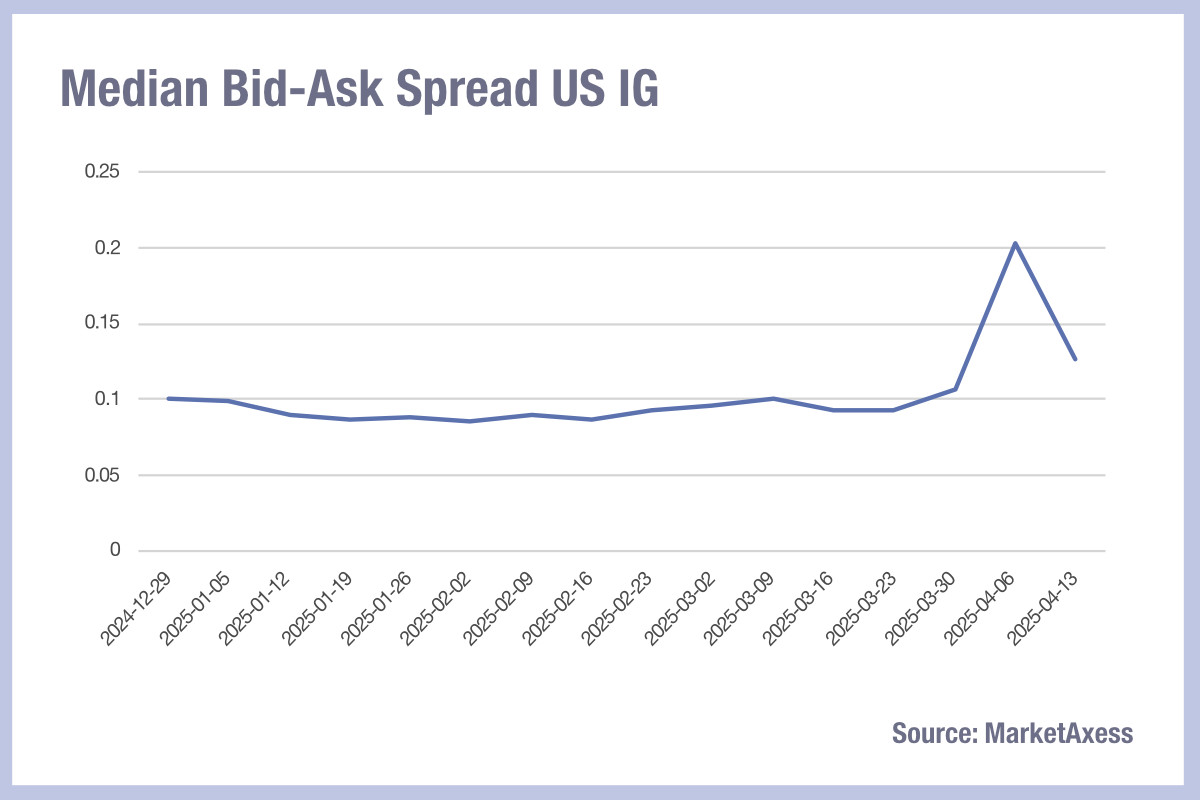

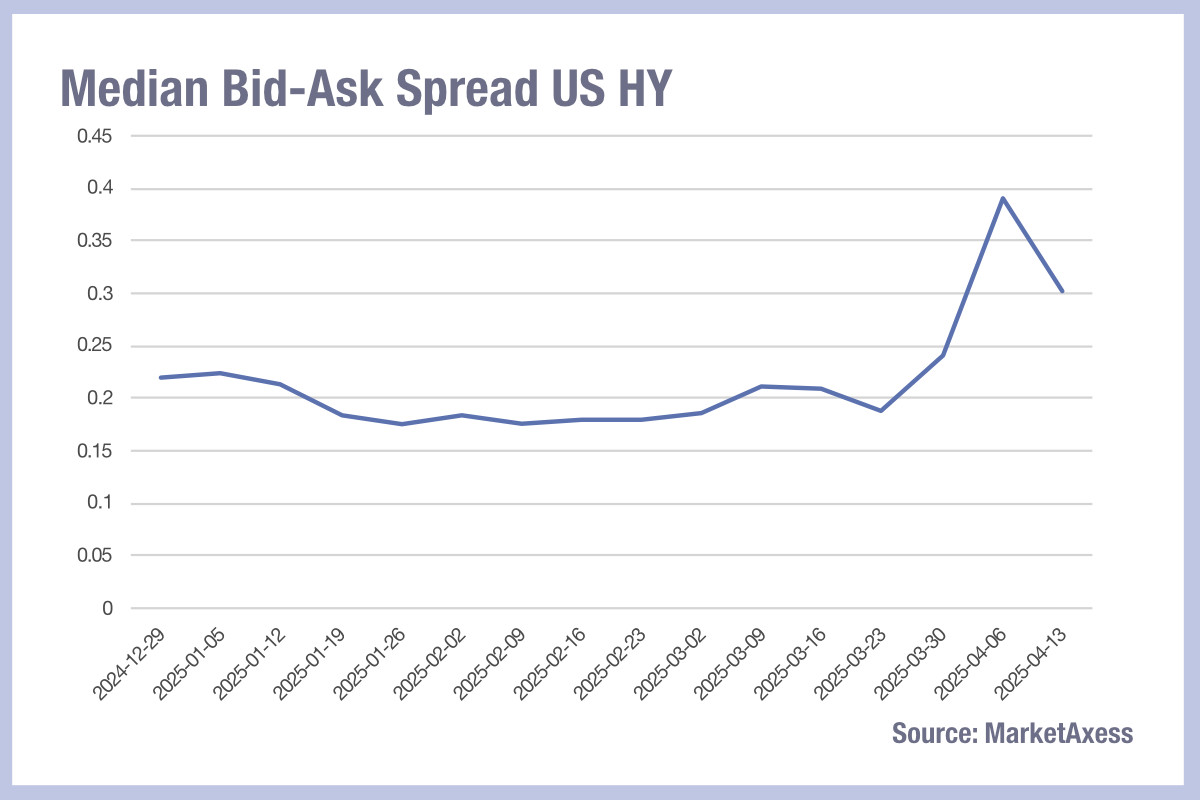

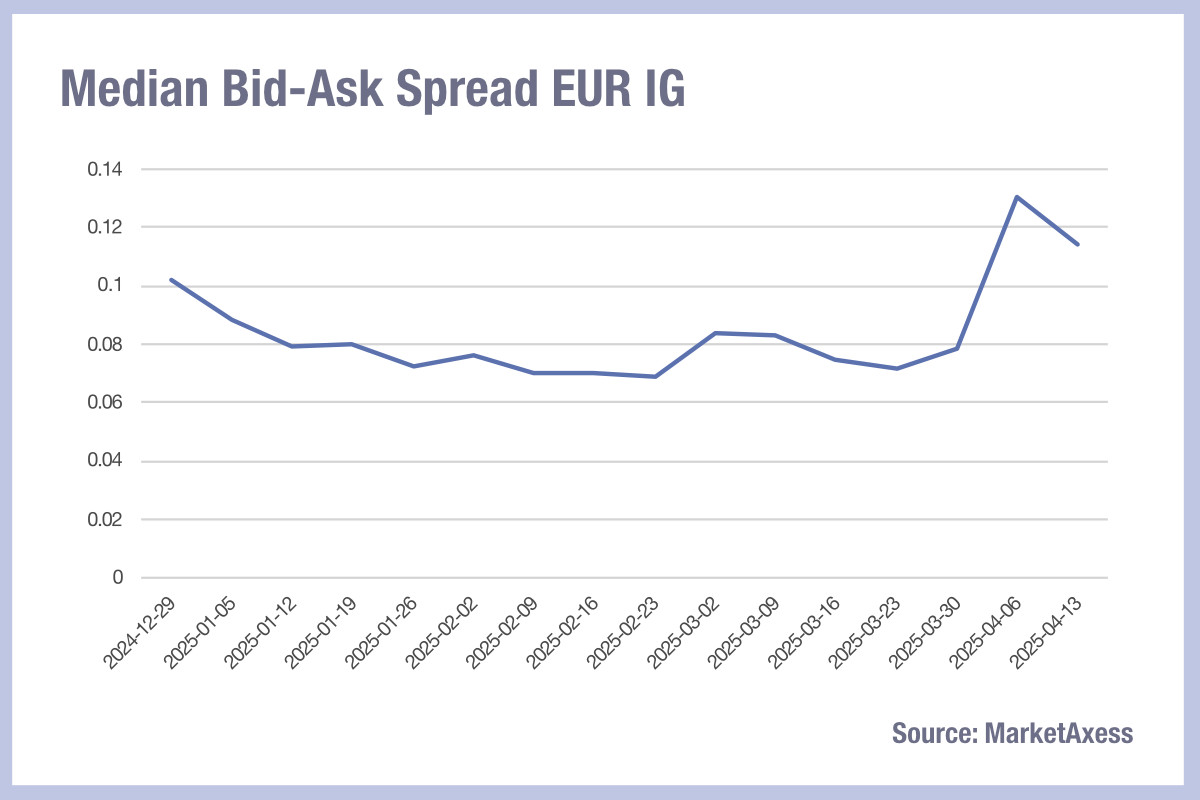

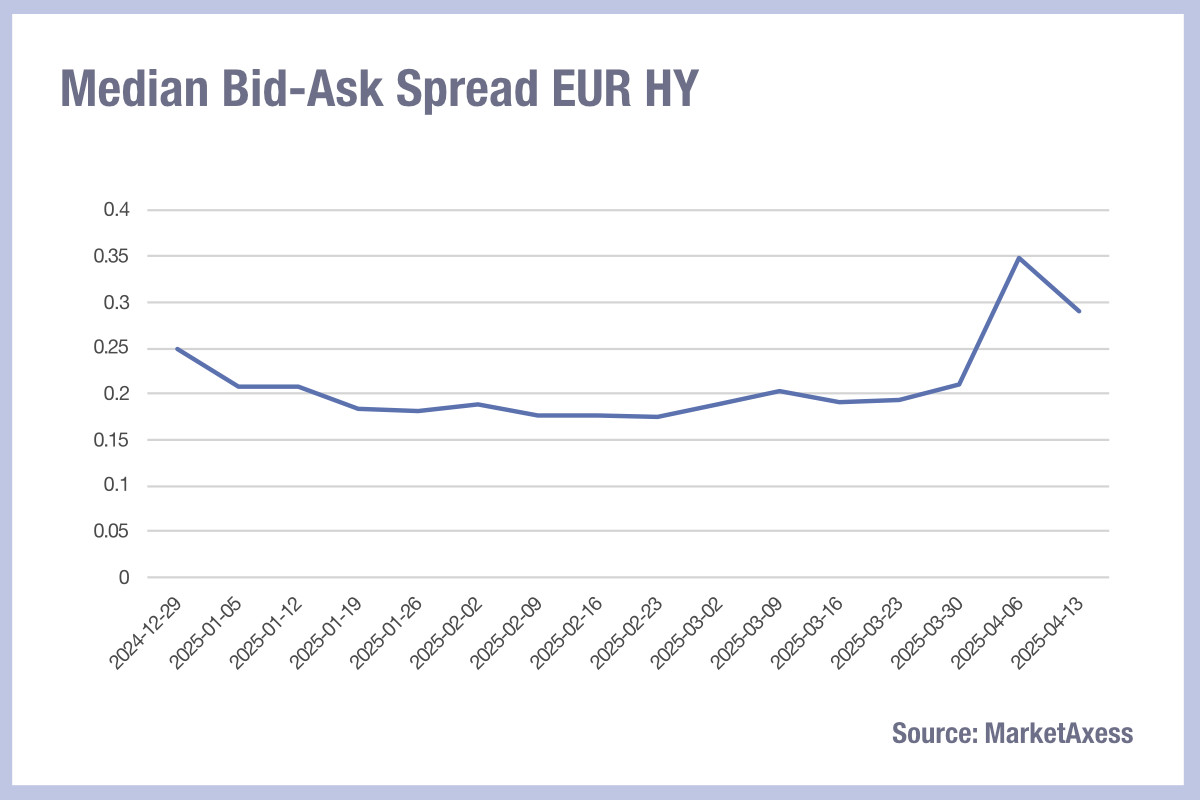

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the US on 2 April.

In US investment grade (IG), data from MarketAxess’s CP+ pricing tool indicates bid-ask spreads increased by 98% over their median average for this year, while US high yield (HY) saw bid-ask spreads widen to 80% of their average.

European trading costs were less affected, but with IG and HY traders seeing a 55% and 65% expansion respectively, still seeing significant moves.

These reflected the level of uncertainty that the ephemeral trade policy creates for debt markets, with potentially existential threats to some businesses being created and/or reversed in a matter of days.

Traders report that both electronic liquidity providers and banks have been supportive of buy-side activity, with volumes increasing alongside trading costs, creating a likely boom for dealers’ profitability in Q2 following a successful Q1.

While trading costs dropped back somewhat in the week of 14 April, bid-ask spreads were still considerably wider than the average year-to-date, up 24% in US IG and 39% in US HY, while European IG was 36% wider and HY was 37% wider.

Volumes cratered in the week of 14 April across markets with US IG and HY both down 14% against the YTD average and European IG and HY down 21% and 19% respectively.

©Markets Media Europe 2025