The AllianceBernstein credit trading desk has been refocused to handle market fragmentation and the withdrawal of dealer liquidity, giving its traders a commanding presence in tempestuous markets.

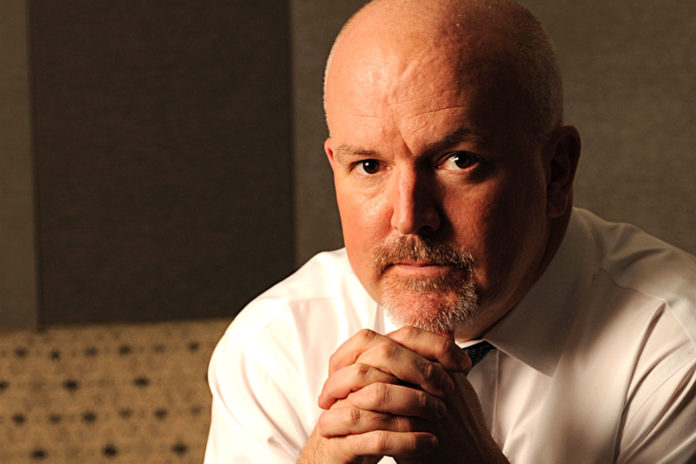

Jim Switzer is the New York-based global head of credit trading at AllianceBernstein. He joined the firm in 2011 and manages 12 credit traders working across high yield, investment grade and emerging markets, who use Fidessa’s Minerva order management system (OMS). The firm has US$135 billion dollars in assets under management in credit instruments.

Previously, he was a managing director at Societe Generale, where he managed the Financial Institutions Credit Trading Desk, and at BNP Paribas, where he managed the Investment Grade Trading Desk from 2000 to 2002. Switzer also formerly served as a sector portfolio manager/trader at UBS Principal Finance from 2002 to 2005 and at Sigma Capital from 2005 to 2008. Earlier in his career, he worked at Paine Webber and Co.; Kidder, Peabody & Co.; and Alex. Brown & Sons. Switzer holds a BA in biology from Colgate University.

How would you characterise the role of the trading desk?

The buy-side trading function has evolved significantly over the past several years, from what used to be a clerical execution role to what is today a dynamic, risk-taking role. AB (AllianceBernstein) identified this trend early on and recognised that doing that well would require a completely different trading mind-set and skillset.

Today, our trading desk is the tip of the spear. We have traders that take ownership within their space. They know what is going on in the portfolio, know the risks we are trying to get in and what risks we are trying to get out and frankly drive a lot of these ideas. We develop our view of how we want the portfolios to look, but the portfolio managers also know that liquidity and market structure today are more challenging than they were in the past, so they leave it up to the traders to determine how we can make things happen.

How has the desk changed since you joined five years ago?

AB’s fixed income trading desk had been very execution-focused. We needed a more diverse group of individuals who could bring different things to the trading desk. So we began investing in our traders. I hired one senior person to run the high yield business, but that’s the only senior hire I made. Everyone else came from within AB, or were junior people from other firms with backgrounds in operations, derivatives, cash trading, rates and structured products. I was looking for intellectual curiosity with these more junior hires. I brought them into AB’s credit trading organisation, and I then spent a lot of time mentoring, coaching, and developing them, with the objective of taking all those varying skill sets and piecing them together. And I think we did that. AB traders today not only have a lot of trading experience, but they also, importantly, have a ‘risk-taking’ mind-set.

What changed operationally?

From senior management on down, we had buy-in that AB’s credit trading desk needed to be more integrated into the overall fixed income investment process. To do that, our traders’ responsibility had to grow, to cover not only execution but also new trade ideas, risk management, sector views and relative value analysis. As another example, given current liquidity considerations in the fixed income markets, we needed to be able to go globally to wherever liquidity is. So, today, we don’t just trade dollar products in New York – if there is more liquidity in London for dollar products at a given time, we trade them there. That’s a change. Another change is that today, we think “cross-currency”, and we trade in whatever currency we need to. Our developed-market and emerging-market trading are now totally integrated; that means we look at credit from a truly global position.

What did you use as a model for this idea?

I started with my background on the sell side. For many years I was at boutique sell-side firms where I honed my relative value skills. I worked at UBS Principal Finance, which is a very large prop desk, and I also saw the hedge fund dynamic. I saw the way the market forces and various investors were interacting. When I came here to AB, a buy-side asset manager, I realised quickly that to compete in this world we had to get a lot faster. The only way to get faster was by changing the people and the process, and by bringing in new technology. For our brand it’s very simple, but it’s very, very powerful.

Market structure has changed a lot over the last five years; what has that meant for the skills your team now needs?

Ten years ago, the only thing we traded was cash bonds. Today, we trade cash, index, single main CDS, total return swaps, ETFs, and credit options. I need people on my credit trading desk that know the interactions between all of these markets and can effectively analyse and deliver that information into our investment process.

To what extent can your team influence what is, to some extent, a sell-side liquidity issue?

Liquidity will not bring efficiency, but efficiency may bring liquidity. We have to start focusing on getting more efficient. I have three people on the trading desk now that I took out of our Rotational Program, a two-year AB development and training program for our newly hired college graduates. I trained each of them how our trading approach and process was going to work, in the way we want it to, but the beautiful thing is they, in turn, bring the new technology to me. I am open to it, but I don’t understand it nearly as well as those people do.

How does the liquidity situation impact trading decisions?

We are taking a slightly longer view when we are making trading decisions. We are trying to trade when we can, not when we have to. We are trying to be a liquidity provider. The ‘shock absorber’ that dealer balance sheets, prop desk balance sheets and hedge fund balance sheets once provided seems to be gone. In good markets and bad, we are typically over-shooting, and so our process is to try to anticipate that, or when we see that, to be a liquidity provider. The way we think is: when the market is at its worst, be a buyer, when it is at its best, feed into the market.

Which non-technological solutions are you using to manage the situation?

We have created a steering committee that has a member of my rates trading team, a member of my currency trading team and a member of my credit trading team. I want the three of them to assess the problems that we are facing in fixed income trading and make sure that the solution doesn’t already reside in one of the other asset classes.

We are also looking at other types of instruments within credit, such as index swaps, total return swaps, options, some single main CDS as alternatives, either to hedge the portfolio or as cash alternatives, just to give us more flexibility.

How is the broker community coping?

If you asked me a year ago if the sell side was adapting, I would have said no. Six months ago, I would have said ‘Kind of’, and today I say, ‘Yes, they are.’ We are seeing a ground swell of change on the sell side. Firms are coming to us to figure out ways to get more connected, from the most senior level to the most junior level. E-commerce people at these firms had really good ideas a year ago, but now, they also have the mandate, with the teeth, to move forward.

How are counterparty relationships changing?

A number of dealers used to come into AB and say, ‘We want to do more business with you.’ What they were really saying is they wanted us to do more business with them. They wanted us to focus on what they were trying to do, as opposed to them being focused on what we are trying to do. That has now turned almost 180 degrees. Now, customer service is of paramount importance to them, and those firms that are most successful with us are the ones that come in and ask, ‘What can we do to help you today?’ That’s where the synergies are really starting to develop.

Do you see relationships starting to open up with other non-traditional counterparties?

Not yet. We have talked with a lot of inter-dealer brokers, markets which have typically been taboo for us to trade in, and I still feel that those markets are not open to buy-side firms like AB. We have discussed some sort of sponsored access with those inter-dealer brokers. I think that probably would work with most dealers, so we are exploring that.

How is the explosion of new liquidity aggregating platforms affecting business?

In terms of the electronic platforms, a few are working very well, notably MarketAxess and Tradeweb. MarketAxess’ all-to-all trading is pretty interesting to us. Called OpenAxess, it is a top ten counterparty at AB now. I don’t see why it would ever fall outside of that top 10. That is a platform that we want to be more involved in. Tradeweb is on the right path, turning into a utility in the marketplace, where the dealers can transfer information to us, we can transfer information back, we can auto-spot trades.

Are there structural changes that would improve the capacity to trade electronically?

I think the pre-trade transparency in the fixed income market is awful. When you get volatility in the market and oil is moving up 5 per cent, down 5 per cent in a day, it’s very difficult to know where prices are. Better pre-trade transparency will enable these electronic platforms to move forward. If there was more transparency in the market, I think that you would see a higher success rate within these various systems.

Are there operational changes that you have to make in order to support your role as a price maker?

For buy-side to buy-side trading where there isn’t a counterparty in the middle, we are accounting for that differently because in our best execution process, we have to make sure we understand that there is not a dealer as an intermediary, and so we look extra hard at the prices to make sure that’s falling within our best execution guidelines.

How have you managed the fragmenting market structure?

Electronic pools are popping up everywhere, and we found it was getting more and more difficult to look into them effectively, without hiring a lot more traders. I have people on the trading desk that are excellent traders and really understand technology, so together with our technology department, they built us a tool that we call the Automated Liquidity Filtering and Analytics (ALFA) tool.

What does it do to overcome fragmentation?

As I mentioned, in the fixed income market, there is currently a lack of pre-trade transparency, especially in the bottom 70% of the market. ALFA sits on top of our order management system and looks into our Bloomberg chats, our messages, into TRACE, and into all the electronic platforms we are hardwired to. ALFA will aggregate market liquidity across all of these communication channels and will notify us of all actionable trades. One of the hardest things a trader has to figure out is where to execute an order; our ALFA tool tells us exactly where to go

Another great benefit of this tool is that we can create watch-lists of the bonds our portfolios want to find liquidity in, whether we want to add the bond or sell it. It is rules-based; if we have certain enquiries on the desk, we build those rules and that will filter everything that we need. We are able to react extremely quickly so if we have something on our watch-list that is asked about, we are on it.

Do you find the request-for-quote (RFQ) model problematic?

No. If we see opportunities in the RFQ market and we want to be on the other side of them, we are very quick to pounce. Our traders can see opportunities, get answers from the portfolio management teams, and then buy or sell within 10 minutes. My philosophy is: if we can buy when we can, and not when we have to, we can better generate alpha. When we run transaction cost analysis on our trades that are happening on all-to-all, they are very profitable, and we see the positive returns in the portfolio.

©TheDESK 2016