Bloomberg has a strong position as data provider, interface into the market and a trading venue.

The ubiquitous terminal allows it to build new services and test them with clients within a fixed cost base, making new services appear ‘free’.

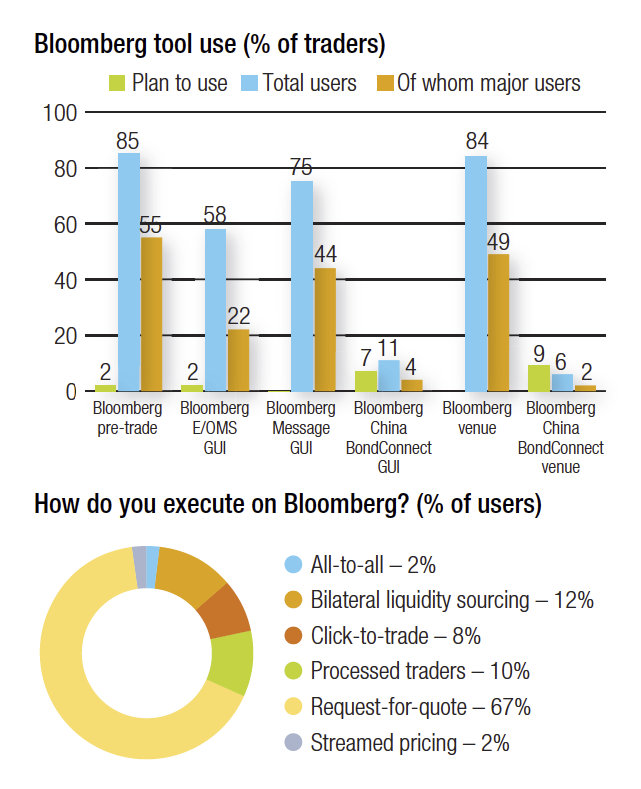

This leads to a high level of new services being pushed out to traders, which is reflected in the breadth of execution protocols that are used.

Having a single point of access on the platform clearly helps to concentrate workflow activity, and Bloomberg is in a strong position, however it has a very small pipeline of new business as a result and may need to increase the depth of trading in non-RFQ protocols in order to keep a grip on business as trading become more automated and less message-based.

Its EMS/OMS offerings have an impressive market share compared to its rivals, and even stand up against platform GUIs, the only OMS/EMS provider to do so in fixed income.

©The DESK 2020