By Iseult E.A. Conlin, CFA

By Iseult E.A. Conlin, CFA

Managing Director, U.S. Cash Credit, Tradeweb.

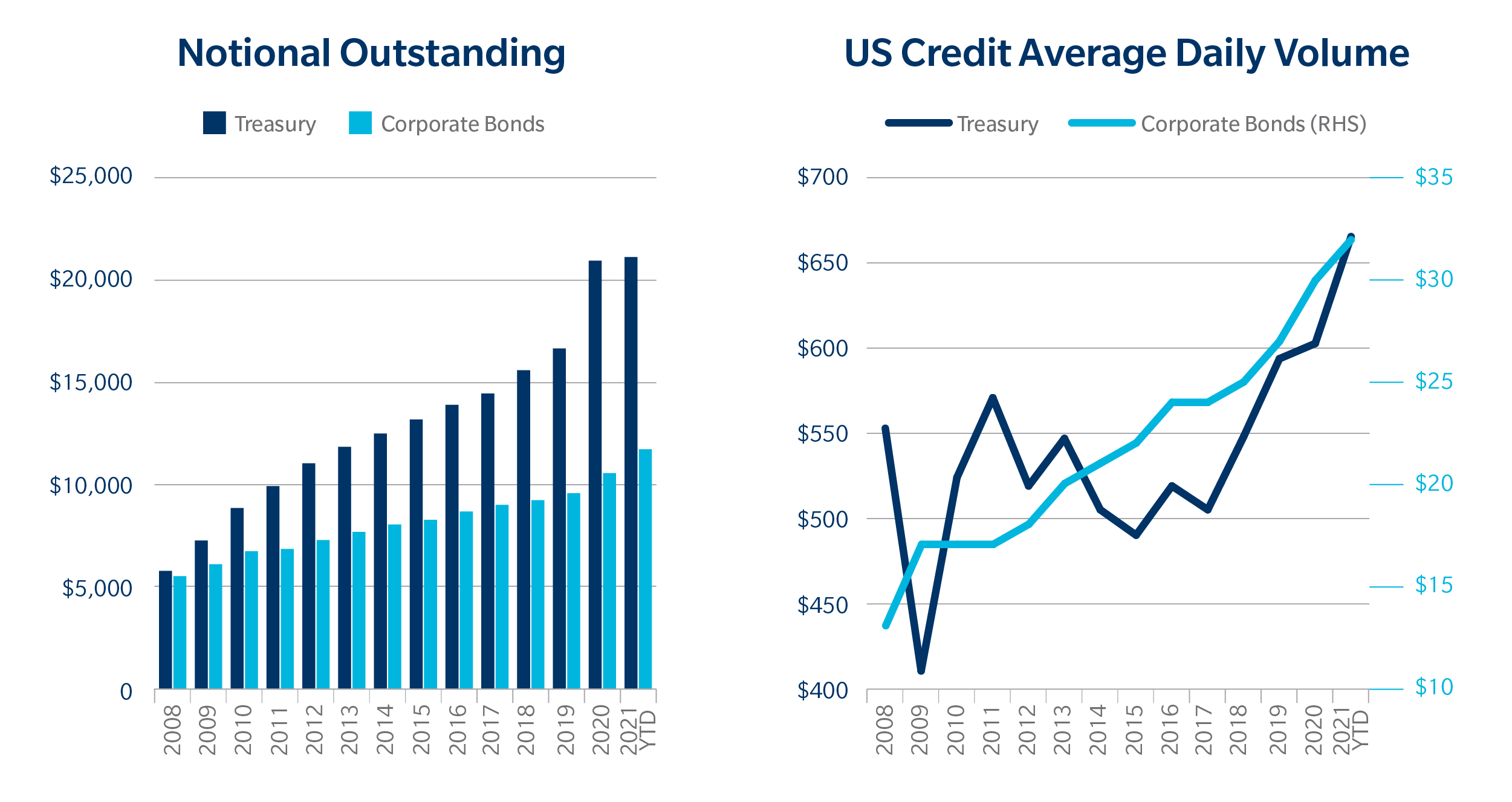

In the wake of the 2008 financial crisis, the majority of the US fixed income marketplaces took its first steps towards an unprecedented ascent of growth in overall market size and trading volumes. For US Treasuries, size has nearly quadrupled and volume grown by 60%. Over the same period the US Credit market has doubled in size and volumes grown by 80% (Exhibit 1).

Exhibit 1: US Treasury and US Credit Notional Outstanding & US Credit Average Daily Volume, $ Billions

Source: SIFMA

Underlying this ongoing growth has been a significant transformation of the US fixed income trading landscape both in terms of market structure and the dynamics between marketplaces. The thread connecting all of this change: electronification. And while the direction and speed of electronification has differed across the various fixed income marketplaces, broad themes remain. Put simply, markets are getting faster and more connected. Investors need to be more agile- but are presented with significant new opportunities as a result.

Looking specifically to electronification occurring within the US Credit marketplace, traders are focused not just on market structure shifts such as a growing appetite for all-to-all trading, but also on how these advancements- in collaboration with (time and cost saving) efficiency tools- can improve the overall trading process.

This focus has translated to an increased interest in data and its new role within the traditional trade lifecycle. Because, the reality is, that for an increasingly workflow-conscientious fixed income market, it has never been clearer that different traders with the same strategy and goals might see significantly different outcomes- depending on which electronic trading ecosystem they are using.

Enter AllTrade

Since the halfway mark through the last decade, when the electronification of the corporate bond landscape began to pick up momentum, the Tradeweb Credit platform has evolved with a focus on integrating the workflows of intrinsically linked markets. This is particularly true with respect to Investment Grade Credit and the US Treasury market. Given the success this philosophy has had so far, the company has applied the same holistic approach to Tradeweb AllTrade, its anonymous network.

AllTrade, which provides a comprehensive network of anonymous liquidity, is the latest representation of the company’s driving vision for a more electronic, and efficient trading environment.

All in the Name

In many ways, the name AllTrade is a perfect encapsulation of the Tradeweb approach– which is to build out the most comprehensive network of credit liquidity as possible. It boils down to a combination of market integration and workflow optimization.

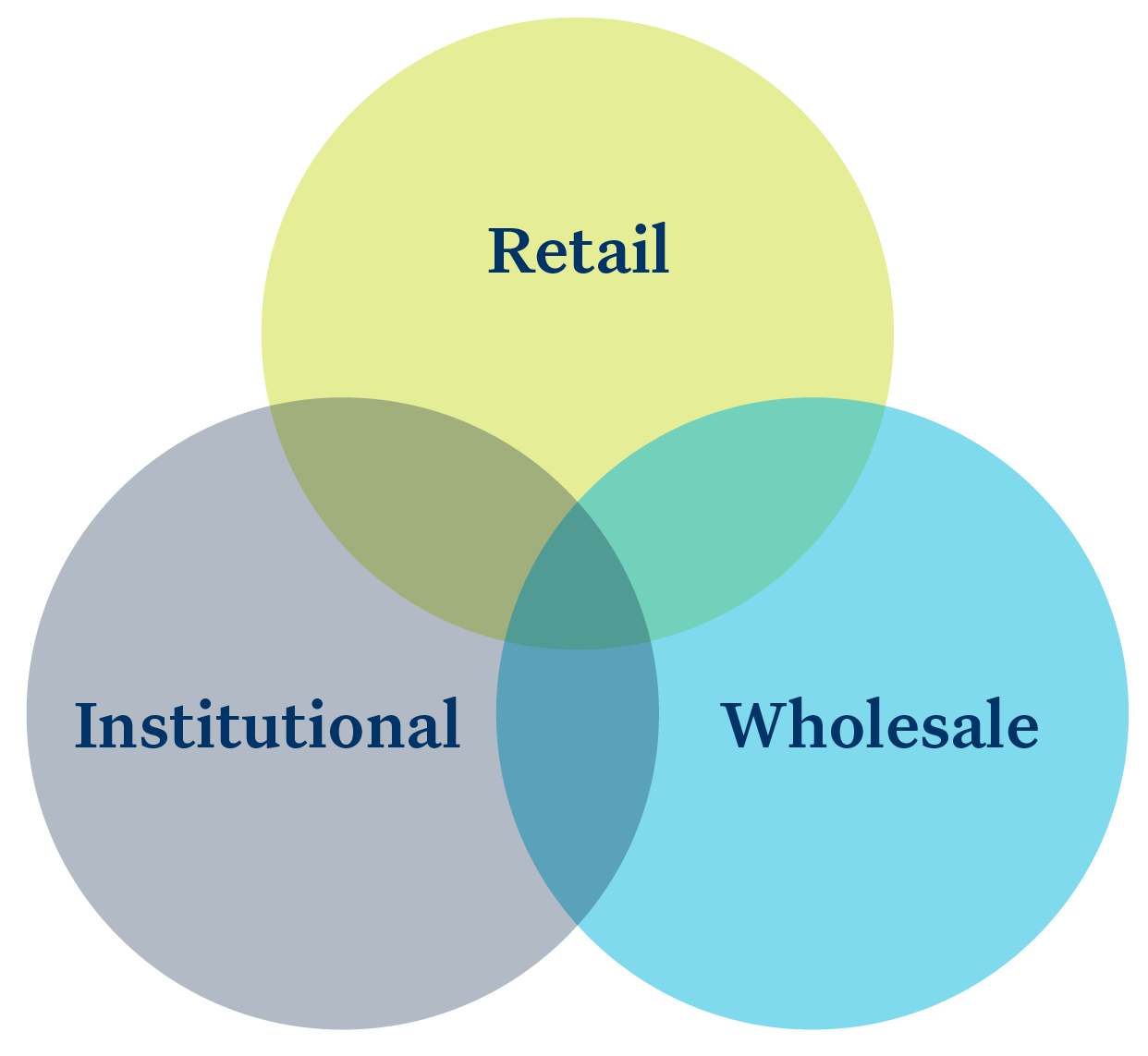

By leveraging its industry-leading efficiency tools, such as Automated Intelligent Execution (AiEX), Ai-Price reference pricing, and Net Spotting, in conjunction with connected liquidity of institutional, wholesale, and retail markets Tradeweb AllTrade offers unparalleled trade opportunities in the global marketplace.

Exhibit 2: The AllTrade Network

Liquidity Access

Several recent innovations now available exclusively to investors on the AllTrade network set it apart from the competition.

The early days of anonymous, all-to-all trading was a limited-scope numbers game of bringing together the largest number of institutional clients together within a single liquidity pool. And while in the four years since Tradeweb first launched its all-to-all network, institutional all-to-all trading has grown to represent almost 30% of RFQ electronic volume at the end of Q1 21, the AllTrade network has expanded to encompass so much more.

Streaming Liquidity

By linking the AllTrade network to Tradeweb Direct, the firm’s retail marketplace, institutional clients now have seamless access to live streaming liquidity that does not require logging into a different platform or navigating unfamiliar protocols or pricing conventions. On average Tradeweb Direct offers 16,000 live markets on quotes of $250k and above, and over 5,000 live markets on those over $500k daily. Given that Tradeweb Direct facilitates one in seven corporate bonds trades reported to TRACE, the retail liquidity now available to institutions through AllTrade is a unique pool that should only grow deeper.

Sessions Liquidity

Participants on AllTrade not only have access to significant new liquidity on the retail side but can now tap into the residual liquidity originating within the wholesale market via anonymous dealer sweep sessions – which also links to the AllTrade network.

Tradeweb’s Rematch, an industry-exclusive solution, takes the theme of connected markets one step further. Institutional investors trading within AllTrade, for the first time, have access to hundreds of millions in unmatched risk from dealers through Rematch.

Rematch opens the door to a potentially enormous pool of liquidity to institutional investors that would previously not been brought to their table. With a click of a button, using AiEX auto-trading, a dealer can elect to expose their unmatched orders from a session to the all-to-all network as an anonymous RFQ. For a pre-set period of time, sell-side participants in essence create a second opportunity for a potential trade match.

Match Rates and Execution Flexibility

A fundamental advantage of AllTrade is the suite of innovative solutions, such as AiEX auto-trading, which accounts in Q1 2021 for 28.8% of investment grade RFQ and 32% of high yield in-comp RFQ volume (excluding portfolio trades) and reference pricing through Ai-Price, that all work together seamlessly and often times completely behind the scenes to drastically improve match rates.

Regardless of investor type, be it a dealer, buy side clients, asset managers, hedge fund, or pension fund, investors today need require a certain amount of flexibility on a trade-to-trade basis. This fact is central to the Tradeweb philosophy. That is, in addition to options to trade via: RFQ, wholesale sessions, streaming live markets, or automated strategies; AllTrade users are also able to designate whether they want to spot or cross a trade or when they would like to spot or cross a trade. That means, for example, if an asset manager sends a list of RFQs to the AllTrade network and finds someone else on the other side that wants to cross at a certain time, AllTrade allows them to choose when to cross and based on users decisions the electronic treasury hedging system will calculate the differences and routes the treasury hedges electronically at their chosen time in their chosen method.

Room for Growth

Because the AllTrade network, which is comprised of over 700 large institutional firms, represents one of the most comprehensive pool of anonymous all-to-all liquidity to date, it should come as no surprise that it has seen significant growth since Tradeweb first launched its anonymous trading offering in early 2018.

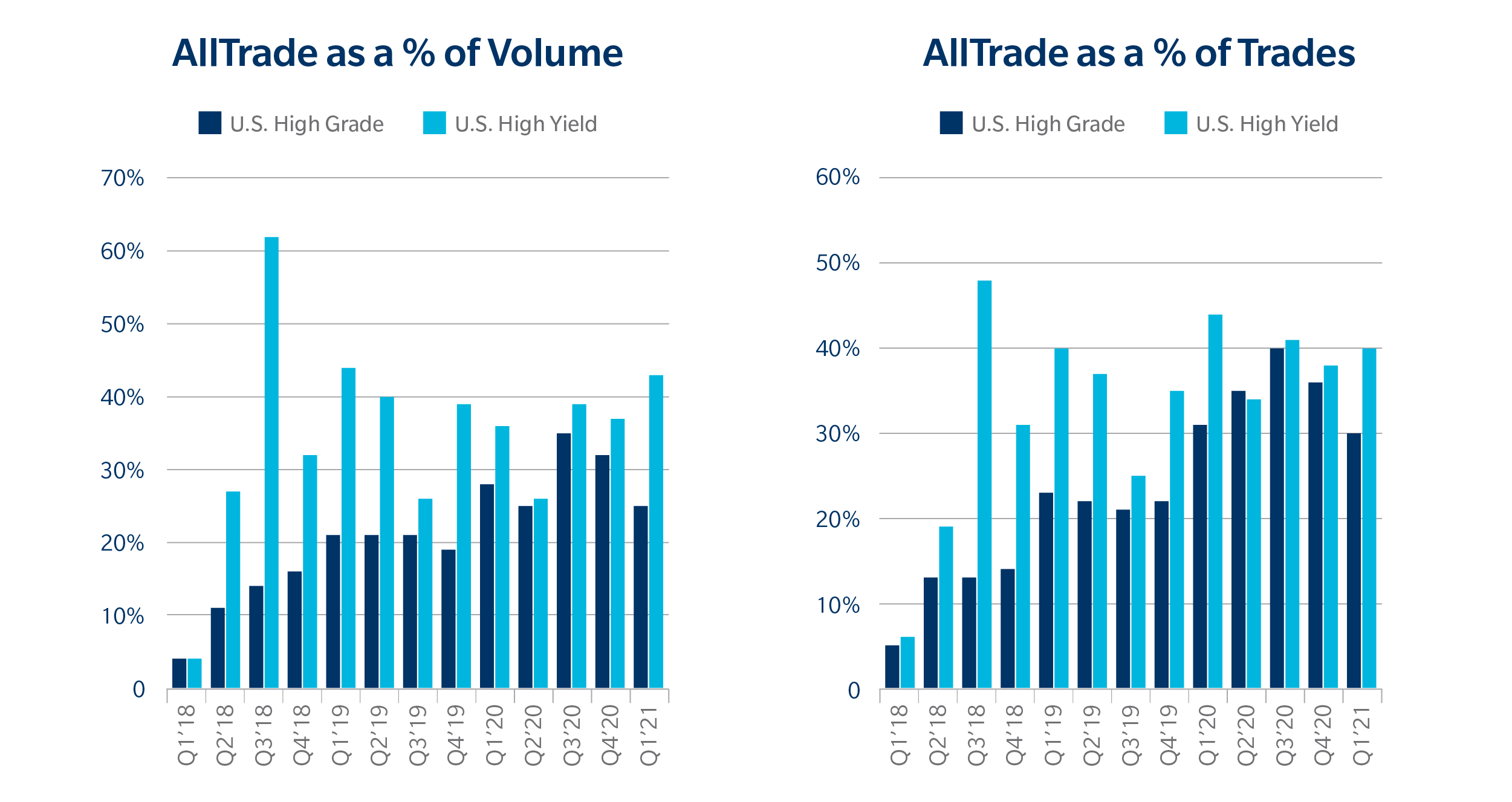

As of Q1 2021, high yield and investment grade AllTrade volume represented 43% and 25% of in-comp RFQ volume (excluding PT). In terms of the percentage of trades (using the same metrics), high yield and investment grade AllTrade trading has similarly seen significant growth with 40% and 30% of the total captured trades (Exhibit 3).

Exhibit 3: AllTrade as a Percentage of in-comp RFQ (ex-PT) Activity on the Tradeweb Platform

Excludes Portfolio Trading

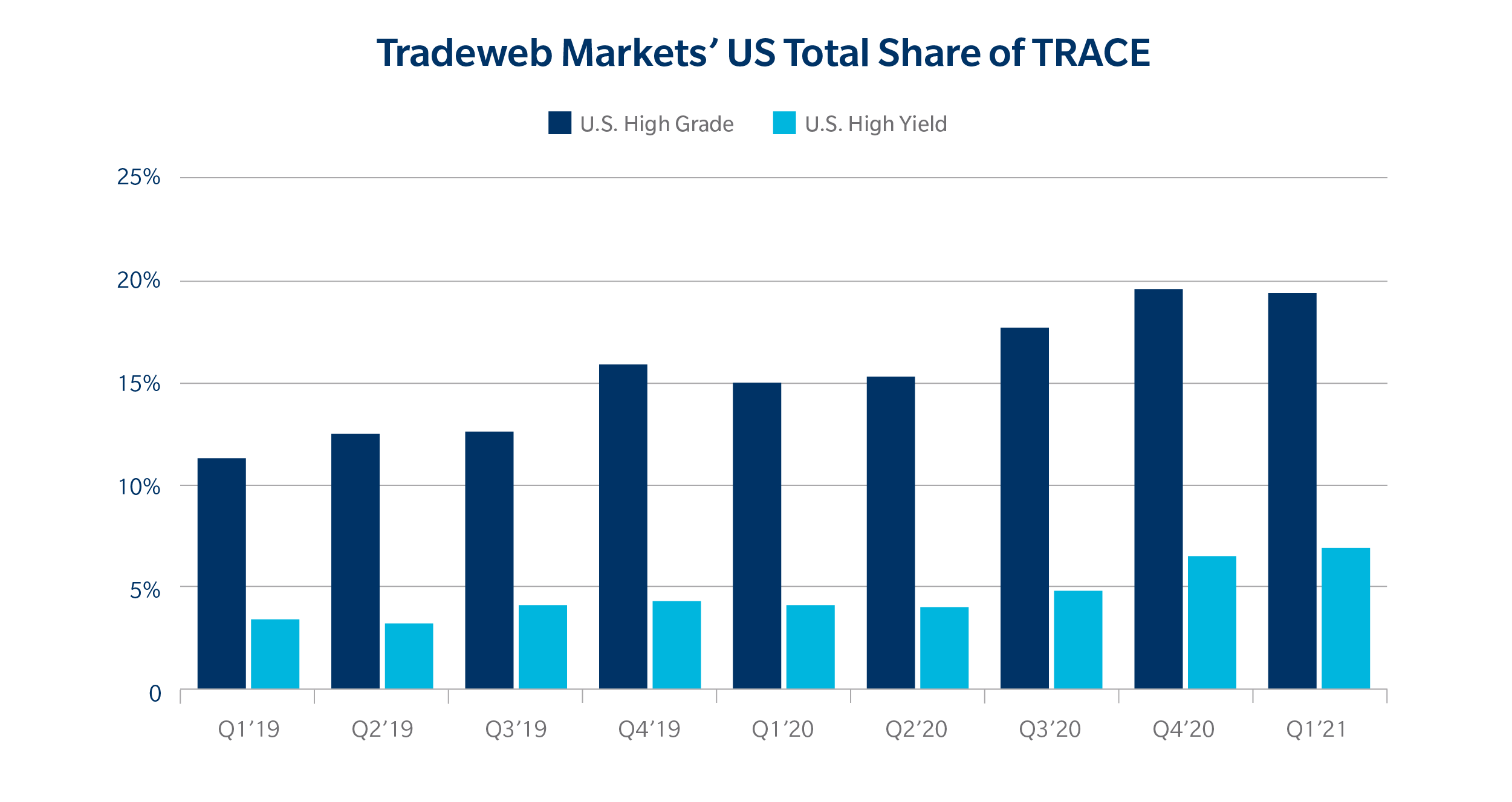

Speaking to the broader fixed income market, considering that the Tradeweb Markets’ share of US TRACE volumes continues to grow on an annual basis (Exhibit 4), it is clear that the Tradeweb philosophy of embracing a holistic approach to improving the entire trade lifecycle is gaining momentum.

Exhibit 4: Tradeweb Markets’ US Total Share of TRACE.

By connecting the dots of innovation across both execution and trade workflow across all markets, Tradeweb is positioned to break through even further, easily expanding upon its industry-leading, comprehensive liquidity pool as the post-COVID market evolves.