New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was originally asserted by conservative thinker Joseph de Maistre, who traced the origins of the French Revolution to the Protestant Reformation.

With US trade body the Securities Industry and Financial Markets Association (SIFMA) citing 14 electronic execution protocols currently in use, the options offered to buy-side traders represent a more complex choice than that available to most voters. The pace of change can make these choices either empowering or confusing. Yet for some firms, these protocols are creating a revolution in electronic trading in fixed income, says Gareth Coltman, global head of trading automation at MarketAxess.

“Automation of the traditional request-for-quote (RFQ) protocol was a big change, but we’re now reaching a tipping point, with some major clients executing 50% of credit tickets electronically,” he remarks.

Adoption is being facilitated by a structural shift in the industry towards low-cost passive investment funds, which in the quantitative easing era has accelerated the velocity of investment grade credit trading in particular, enabling new market-making models.

“Buy-side traders have to adapt to the reality that they must interact with a wider range of counterparties, including electronic market-makers,” says Carl James, global head of fixed income trading at Pictet Asset Management. It has also contributed to belt-tightening by asset-hungry active managers, which must automate to handle more trades with fewer internal resources.

Protocols replacing sell-side risk taking

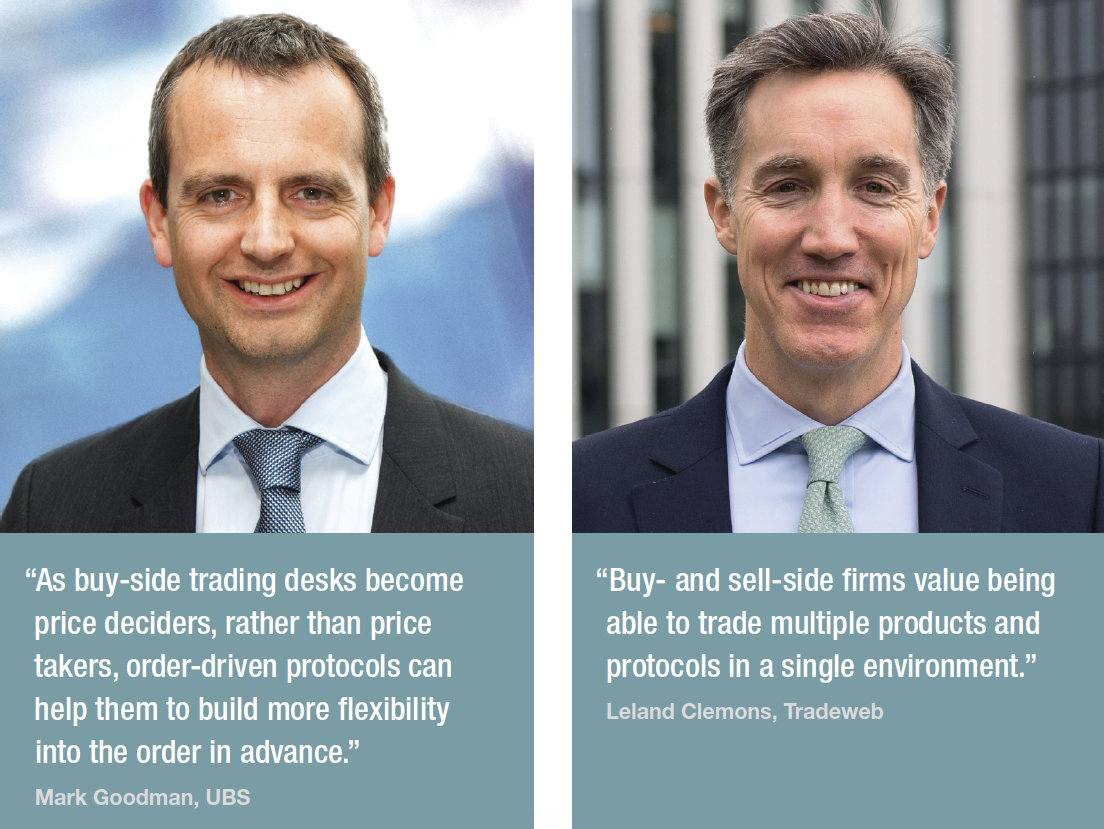

In parallel, a dismantling of sell-side balance sheets has fuelled the dispersal of liquidity, forcing banks and brokers to re-think and re-tool. Many are bolstering buy-side relationships through analytics, advice and agency execution, resorting only to risk for the most valued clients. In today’s fast-paced, multilateral and low-margin environment, portfolio trading, all-to-all (A2A) trading, direct streaming, and central limit order books (CLOBs) are reshaping fixed income. Venue operators are offering more choice and inter-connectedness. “Buy- and sell-side firms value being able to trade multiple products and protocols in a single environment,” says Leland Clemons, head of fixed income for Europe at Tradeweb.

Buy-side traders are presented not only with a range of protocols, but also roles, according to a GreySpark analysis of fixed-income venues, ‘Trends in Fixed Income Trading 2019’ published in March 2019. The transition from bilateral, broker-centric market structures means buy-side price-making is becoming “normalised”.

Distinctions between dealer-to-dealer (D2D), dealer-to-client (D2C) and even all-to-all are being supplanted by single- or multi-tier user models, the key differentiator being the degree to which participants in a given liquidity pool are granted different price-making and price-making rights, the report said.

“Order-driven protocols undoubtedly have a place,” says Mark Goodman, head of electronic execution at UBS. “As buy-side trading desks become price deciders, rather than price takers, order-driven protocols can help them to build more flexibility into the order in advance, which can accelerate the execution process.”

Liquidity key to protocol selection

Newer protocols often borrow something from equities, adapted to a credit market in which liquidity is not what, or where, it once was.

“There has been a convergence since MiFID II, with equities becoming more principal-based and fixed income increasing its proportion of agency executions,” says Yannig Loyer, global head of trading at AXA Investment Managers. “I don’t expect full convergence, but the key is data. When automating, you need to augment the right in-house data with additional sources to direct orders efficiently. We’re always working to load new data providers and working at an industry level to improve data quality.”

The slow pace of progress toward a European equivalent of the US’s TRACE transaction reporting feed remains a bugbear.

The popularity of passive vehicles has upsides for active managers. Fixed-income exchange-traded funds (ETFs) inflows doubled in 2019, with most portfolios concentrated in highly liquid bonds, generating unprecedented levels of trading velocity through the create/redeem process.

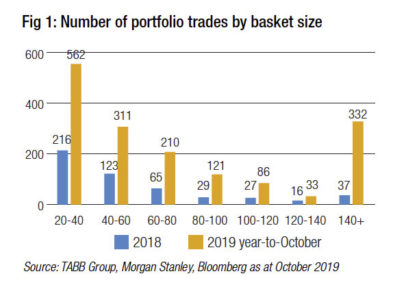

Intense competition for liquidity has seen a new breed of market-makers develop high-volume, low-margin models and technologies. Interaction with electronic liquidity providers has incentivised banks to price risk and offer liquidity in multiple bonds more quickly and accurately than previously, facilitating the development of portfolio trading services. These offer buy-siders the opportunity to trade 100-plus line items with a single counterparty (see Fig 1), sharply reducing the risk, time and effort otherwise involved in a rebalancing.

Speaking at FILS Europe last November, global head of fixed income trading Matt Berger said Jane Street facilitated US$22 billion in portfolio trades in Q3 2019, a more than fivefold increase over Q3 2018. A Morgan Stanley report estimated a tenfold surge in the number of 140-line-plus portfolio trades conducted in the year to October. Trading platforms are further automating the process. Having launched portfolio trading services for US credit bonds in January 2019, before extending the offering to Europe last November, Tradeweb facilitated US$51 billion of portfolio trades by end-Jan 2020.

Other protocols are evolving thanks to incremental development. One can trace a direct line from the traditional RFQ to automated RFQ through A2A to CLOBs and dark pools. Indeed, many order types have made that journey, with smaller odd and round lots increasingly conducted via automated RFQ whilst more complex trades graduate to formats more suited to their needs and the times. This reflects in part the power of the proven workflow, widely understood and deeply embedded. It also speaks to the inherent flexibility of the RFQ and the ability of innovators to extend its reach and lifespan.

A work-in-progress for more than two decades, RFQ automation has been refined and streamlined to widen its scope, with platform operators working with clients to pre-configure parameters to increase automation from the order management system onward. This minimises time spent on small trades, but the automated RFQ is not confined by size or asset class. Last year, 23.1% of institutional trades executed on Tradeweb were automated via its Automated Intelligent Execution (AiEX) solution.

“Recently introduced functionality allows traders to adjust RFQ parameters in mid-flight, or compare prices with those available on exchange, for instruments such as ETFs,” says Enrico Bruni, head of Europe and Asia, Tradeweb.

Semi-automatic only

Sharon Ruffles, head of fixed income dealing at index fund provider State Street Global Advisors, attests to the value of recent innovations but suggests the market is currently at the stage of ‘assisted RFQ’ for many trades, rather than full automation. “The buy-side trader still needs to do a lot of pre-trade enquiry before setting the parameters, taking account of the liquidity characteristics of individual issues. Data continues to be a challenge in many fixed income markets, but we’re moving toward greater transparency and can attach more certainty to our pre-trade evaluations,” she says.

From a process if not mindset perspective, it is a short step from sending out a semi-automated RFQ to trusted sell-side counterparties, to widening the search for liquidity to fellow-buy-siders and beyond.

“A2A has grown in importance, particularly for credit, as the major banks no longer have the balance sheet needed to warehouse inventory at previous levels. This has opened up new avenues, but the buy-side trader still needs to be aware of information leakage,” says Ruffles.

The risks of information leakage when trading large blocks has been a driver behind the growth of dark pools or CLOBs for credit, with MarketAxess launching its Live Markets pool in December. CLOBs have a chequered history in fixed income, but the tools and data now available to buy-side firms offer improved pricing accuracy and risk management. An extension of the firm’s A2A Open Trading service, which traded US$2.7 billion ADV in January, Live Markets includes ‘I would’ functionality which allows resting orders to interact with other liquidity according to pre-set guidelines, e.g. on price and size.

This helps buy-side firms to act as liquidity providers, and helps to balance any technology advantage that sell-side or proprietary trading firms might otherwise hold.

“Live Markets protects against information leakage by enabling the buy-side to seek liquidity anonymously. We see particular value for firms looking to trade in the post-new issue market in size,” says Coltman. “Buy-side desks can add alpha by trading blocks closer to the mid, whilst also increasing the fluidity of the firm’s assets by interacting with natural liquidity cheaply and efficiently.”

Electronic trading grew to 45% of European fixed-income trading volume in 2019 from 38% in 2018, according to Greenwich Associates, with more than half of corporate bond volume priced and executed electronically, driven partly by sell-side investments in auto RFQ responses, portfolio trading and direct streaming via APIs. Greenwich expects streaming to grow as buy-siders aggregate dealer streams into their OMSs to mimic the multi-dealer liquidity offered by multilateral platforms.

Block-focused firms such as AXA Investment Managers have been in the vanguard. “We have been streaming axes from the sell-side via direct connectivity into our OMS for around 15 years. We welcome new innovations, but direct connectivity provides the optimum channel for sourcing liquidity confidentially,” says Loyer.

A question for the future may be how the buy-side interacts with direct streams from electronic liquidity providers.

For James, much will depend on the ability of traders to master the data. “Previously, it was like taking a random walk with a torch in a dark warehouse; you needed skill and experience to find the other half of the trade. As balance sheets expanded, it became much easier to trade in size. As liquidity dried up again, the buy-side has had to aggregate information from multiple sources, including APAs, recent axes and indications from brokers, hit ratios and other data from previous trades.”

©The DESK 2020

©Markets Media Europe 2025