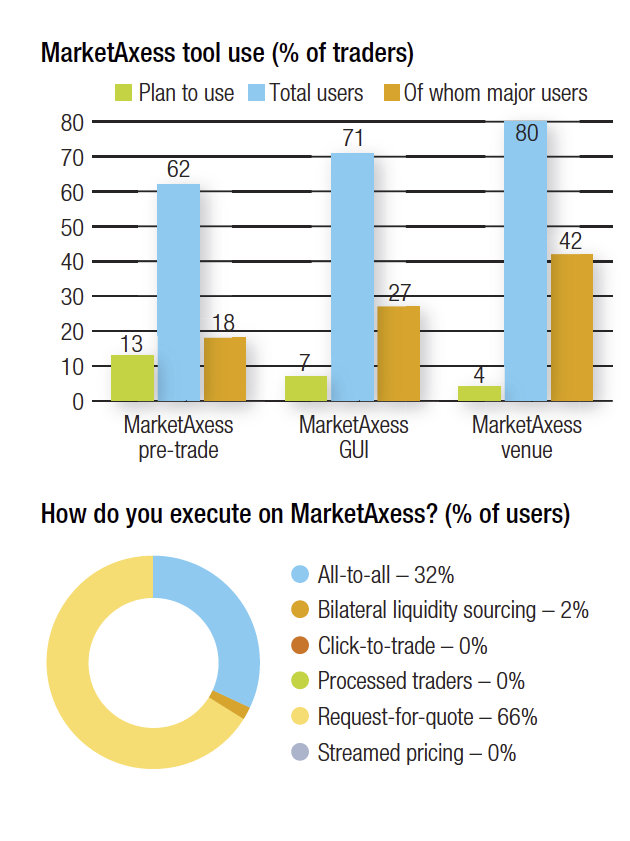

MarketAxess is rated as the most effective platform for finding liquidity in the corporate bond space by buy-side traders, and is a constant contender for the leader position as most-used venue, with 80% of traders using it and over half of those (42% total traders) being major users.

Its pioneering of all-to-all trading, its early partnership with BlackRock Aladdin and its ownership of the Trax data suite has kept it at the forefront of platforms across the trading workflow for the buy-side trader.

The firm’s Open Trading all-to-all protocol has been a success in the US and increasingly European and Asian markets, now making up around a quarter of euro bond activity. Operated via RFQ, 32% of traders note they primarily use all-to-all RFQ to execute trades, over D2C RFQ. And it has backed its execution offerings with a very robust and increasingly AI-enhanced data offering.

“Our drive to provide unique liquidity is matched by our goal to provide unique data sources to clients,” says Gareth Coltman, MarketAxess. “We’ve worked hard over the last 12 months to add contributed data sources from liquidity providers on the platform to add to our axe content, alongside that building on our completely unique data sources.”

MarketAxess is the second most-popular pre-trade data source, with 62% of traders using it, 18% of traders citing it as a major source and 13% planning to adopt it. Its CP+ composite price tool, based on its view across trading and market data, is used not just as a pre-trade data source, but as a price point to support internal crossing within firms, as well as for automated trading, and is part of its portfolio trading offering.

“Clients now have a much more data-driven approach to trading,” says Coltman.

Sixty two percent of traders are using its workflow tools to access the market, and with an expanding range of instruments – for example via its acquisition of LiquidityEdge, a US Treasury trading platform, announced in August 2019 – it is able to incorporate elements such as hedging into the workflow, as well as quantitative support for decision-making.

“Traders are facing choices, such as whether to conduct a portfolio trade or a list-trade in comp, and the only way to decide that is via data, in determining certainty and cost of execution,” says Coltman, “In the future we expect to deliver more and more tools to help clients make decisions.”

©The DESK 2020

©Markets Media Europe 2025