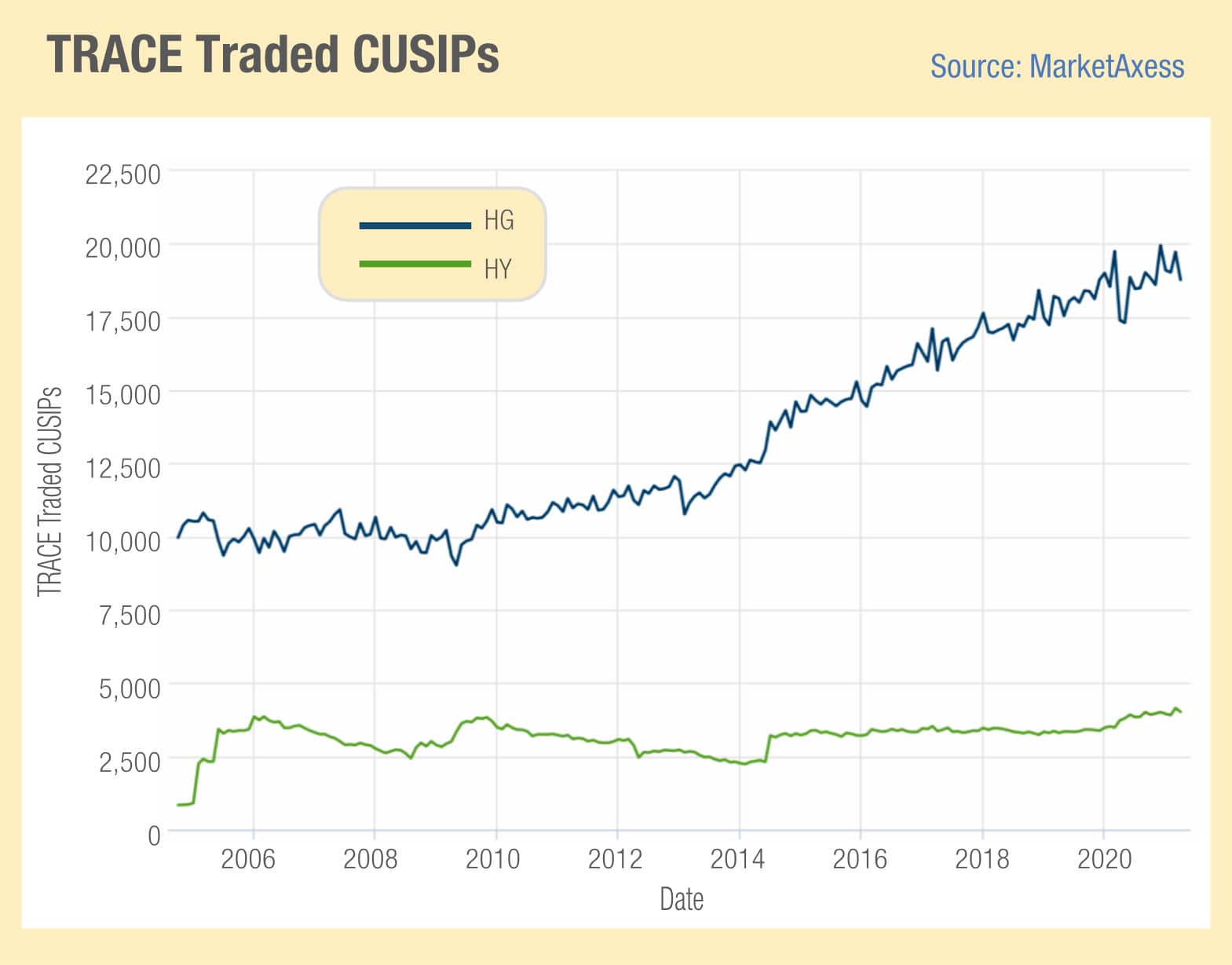

Yet in the year The DESK launched there were 12,000+ investment grade credit CUSIPs, traded on TRACE. CUSIPS, the nine-digit code that identify North American securities, has increased by 50% since then, starting this year at 19,000+, nearly double the size of the market in 2010.

What does this mean for the trading desk?

The implication for the growth in new issuance is that traders on both buy- and sell-side will need to work harder. The process of buying bonds in primary and secondary markets is made far more challenging when the number of securities in play increases. Every bond traded needs to be priced, traded and settled.

While the majority of bonds are held after being bought in the primary market, IG bonds tend to be longer-term debt and so they continue to be traded over time more commonly than high yield debt, which tends to be of shorter-tenor which is rolled over on expiry.

The ‘barbell’ shape of activity for IG bonds, which typically spikes at the point of issuance and the latter stages before redemption, will mean that traders need to address both primary and secondary market workload to deal with this stress.

In primary, the lack of a standard workflow or data exchange for newly issued bonds means this is an arduous task.

Also worthy of note is that the growth in this one sector of the market is concentrating pressure on US IG portfolios and the traders covering that market. Their capabilities will be very different, depending upon the firm they work for, the sophistication of their desk and the type of trading they engage in.

Although traders can handle greater workloads to a point, if the margins available from clients are not increasing then the cost of doing business is simply expanding with the number of CUSIPs.

It is a testament to the many investment traders and sales traders who kept markets turning over during March last year that the current activity levels can be handled in a sell-off. Nevertheless, a sustainable business cannot be built on outsized activity being handled by a normal-sized workforce.

Without higher margins, the workforce cannot be expanded and so traders will undoubtedly need to increase their dependence upon market infrastructure – from data to trading platforms – in order to tackle trading in a different way. The amount of manual activity they engage in across both the primary and secondary markets will need to reduce and a wider set of liquidity providers, using a range of engagement tools, will be needed.

Increasing the use of new trading protocols – from all-to-all, portfolio trading and automated trading – to supplement trading voice will be essential. The trajectory of CUSIP IG growth tells us that the pressure on desks will grow and firms that do not invest in greater trading support may well become the ‘have-nots’ in bifurcated market.

©Markets Media Europe 2025