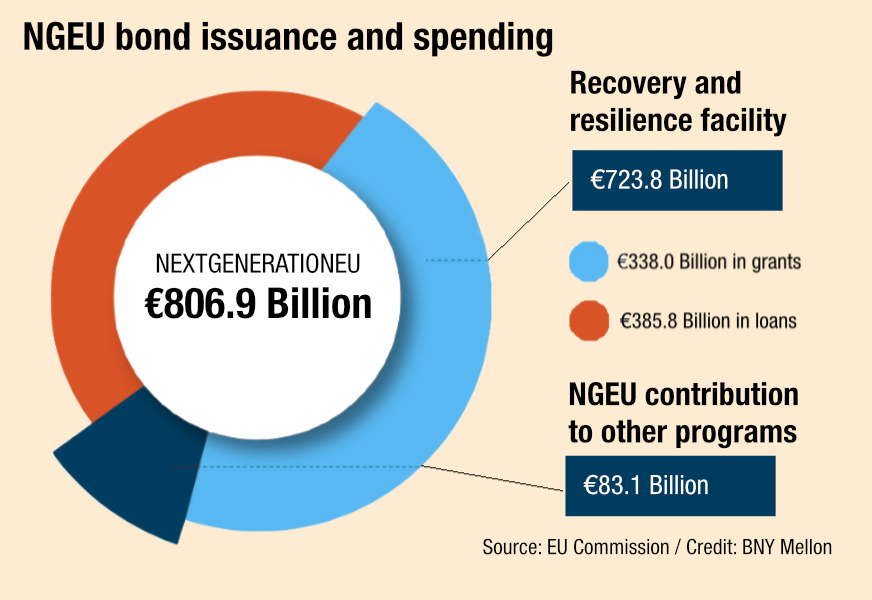

The biggest new-issue news over the past week has been the biggest ever European stimulus package – the NextGenerationEU (NGEU) recovery plan – and getting allocations looked tough.

The biggest new-issue news over the past week has been the biggest ever European stimulus package – the NextGenerationEU (NGEU) recovery plan – and getting allocations looked tough.

The European Union is using the NGEU to fund its members post-pandemic recovery. Not only was there a bun fight to get allocations, a frisson of excitement was added a week before the first trade, when the EC banned several major banks from acting as primary dealers – because of their historical engagement with cartel activity – then reinstating all but two on the basis that the rest had been punished enough already.

On 15 June, the NGEU began the process by issuing a new 10-year bond carrying a coupon of 0%, and traders found getting the right exposure for their PMs was not easy.

The final order book was reportedly in excess of €142 billion, which meant that the bond was more than seven times oversubscribed. Although over subscription can be a result of overdemanding to get an allocation – an inefficient process at the best of times – given that the demand was split between fund managers (37%), bank treasuries (25%) followed by central banks / official institutions (23%). In terms of region, 87% of the deal was distributed to European investors, 10% to Asian investors and 3% Investors from the Americas, the Middle East and Africa.

According to the European Commission (EC) it came at a re-offer yield of 0.086% providing a spread of -2 bps to mid-swaps, which it noted is equivalent to 32.3 bps over the 0.00% Bund due 02/2031.

One cannot help but note that the competition from central banks is again creating potential challenges for buy-side investors, whose trading desks are collectively fighting through the very manual new issue process to get a decent slice of a bond with a 0% coupon.

This is potentially expensive for investors and distorting both price and liquidity formation in the market. Under NGEU, the Commission is expected to raise up to around €800 billion – which is 5% of EU GDP – by issuing bonds. In 2021 it will raise €80 billion in bonds, plus more via short-term EU-Bills.

The borrowing programme will be concentrated between mid-2021 and 2026, and all borrowing will be repaid by 2058.

The joint lead managers were BNP Paribas, DZ BANK, HSBC, IMI-Intesa Sanpaolo and Morgan Stanley. Co-leads were Danske Bank and Santander; of the banks originally excluded only NatWest Markets and Natixis were eventually excluded, for their role in a scandal that covered trading between 2007 – 2012.

Most of the funding will be put towards the Recovery and Resilience Facility (RRF), split between grants and loans (the latter slightly larger) to member states. Other projects will also be supported by the remaining €83 billion.

©Markets Media Europe 2025